Mobile apps are fantastic marketing opportunities for brands—opening up direct ways to connect with users daily. Projections show the global app market reaching almost 570 billion dollars by 2030. Partnering with high-value publishers and setting commission rates for app installs/engagement is a perfect way to grow your brand and boost revenue.

However, mobile app fraud detection plays a crucial role. Companies should recognize and avoid bad actors—ensuring optimal ad spend and return. Understanding how mobile app fraud works is the first step.

In 2022, ad fraud hit 81 billion dollars worldwide across the web and mobile, and projections continue to climb. Online advertising scams simultaneously hurt brands and partners, skewing performance metrics and taking earnings away from legitimate publishers and content creators. Brands have spent years figuring out ways to combat advertising fraud. Unfortunately, fake app installs and mobile engagement makes your brand vulnerable, but you can take steps to protect your partnerships program.

How mobile app fraud works

This type of scam happens in various ways. Depending on your brand and business model, you might be paying for installs, clicks within apps, ongoing engagement, or other factors. Here are some of the most common fraud tactics:

App install fraud

Some fraudsters create repeated app installations with no intention of actual use. These parties game the system by artificially boosting install rates and collecting unearned brand commissions.

- Some parties create install farms: hiring people to use real phones to repeatedly install apps, wipe/reset the device, and install again.

- Scammers use scripts and emulators to fake downloads on a simulated mobile device. That way, they can automate the process even further.

- Other bad actors rely on incentivized traffic. Some affiliates try and improve performance metrics and earnings by sharing some of their commission with customers: offering rebates, credits, donations, etc. These partners can earn more from brands by hiding these incentives and mislabeling incoming traffic as un-incentivized.

- Proxy tunneling happens when fraudulent affiliates create a mobile bot network by installing insidious apps on customers’ phones. Operators then protect themselves behind these hijacked IP addresses to cover their fraud.

- Malvertising is malicious code installed from ads. It sends users straight to app stores or simulates fake clicks and engagement. This can also happen to unsuspecting publishers and impact their relationships with potential customers.

Mobile app click fraud

Some scammers also manipulate clicks and customer interactions. Partnering brands can be tricked by this fake engagement and pay commissions without any idea of what’s happening behind the scenes.

- Click flooding refers to apps secretly taking over users’ phones and opening hundreds of ads in the background. With skewed performance and attribution numbers, brands lose money for no real benefit. Some publishers also take advantage of self-reporting partnerships—reporting fake click rates to brands (click spoofing).

- With click injection, fraudulent parties use a built-in Android feature that monitors app installs. Then, they jump in and generate fake clicks before any actual user actions occur.

- Inauthentic engagement becomes a significant issue when human and/or bot farms create post-install events. Fraudsters make sure they hit the right triggers for attribution and payment without any real user engagement.

Four ways to detect and prevent mobile app fraud

Recognizing and fighting back against these varied tactics might feel like a losing battle. Thankfully, you also have powerful tools and strategies to fight back. Time and resources wasted on fraudulent installs and engagement can seriously hamper your growth and success as a brand. It’s worth making the most of every option to ensure authentic and healthy partnerships.

1. Look for dormant users and low app interaction

While scammers may score highly with installs, app interaction quickly drops. Track your app’s average usage and churn rate—looking for outlying partners. Install farms create installs but cannot simulate longer-term use. Keep an eye on your metrics and examine publishers bringing in noticeably higher-churn traffic.

2. Check for low conversion rates

Start by asking your partners about average conversion rates. If commission triggers aren’t linked directly to purchases or payments, fraudulent partners might take advantage. It’s easier to fake actions that don’t require financial transactions—like downloads, applications, or filling out contact forms. Compare your app’s overall conversion rates and follow up with the lowest-performing partners.

3. Recognize suspicious uninstall times

Install farms don’t have access to endless mobile devices and unique IPs. Many scammers will download your app, fake engagement briefly, and then factory reset the phone. That way, they claim credit and swiftly reset the loop. You can pick out potential bot farms and scammers within your partnership program by measuring uninstall times and looking for outliers.

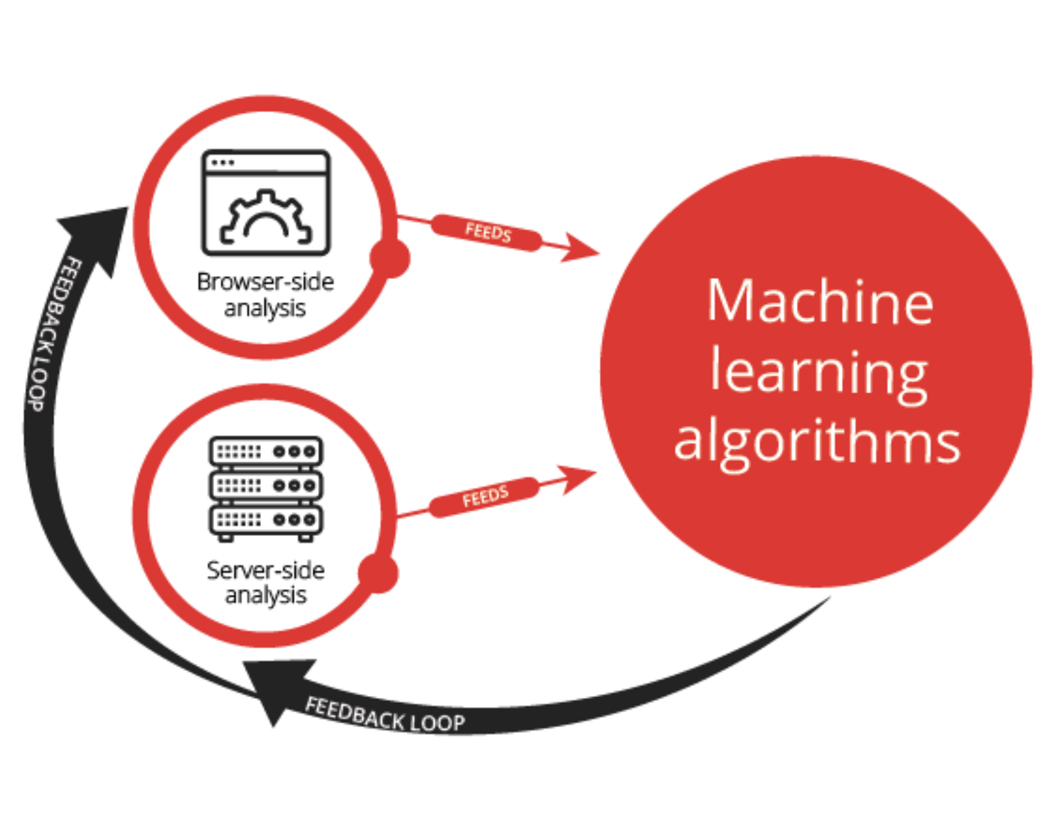

4. Rely on powerful anti-fraud resources

Finally, finding the right anti-fraud protection is critical. Specialists have gathered expertise and built custom tools to recognize and stop mobile app fraud. With anti-fraud protection through a powerful platform like impact.com, you can save money and cut down on ad scams.

With impact.com’s Ad Fraud Protection, you’ll have access to:

- Detailed fraud scores

- Suspicious payment detection

- Data science support

These features will help your team reward honest partners and kick scammers out. Their actions harm everyone involved in your partnership pipeline—pulling focus and resources away from where they’ll have the biggest impact.

Protecting your mobile app marketing pipeline

Fraudulent mobile app installs and engagement aren’t just minor issues. In 2021, post-install attribution fraud on iOS devices hit 20 percent—making a significant dent in brand revenue, partner commissions, and user experience.

However, these tactics work best when no one is looking. Start looking out for potential fraudsters in your affiliate program. Keep an eye on unusual churn and uninstall rates. Partner up with anti-protection experts. With these mobile app scams out of the way, you’ll be able to focus on rewarding and generating real value: paying authentic publishers and building lasting user bases.

Do you want to stay on top of fraud protection? Check out PXA’s course on protecting and monitoring affiliate partnerships.

Leverage impact.com’s insightful resources to bust mobile app fraud