Rising inflation and economic uncertainty have left brands wondering what to expect from Black Friday/Cyber Monday shoppers this year. While 2021 holiday sales grew over 14 percent and reached $886.7 billion, the current inflation rate means today’s dollar doesn’t go quite as far as it did just one year ago.

The impact.com Black Friday Consumer Research Report uncovers consumer behavior predicted to influence the buying decision during the 2022 Black Friday shopping season. While most shoppers who participated in last year’s sales plan to shop again this season, there were caveats to how much they are willing to spend and what kind of products they’re likely to buy.

Key research findings

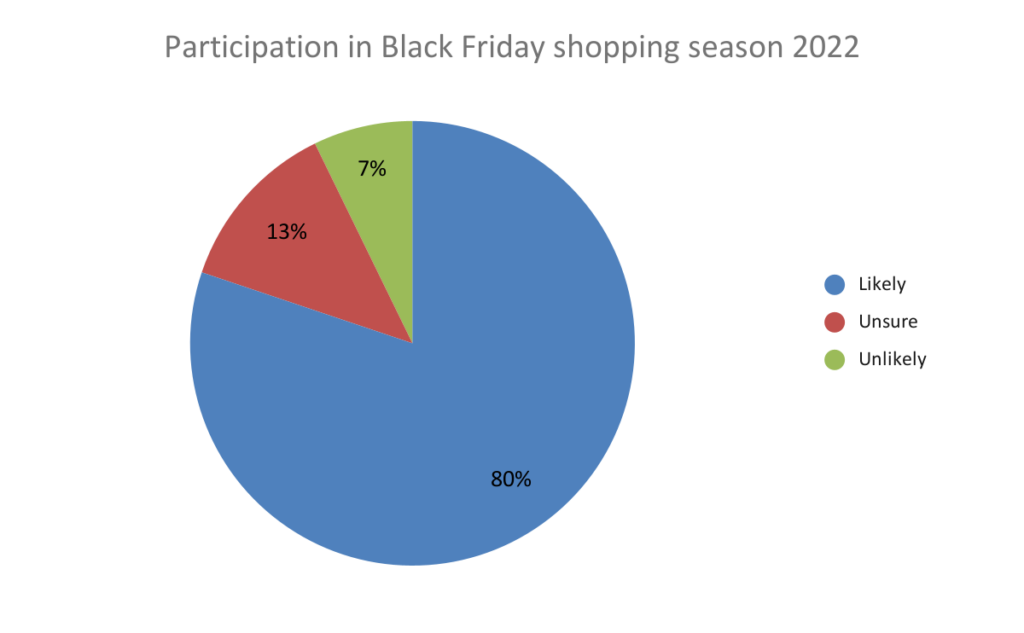

- 80 percent of shoppers will be inclined to shop for 2022 Black Friday deals

While 11 percent didn’t make any purchases during the 2021 Black Friday shopping season, only 7 percent of respondents showed no interest in buying this year.

- Shoppers taking advantage of ‘early bird’ discounts

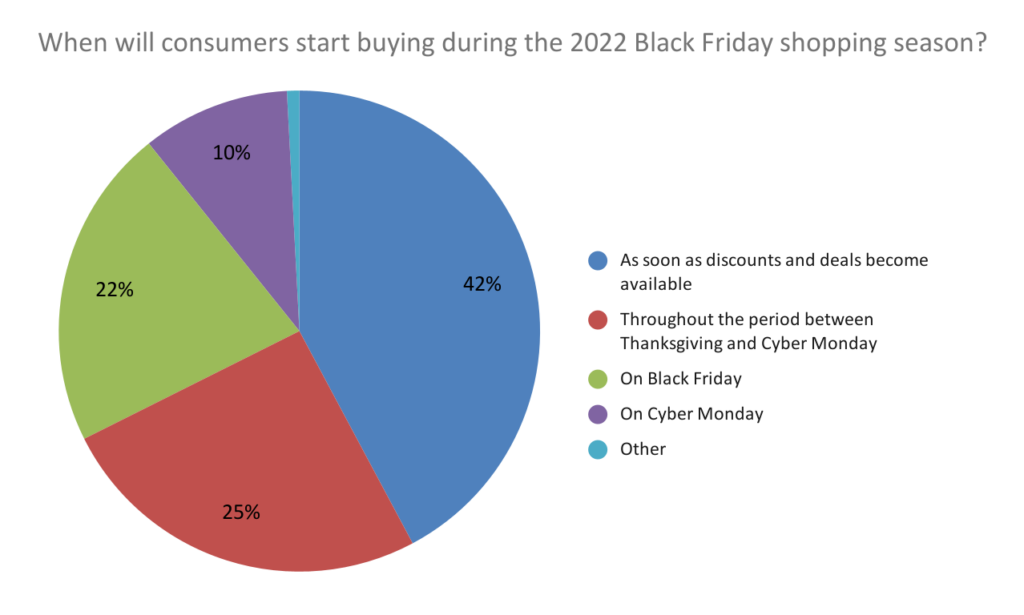

Shopping from Thanksgiving to Cyber Monday remains popular. However, most consumers (42 percent) will start making purchases when discounts and deals become available.

- Household income determines consumers’ shopping wishlist

Clothing, shoes, and accessories were the top mentions of product types on consumers’ shopping wishlists of all income and age groups. Shoppers with larger household incomes look forward to airline tickets and vacation package deals.

- Great discounts and price savings promote consumer spending decision

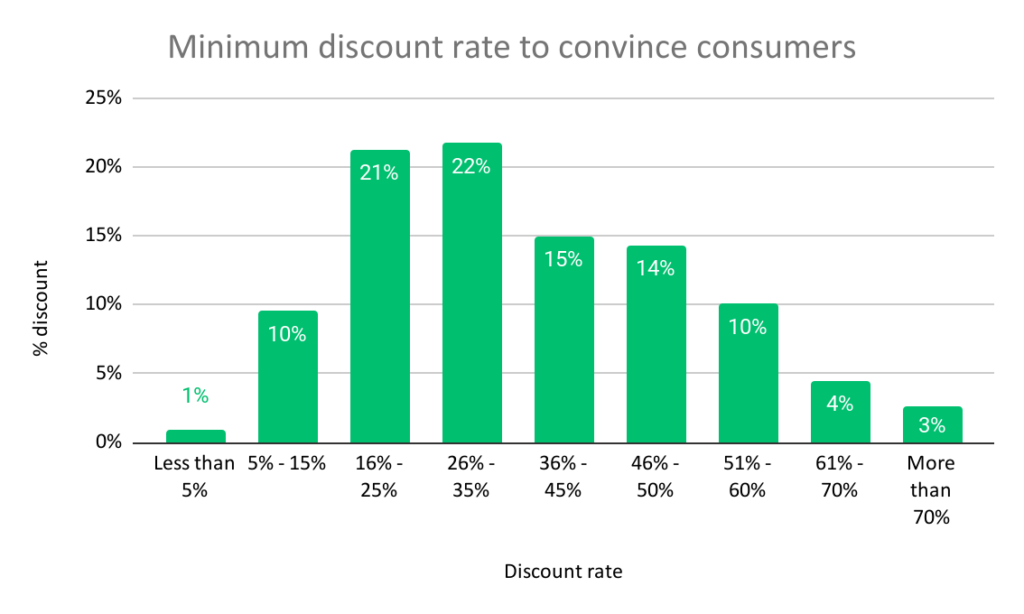

Roughly 82 percent of respondents will be looking for the best discounts and price savings, with 16 to 35 percent being the desired minimum discount rate to convince a purchase.

Methodology

The impact.com Black Friday Consumer Research Report, conducted by impact.com’s Market Research team, polled consumers aged 18 to 70 with an annual household income of $25,000 or more to gain insight into purchasing behavior ahead of the shopping season.

The research data came from 846 consumers who intended to purchase between Thanksgiving and Cyber Monday. The report aims to give insights and better understand the following:

- Consumer shopping behavior

- Spending intentions

- Economic factors that influence consumer decision-making

10 insights to help you gear up for the shopping season

1. Consumers are ready to participate in the Black Friday shopping season

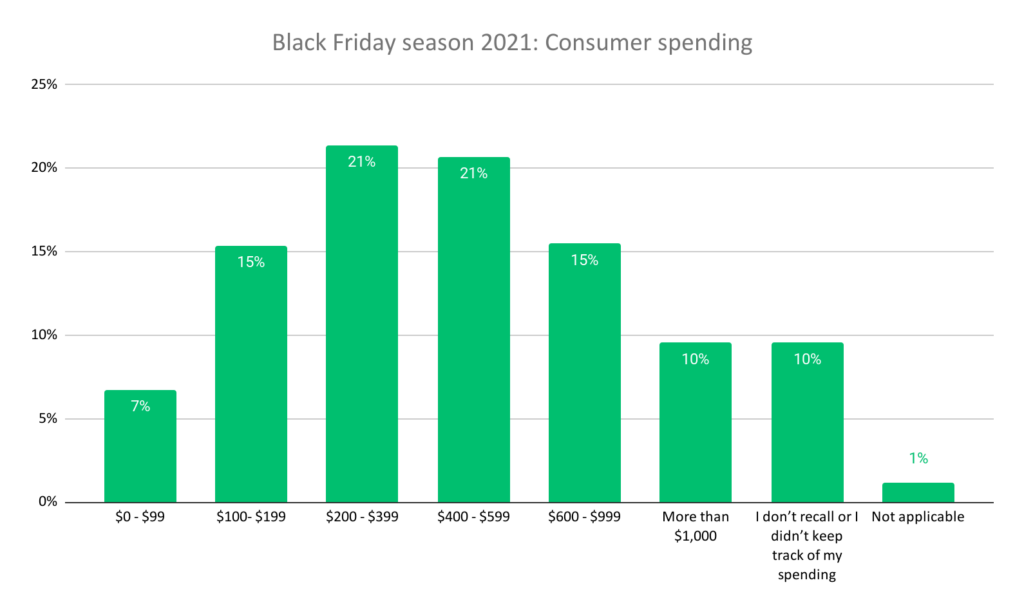

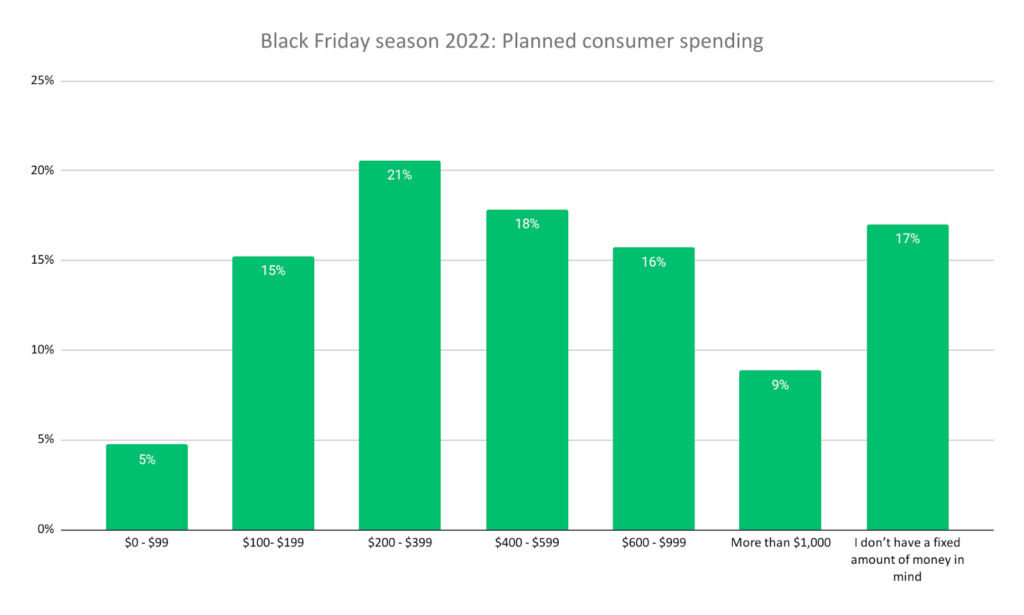

During 2021 Black Friday, 89 percent of respondents made a purchase, with 21 percent spending between $200 and $399. Heading into the 2022 shopping season, the majority plan on keeping within the $200 to $399 spending threshold.

A reported 13 percent remain unsure whether they will make a purchase this year. But 80 percent are ready to enjoy extra savings, and 7 percent have no buying intentions — an improvement from last year’s 11 percent.

2. Consumers are shopping from their smartphones

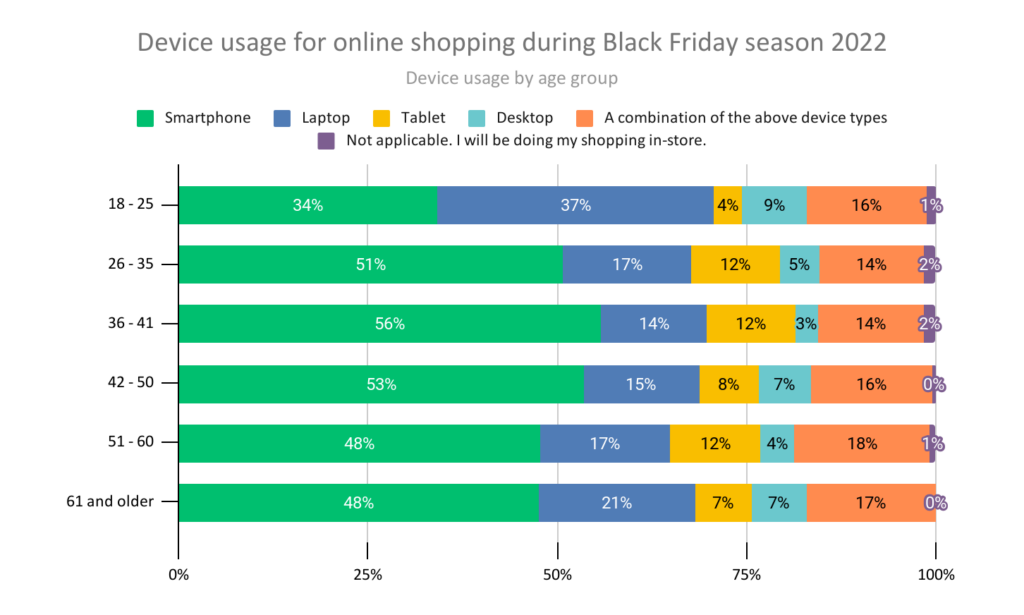

Creating a seamless and enjoyable online shopping experience will be a top priority heading into 2022 Black Friday. As many as 50 percent of shoppers opt to skip the queues and shop online via their smartphones.

Within the 18 to 25 age demographic, 37 percent will be scouring the net on their laptops for the best deals.

3. Consumers aren’t waiting for Black Friday to start buying

As the biggest retail sale days of the year, shoppers expect the best discounts and price savings. According to 43 percent of respondents, applying a minimum discount rate of 16 to 35 percent will convince consumers to purchase.

Close to 32 percent of consumers stated they would shop on sale days (22 percent on Black Friday and 10 percent on Cyber Monday). Another 42 percent of shoppers anticipate purchasing when discounts and deals are available. Additional insights show that:

- 1 in 4 consumers will shop throughout the period between Thanksgiving and Cyber Monday

- 56 percent of consumers aged 42 to 50 favor shopping when deals drop

- Shoppers aged 18 to 41 will make most of their purchases on sale days (Black Friday and Cyber Monday)

*Other in the chart = 1%

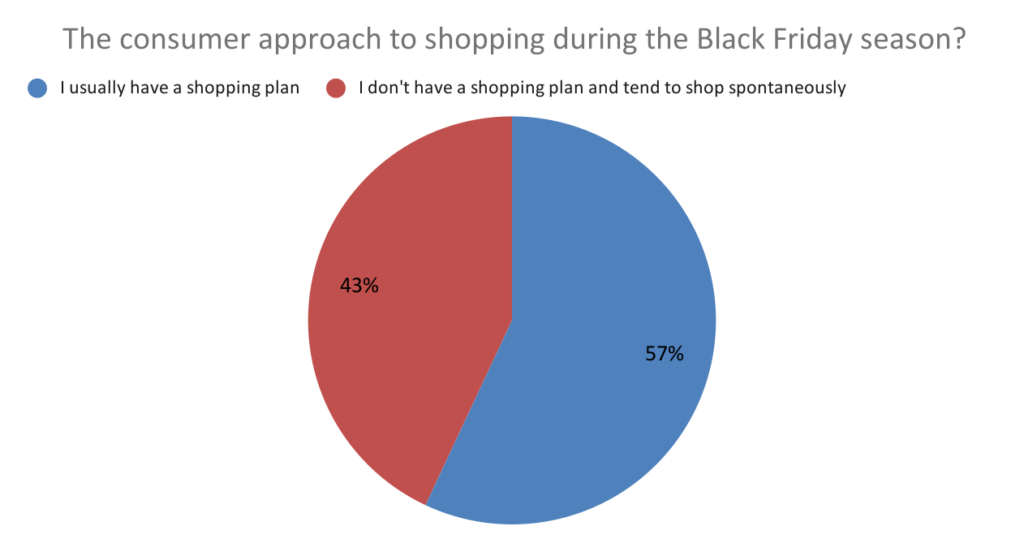

4. Over half of shoppers have a game plan

As many as 57 percent of consumers create a shopping strategy to secure the best discounts on the items on their wishlist — 22 percent start planning a week before Cyber Week. While 34 percent will make spontaneous buys based on sale items, 51 percent will stick to their wishlist.

Additional interesting facts:

- 32 percent shop specific product categories

- 17 percent buy big-ticket items

- 31 percent visit their favorite brands and stores to view the sale

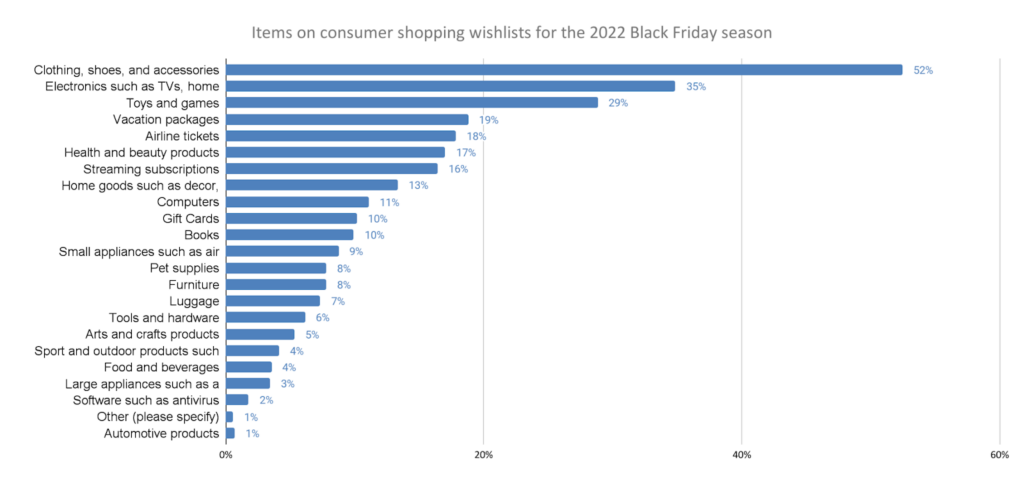

5. Consumers will have diverse shopping carts

Top 6 items on consumer’s Black Friday shopping wishlist:

- Clothes, shoes, and accessories (52 percent)

- Electronics (35 percent)

- Toys and games (29 percent)

- Vacation packages (19 percent)

- Airline tickets (18 percent)

- Health and beauty products (17 percent)

Clothing, shoes, and accessories were the most popular, regardless of age or income. Age and income did impact what was listed second and third. Shoppers with incomes between $25,000 and $99,999 will prioritize clothing, electronics, and toys and games.

Higher-income groups favor deals on airline tickets and vacation packages. Of the consumers aged 42 to 50 surveyed, 30 percent mentioned airline tickets as their top three products on their wishlist.

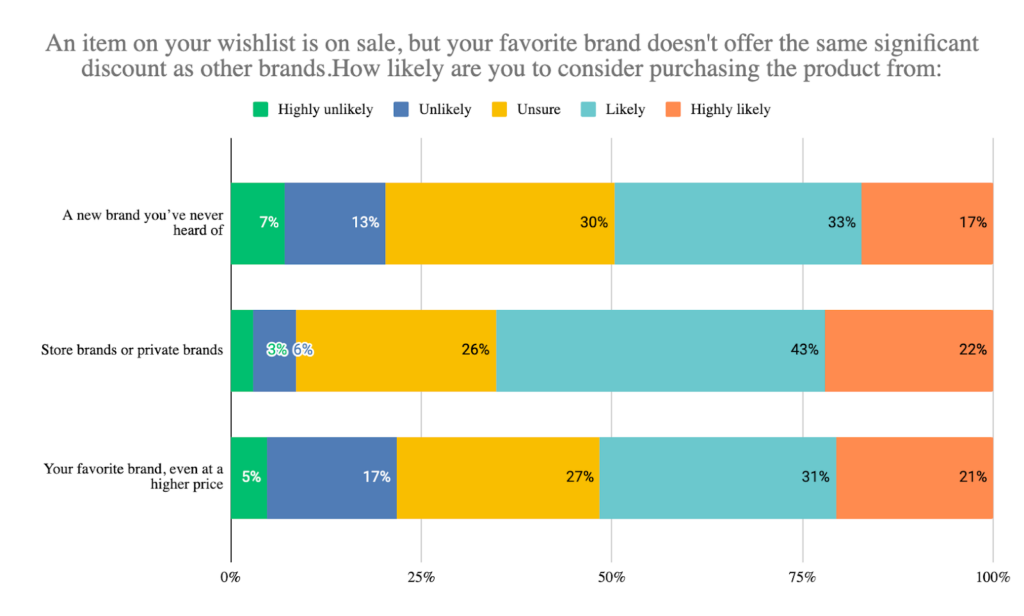

6. Consumers are open to considering new brands for a better price

Some interesting stats:

- 50 percent will purchase from a new brand offering a good discount

- 65 percent will buy a private or store brand offering a good discount

Brand loyalty plays a crucial role in consumers’ buying decisions. A reported 52 percent are likely to purchase from their favorite brands at a higher price. However, as mentioned previously, discounts and price savings are also big motivators, making consumers more susceptible to new brands and private or store labels.

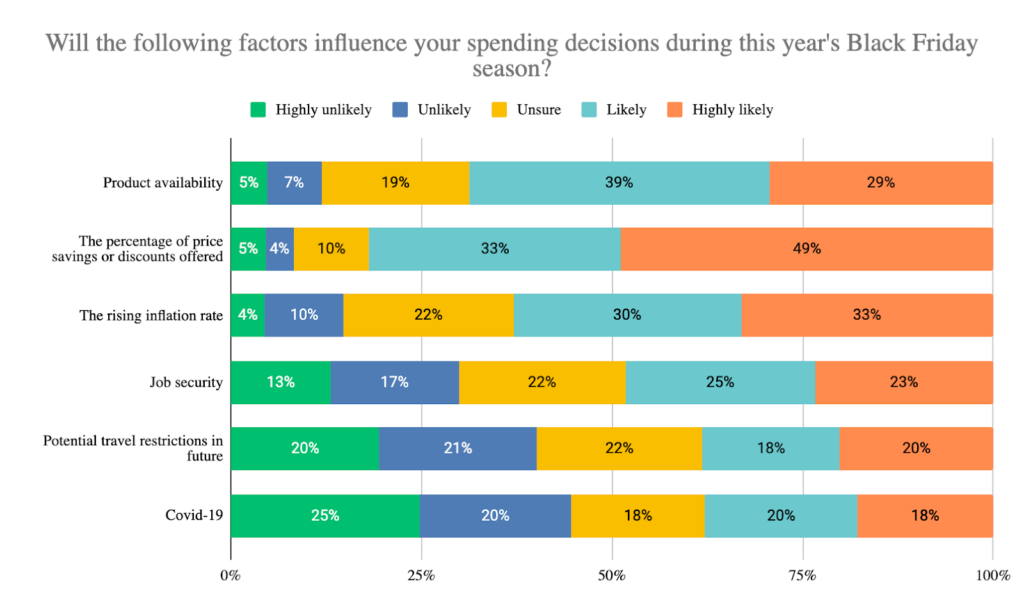

7. Economic factors will influence spending decisions

Top factors influencing spending decision:

- 1 – Discount and price saving (82 percent)

- 2 – Product availability (68 percent)

- 3 – Rising inflation rate [63 percent)

- 4 – Job security (48 percent)

- 5 – Potential travel restriction (38 percent)

- 6 – COVID-19 (38 percent)

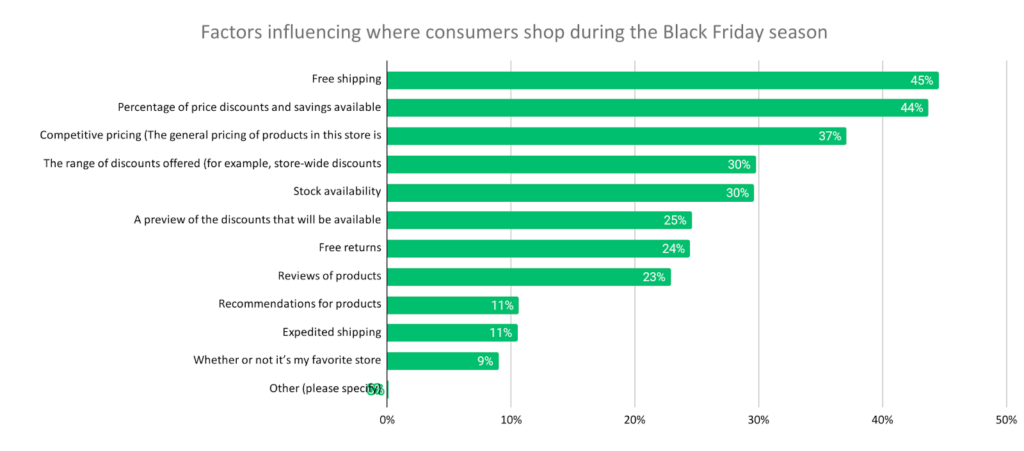

8. Discounts and free shipping influence where consumers shop

As many as 81 percent of respondents chose online shopping and shipping as their desired shopping method. So it’s no surprise that 45 percent selected free shipping as a major influence to shop.

Black Friday brings out the sport shoppers who enjoy the thrill of bargain hunting, with 44 percent of consumers citing the percentage of price discounts and savings as a significant influencer. Shopping at their favorite store was the least important to shoppers.

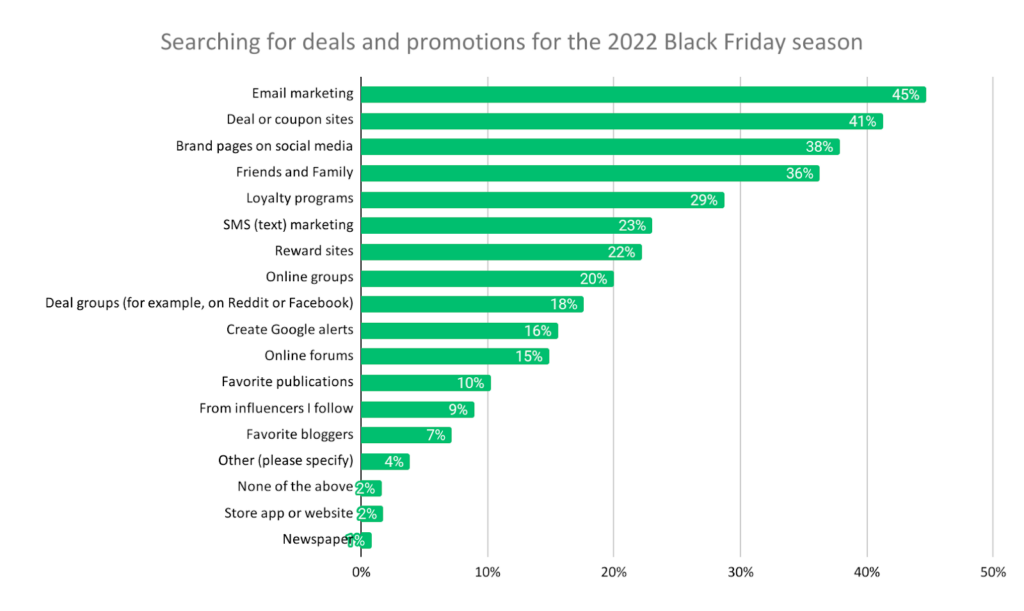

9. Deal hunting will start in the inbox

As many as 45 percent of shoppers will search or opt-in to be alerted of the hottest deals and promotions in their email inboxes. Other consumers (41 percent) will comb through deal and coupon sites, while 38 percent will turn to brands’ social media pages.

Popular channels to search for deals and promotions:

- Email (45 percent)

- Deal and coupon sites (41 percent)

- Brand’s social media (38 percent)

- Friends and family (36 percent)

- Loyalty programs )29 percent)

- SMS (23 percent)

10. Consumer spending will mimic 2021 Black Friday

Black Friday 2021 saw consumers spend between $200 and 399 (21 percent), $400 and $599 (20.7 percent), and more than $1,000 (10 percent).

Planned consumer spending for 2022 Black Friday:

- $100 – $199 (15 percent)

- $200 – $399 (21 percent)

- $400 – $599 (18 percent)

- $600 – $999 (16 percent)

- More than $1,000 (9 percent)

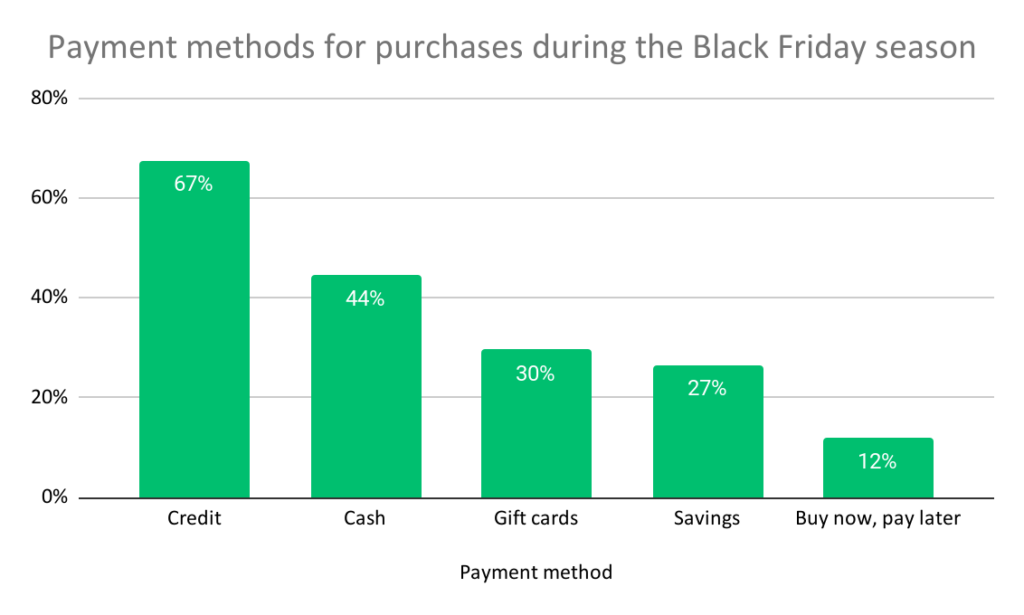

Consumers will use a combination of payment methods to pay for their Black Friday purchases this year. They may opt to use credit cards with incentives like cashback or bonus points.

Top payment methods:

- 67 percent will use a credit card

- 44 percent will pay cash

- 30 percent will pay with gift cards

- 27 percent will pay with savings

- 12 percent will pay using the buy-now, pay-later method

Ready, set — Succeed this Black Friday

Understanding insights into consumer behavior will help you build a sales plan that will offer success beyond the Black Friday shopping season. Use impact.com’s Black Friday consumer research report to improve and optimize your marketing efforts, including partnerships ahead of the year’s sale event.