Your brand just lost a $200 sale. The shopper had your product in the cart for 8 minutes before they spotted the promo code field, opened a new tab, and never came back. This scenario plays out 70 times for every 100 carts on your site.

With unexpected costs like shipping, taxes, and fees driving 39 percent of that abandonment, many shoppers are looking for a deal that could push them over the finish line.

This is where coupon and deal publishers come in. These sites have built massive audiences of deal-motivated shoppers actively looking for savings. When a consumer searches for your brand plus “promo code” or “coupon,” they’re signaling high purchase intent.

Despite the demand, many brands remain hesitant to partner with coupon publishers. But the reality is that 96 percent of shoppers look for coupons before making an online purchase. Black Friday research by impact.com also shows that 43 percent will definitely use a code if they come across one easily.

Consumers will search for deals. The only question is whether they’ll find your brand or your competitors when they do.

Source: 2025 Black Friday consumer report: How brands can prepare for Holiday shopping

Dispelling the myths: What brands get wrong about coupon partners

Skepticism about coupon partnerships often stems from a few persistent misconceptions. Let’s examine the most common objections—and how reality shapes up in comparison.

Myth 1: “They just poach sales we would’ve gotten anyway”

The moment a shopper sees an empty promo code box, your brand has already triggered their deal-seeking instincts. You’ve invited them to go looking for a discount.

“I think consumers are pretty savvy. So if you do have a coupon box at checkout, they’re obviously going to know that you have coupons, so they’re going to go looking for them,” says Tiara Rea-Palmer, Director of Partnerships at CouponFollow.

Coupon publishers capture those shoppers’ buying intent and guide them back to complete the purchase.

“Coupon and deal guys are closers,” says Vern Rodriguez, Senior Director of Customer Success at impact.com.

Without that intervention, many of these shoppers would abandon their carts entirely. These sites aren’t poaching sales—they’re completing sales that would otherwise be lost, converting browsing into buying.

Myth 2: “They attract low-value, discount-obsessed customers”

The assumption that coupon users are primarily low-income shoppers who only buy at a discount doesn’t hold up to scrutiny.

According to CouponFollow, 86 percent of households making over $200,000 a year had used a coupon in the last 12 months. “It’s not just people who can’t afford the thing you’re offering,” says Rea-Palmer. “It’s literally everybody. Even if you’re making a million dollars, you’re still going to look for a coupon.”

Promo codes and discounts are effective both in customer acquisition and retention. 73 percent of customers say that discounts make them more loyal customers, while 66 percent say they discover new brands through promo codes. Once they experience great products, many become repeat customers who purchase without a discount.

Myth 3: “We can’t control what they promote”

Brands that avoid coupon publishers often worry about rogue promotions or inaccurate information appearing on deal sites. However, when you work proactively with coupon publishers, you gain substantial influence on what promotional content looks like. Direct relationships mean you can provide accurate deal information, set clear guidelines, and address issues quickly if they arise.

Joanie Demer, co-founder of Krazy Coupon Lady, told impact.com about a scenario where a manufacturer contacted her site after unexpected sellouts from coupon promotions. They initially budgeted for 85,000 coupon redemptions, but when Krazy Coupon Lazy featured the deal, they received 400,000 redemptions. “And now you’ve blown your budget for the year,” she recalls.

But rather than severing the relationships, these manufacturers saw an opportunity, asking Demer to help them plan ahead in the future so they wouldn’t sell out of product.

The key here is that shift from reactive to proactive. Publishers want to promote accurate information because their audience trusts them. Brands want to convert deal-seekers into customers. When brands provide the most up-to-date, accurate information, publishers have every incentive to help them sell as much as possible without leaving shelves empty.

Myth 4: “We don’t have budget for more promotions”

This objection conflates two different things: the cost of the discount itself and the cost of the partnership. Coupon partnerships typically operate on a performance-based model where you pay commissions only when a sale occurs, making testing new publishers a relatively low-risk proposition for a promotion that funds itself.

You’re not necessarily losing any more profit margin than you wouldn’t have given anyway. If shoppers are already searching for your promo codes, they’ll find those deals through other channels. Working with coupon publishers gives you more control over what offers are available and ensures that when shoppers find a deal, it comes through a tracked, measurable partnership.

How to successfully collaborate with coupon or deal websites

Coupon partnerships are valuable, but executing them well requires intentionality. Here’s how to build a coupon partnership program that drives results.

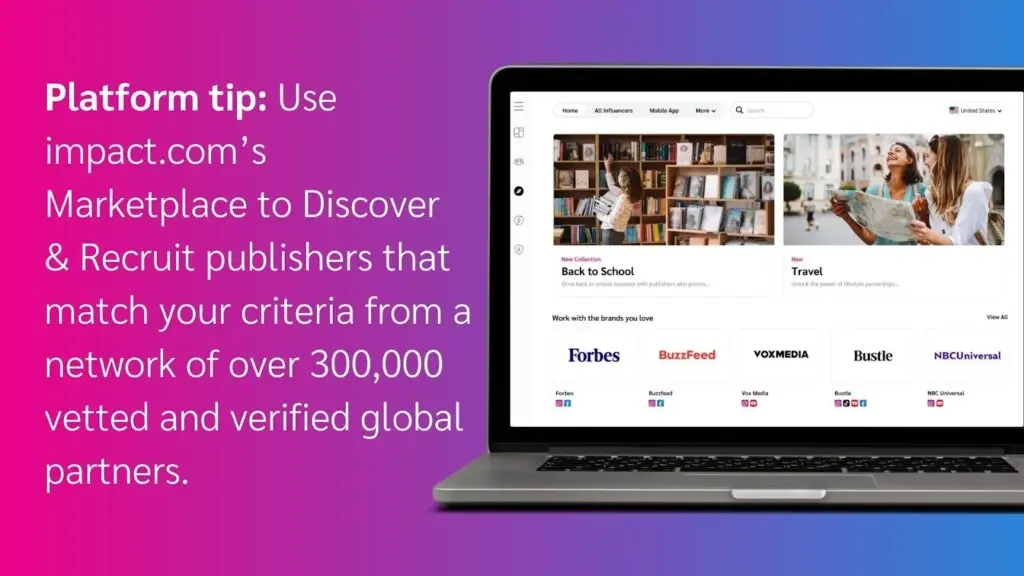

1. Find the right partners

Your customers are already searching for your coupons right now. Want to see which publishers they’re finding? Open an incognito window and search for your brand name plus “promo code” or “coupon.” Those results are exactly what your shoppers see when they hit your checkout page and go looking for a deal.

Don’t just chase the biggest names. A publisher with 10 million monthly visitors across all categories might deliver less value than a niche site with 500,000 visitors who match your ideal customer profile. Relevance beats reach when you’re paying commissions on actual sales.

2. Run meaningful tests

You can’t judge a book by its cover, or a coupon partnership in a week. Rodriguez recommends testing for a minimum of three to six months to gather enough data to make meaningful conclusions. Shorter tests often miss seasonal patterns, promotional cycles, and the time it takes for publishers to optimize their content for your brand.

“We always tell advertisers who are a little concerned about working with us, just give us a try for 30 days,” says Rea-Palmer. “We can usually show you that it’s going to be far beyond meeting your expectations of what you thought you were going to get from ‘just a coupon site.’”

Here’s what might surprise you—some brands find that shoppers coming through coupon sites actually have higher basket sizes than their baseline. Why? Because 70 percent of consumers will make an unplanned purchase when they have a coupon. The discount gives them permission to add more.

That’s why you need to measure beyond just new customer acquisition. Track average order value, return rates, and customer lifetime value for coupon-driven shoppers. You might find they’re more valuable than expected.

“All you need to do is watch your revenue. Has it been cannibalized or has it increased incrementally? Look at your partner contribution reports,” says Rodriguez. “Is the average order value higher than what it normally is for your normal non-coupon deal publishers?”

3. Structure offers strategically

Not all promo codes are created equal, and the difference shows up in your bottom line. For example, a home goods brand could test two approaches: a flat “10% off everything” code versus “15% off orders over $75.” Same discount depth, different psychology. The tiered offer will likely increase a customer’s average order value because they’ll be persuaded to add more items to hit the discount threshold.

“Looking at AOV, if you have specific marks you want to hit, offering some kind of coupon incentive for them to spend an extra five or 10 dollars definitely helps,” says Rea-Palmer. The psychology checks out too. Roughly 40 percent of shoppers end up spending more than they planned when they have a coupon because the savings feel like permission to add more to their cart.

Welcome codes give you another strategic option. By restricting these offers to first-time buyers only, the discount goes toward expanding your customer base rather than subsidizing people who would have bought anyway. Once they experience your product, you can focus on converting them into repeat customers at full price.

If you’re worried about margin erosion, non-coupon alternatives still appeal to deal-seekers. Free shipping thresholds, bonus products with purchase, and cashback programs provide value without directly discounting your products.

4. Make deals easy for coupon partners to find and promote

Publishers can’t promote what they don’t know about. If they have to email you every time they want to feature a deal, they’ll just feature your competitor instead.

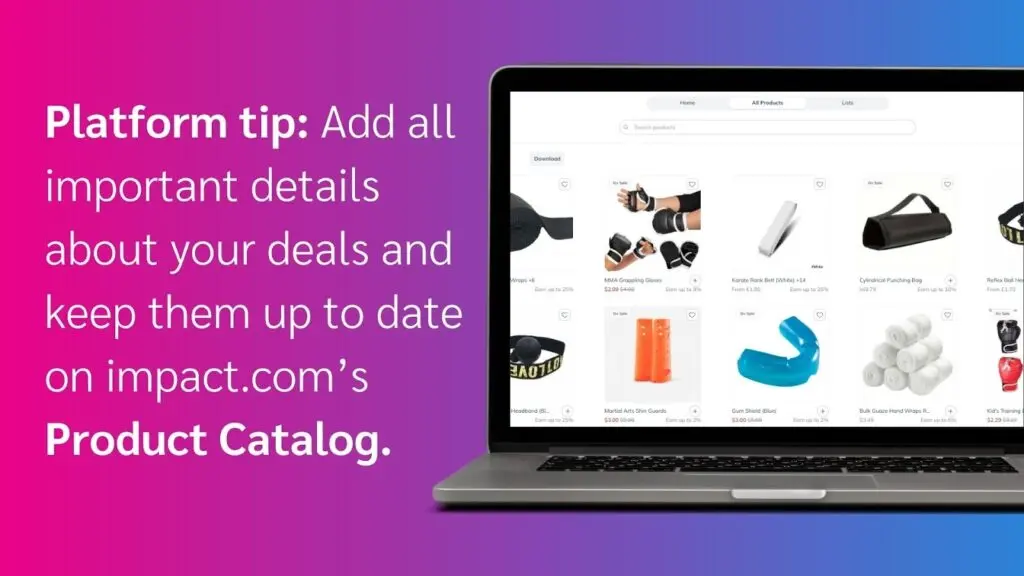

Make it easy. When you launch a promotion, send your coupon partners the complete picture: exact promo code, start and end dates, any product exclusions, and SKU details if relevant. The more specific you are, the less likely their audience sees an expired or incorrect code on your brand page.

Outdated codes frustrate shoppers and train publishers to stop checking your deals. One incorrect promotion can cost you visibility for months, as the publisher will prioritize brands that keep their information current.

5. Empower coupon partners with autonomy and inventory information

Stop micromanaging every promotion. Your product catalog does the heavy lifting if you keep it current. When publishers can see both your regular prices and sale prices in real-time, they’ll spot deals worth featuring without you having to announce every discount.

A publisher might notice your blender dropped 30 percent and decide to feature it on their homepage that day—even though you never formally flagged it as a promotion. That’s free marketing you didn’t have to coordinate.

“Let your publishers make their own deals and their own promotions. They’re the ones that know their audience,” says Rodriguez.

Real-time inventory updates matter just as much. When your featured product sells out, publishers who see that information can pivot immediately and promote your next best item instead. Without it, they’re stuck promoting something unavailable while your actual inventory sits unpromoted. You both lose.

Check out this video on how to update your product catalog:

Matching coupon publishers with your customer journey

Not all coupon publishers work the same way, and that’s actually useful. Different publishers intercept shoppers at different moments—some drive discovery, others prevent cart abandonment, and some do both. Here’s how to think about which publishers fit where.

Discovery-stage publishers: Building awareness

- What they do: Surface your brand to shoppers actively browsing deals, often before they’ve decided what to buy.

- Best for: Brands launching new products, entering new markets, or competing against established category leaders.

- Example: Slickdeals (community-driven platform where viral deals can introduce your brand to thousands of deal-hunters).

Consideration-stage publishers: Influencing choice

- What they do: Help shoppers compare options and decide between brands

- Best for: Brands where trust and editorial context matter (premium positioning, complex products, value-driven customers).

- Example: Offers.com (curated editorial approach), CouponCause (values-alignment through charitable giving)

Conversion-stage publishers: Closing the sale

- What they do: Capture shoppers who’ve already chosen your brand but are looking for a deal before checkout.

- Best for: Reducing cart abandonment, especially if you have a promo code field at checkout.

- Example: Honey (browser extension that activates at checkout), RetailMeNot (high-intent brand-name searches).

Multi-stage publishers: Full-funnel presence

- What they do: Operate across the entire journey with different content types.

- Best for: Brands that want comprehensive coverage without managing multiple small partnerships.

- Example: RetailMeNot (combines search traffic, browseable categories, and checkout tools).

Starting point for most brands: One conversion-stage publisher (Honey or RetailMeNot) + one discovery or consideration publisher based on your specific growth challenge.

Turning coupon partners into growth partners

Your customers are searching for coupons whether you partner with publishers or not. The only difference is what they find when they search.

Without partnerships, they’ll find expired codes, competitor deals, or nothing at all. Then you’ve lost the sale. With strategic partnerships, they find a validated code that brings them back to complete their purchase.

The brands winning in this channel stopped asking “should we work with coupon publishers?” and started asking “which publishers help us close more sales?” That’s the shift from viewing coupons as a margin problem to seeing them as a conversion solution.

Ready to test? Start with two publishers: one that captures high-intent searchers (like Honey or RetailMeNot) and one that matches your customer profile. Run them for 90 days, measure AOV and incrementality, then scale what works.

Find your edge and accelerate your program with deep-dive partnership tactics in more impact.com blogs:

- Performance marketing explained: Types, benefits, and key metrics (blog)

- How modern marketers can boost campaign effectiveness with performance marketing attribution (blog)

- Marketing budget optimization: The performance marketer’s guide to partnership-driven growth (blog)

- Addressing quality and brand safety in performance marketing: Partnership strategies that deliver results (blog)