The partnership marketing ROI framework helps brands accurately assess the shared value created across digital and in-store touchpoints. Measuring partnership marketing ROI today means understanding how each partner contributes to long-term revenue, influence, and customer engagement.

Consider a common scenario: a customer discovers a product through an influencer’s social media post, researches reviews across multiple third-party websites, checks prices across retailers, and finally makes an in-store purchase three weeks later while on a weekly shopping trip.

Understanding the Shift in Modern Customer Journeys

According to recent research from EMARKETER and impact.com, this complex journey isn’t unusual—69.3% of consumers discover products weekly and engage with brands three or more times across different channels before making a purchase decision.

This creates a critical challenge for marketing leaders: How do you accurately measure and attribute value when purchase decisions unfold across weeks and multiple touchpoints?

Traditional measurement approaches, designed for simpler customer journeys, fail to capture this new reality.

Today’s path to purchase has advanced from a linear funnel into an intricate web of touchpoints spanning digital and physical channels, publisher sites, social platforms, and in-person interactions. Understanding this new dynamic—and accurately measuring its value—requires a fundamental shift in approach.

We’ll explore how forward-thinking brands adapt their measurement strategies to modern consumer behavior, revealing practical frameworks for capturing true partnership value in an increasingly complex marketplace.

This analysis draws from two comprehensive research initiatives:

- EMARKETER and impact.com’s 2025 study of modern consumer shopping behavior, based on surveys of 1,000+ US adults

- impact.com’s 2024 affiliate incrementality research, featuring insights from industry leaders across North America, the UK, and Australia

Key insights from our research:

Modern consumer behavior creates measurement challenges

- 69.3% of consumers discover products weekly across multiple channels, with most engaging 3+ times with brands before making a purchase decision. This creates a complex web of touchpoints that traditional measurement struggles to capture.

- 83.8% of retail dollars are spent in-store despite predominantly digital research patterns, highlighting the critical disconnect between discovery and purchase that must be measured effectively.

- Complex purchase paths span multiple touchpoints and timeframes, often extending beyond typical attribution windows as consumers move fluidly between social discovery, search validation, and retail purchase.

Traditional measurement falls short

- Last-click attribution systematically misses crucial partnership touchpoints, failing to capture the true influence partners have throughout the customer journey. This leads to significant undervaluation of partnership contributions.

- 30-day measurement windows ignore long-term content value, missing how partnership content continues driving value months or even years after publication through organic discovery and repeat visits.

- Cross-channel influence goes uncaptured in traditional models, despite evidence showing that partner interactions create compound value rather than simple linear attribution.

Proven solutions deliver results

- Zenni Optical uncovered $1.5 million in hidden value by moving beyond last-click attribution to understand the full scope of partnership contributions throughout the customer journey.

- DMi Partners found 3x higher customer lifetime value from comprehensive partnership measurement, demonstrating how better measurement directly translates to improved business outcomes.

- New measurement frameworks capture full partnership impact by analyzing direct attribution, contribution value, and assisted revenue across all touchpoints and timeframes.

How Discovery Impacts Partnership Marketing ROI In The New Customer Journey

Understanding where and how customers discover products has fundamentally changed. Our research with EMARKETER reveals three distinct patterns that characterize modern product discovery:

Research Patterns That Shape Partnership Marketing ROI

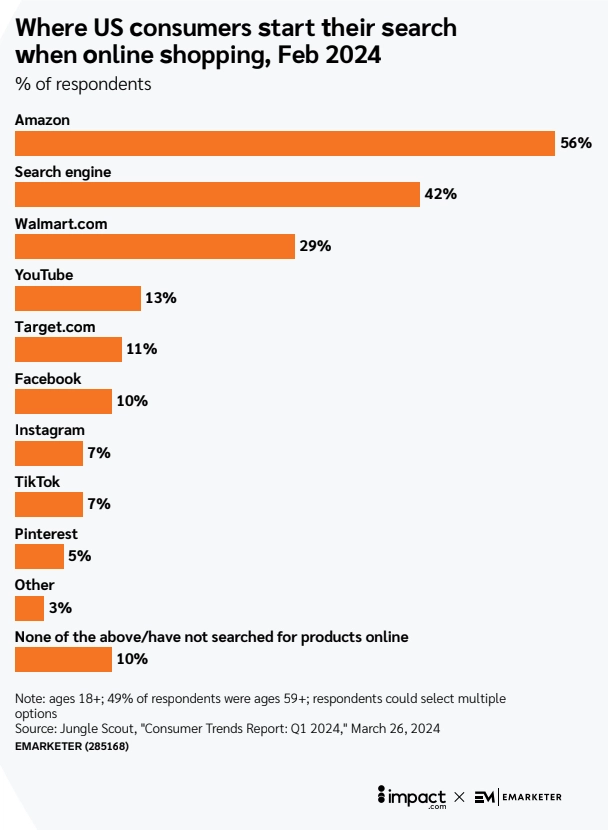

Today’s discovery journey spans multiple platforms, each playing a unique role. While Amazon captures 56% of initial product searches, the more interesting insight is how consumers move between platforms.

A consumer’s first exposure might come through TikTok, leading to a Google search (42% of initial searches), before ultimately converting through a retail platform. This fluid movement between platforms has become the norm rather than the exception.

Source: The modern customer journey: Understanding multichannel discovery, research, and purchase patterns

Demographic discovery differences

Age and income significantly shape how consumers discover products:

- The 44-59 age group shows a 67.3% likelihood of discovering high-consideration products, making them particularly active product discoverers

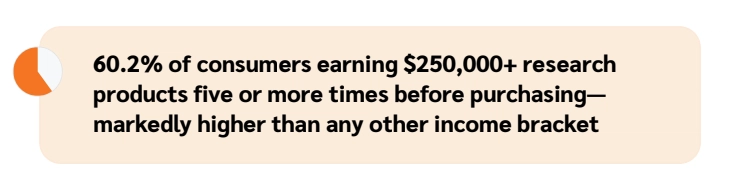

- Higher-income consumers (earning $250,000+) engage more deeply during discovery, often exploring multiple channels and content types

- Younger consumers (18-27) predominantly discover products through social platforms and peer recommendations

The discovery-purchase divide

The path from initial discovery to final purchase rarely follows a straight line. Even among habitual shoppers (39.3% of consumers) who typically stick to familiar brands and stores, discovery frequently occurs in different channels than the final purchase. This creates distinct patterns:

- Social media drives initial awareness, but is rarely used for detailed research

- Search engines serve as crucial bridges between discovery and purchase

- Retail platforms often capture final sales even when discovery happens elsewhere

This new reality of product discovery sets the stage for how consumers research and ultimately make purchase decisions. Understanding these patterns is crucial for brands looking to effectively engage consumers across their journey.

Research patterns: Understanding the extended consideration phase

The multi-platform discovery patterns we’ve identified in this report create ripple effects throughout the consideration phase. Our analysis with EMARKETER reveals how these initial touchpoints shape subsequent research behavior in ways that fundamentally change how brands should think about the customer journey:

Research intensity as a strategic signal

The time consumers spend researching doesn’t just vary by product type—it reveals distinct opportunities for engagement:

- High-price/high-consideration products: While 20.7% spend more than two weeks researching, this extended period isn’t passive. Consumers typically return to the same information 3-4 times, suggesting a need for content that evolves with their understanding

- High-price/low-consideration products: The 11.7% who conduct extended research focus primarily on validation rather than discovery, often seeking peer reviews and comparisons

- Low-price/high-consideration products: Though only 6.7% conduct extended research, these consumers show higher engagement with detailed product specifications and user-generated content

- Low-price/low-consideration products: Even with just 5.9% spending more than two weeks conducting research, mobile price comparison during shopping has become standard practice

Channel preferences signal purchase intent

The customer journey research also uncovered that research channels function as indicators of where consumers are in their decision journey:

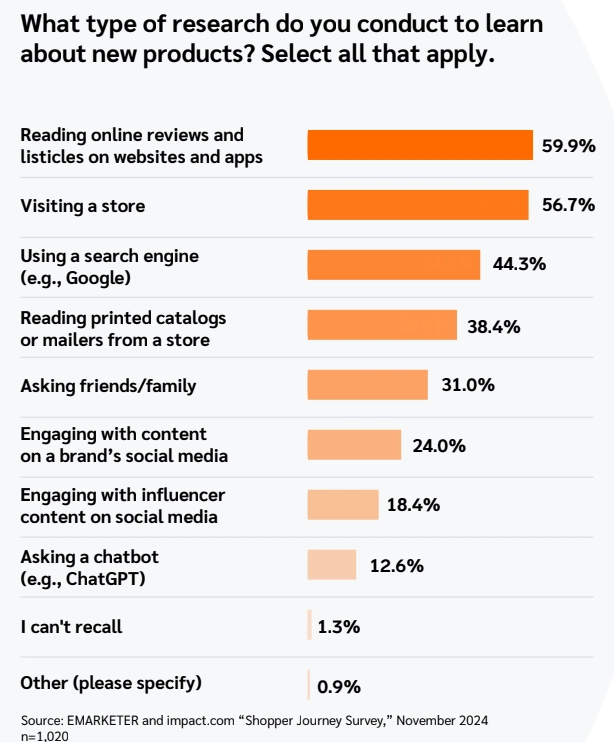

- While 59.9% rely on reviews and listicles, this content serves different purposes at different stages:

- Early research focuses on category-level comparison, comparing available brands

- Mid-journey research emphasizes specific product features

- Late-stage research centers on validation and price comparison

- Search behavior (44.3%) evolves from general category terms to specific product searches, signaling progression toward purchase

- Higher-income consumers create distinct research patterns:

- Multiple research sessions indicate comparison shopping rather than indecision

- Chatbot usage signals active problem-solving rather than passive browsing

- Influencer engagement serves as validation rather than discovery

Source: The modern customer journey: Understanding multichannel discovery, research, and purchase patterns

The discovery-research connection

The way a consumer discovers a product shapes their entire research journey:

- Social media discoveries lead to more extensive cross-platform research, with consumers seeking validation from multiple sources

- Search-initiated discoveries show more linear research patterns, but longer consideration phases

- Retail platform discoveries lead to more price-focused research across competitors

This deeper understanding of research patterns reveals opportunities for brands to create content and experiences that align with natural consumer behavior, rather than trying to force traditional purchase funnels.

The final mile: Understanding purchase decision complexity

The sophisticated discovery and research patterns examined culminate in purchase decisions that defy traditional marketing assumptions. Our customer journey analysis reveals how modern purchase behavior represents a fundamental shift in how consumers traverse the final steps to conversion:

Research-to-purchase channel dynamics

The disconnect between research and purchase channels isn’t just a tracking challenge—it reveals evolving consumer preferences:

- High-price/high-consideration products: While research and purchase often occur online, these journeys typically involve 5+ distinct touchpoints before conversion

- High-price/low-consideration products: The shift from online research to in-store purchase reflects a desire for immediate gratification after thorough digital validation

The persistence of in-store purchases (83.8% of retail dollars) despite digital dominance in research reveals that physical retail serves as the ultimate validation point, rather than just a transaction venue.

Beyond price: The new value equation

While price and value remain dominant factors, their influence manifests in unexpected ways:

- The 62.3% of consumers citing discounts as a primary driver aren’t just looking for the lowest price—they’re seeking the best value for their money

- Product quality (34.7%) and price (20.0%) create a complex interplay:

- Higher-income consumers use price as a quality proxy rather than a decision factor

- Lower-income consumers invest more research time to justify higher prices for quality items

- Cross-channel price comparison has become a validation ritual rather than purely economic decision-making

Source: The modern customer journey: Understanding multichannel discovery, research, and purchase patterns

The new cross-channel purchase reality

Modern purchase behavior reveals sophisticated decision patterns:

- The 3 in 10 shoppers who research online but buy in-store represent a deliberate choice rather than channel friction

- Mobile price comparison during in-store shopping serves as final purchase validation, rather than true comparison shopping

- Social media’s influence on mainstream retail purchases shows how discovery channels create purchase intent even without direct conversion capability

- Multiple retailer touchpoints before purchase indicate a new form of shopping literacy rather than consumer indecision

This new understanding of purchase behavior suggests brands need to stop thinking in terms of conversion funnels and start thinking in terms of purchase validation journeys.

The final mile isn’t the chance to be pushy salespeople. It’s an opportunity to provide the right signals and validation at each touchpoint to support their natural decision process.

Why traditional measurement falls short: The attribution challenge

As we’ve seen, modern purchase journeys involve sophisticated discovery, research, and buying patterns that span multiple channels and timeframes. This complexity exposes fundamental flaws in traditional attribution approaches that go beyond simple tracking challenges. Here is what we uncovered in our incrementality playbook.

The persistence paradox

Partnership content creates lasting value that defies traditional measurement timeframes. Unlike paid media, which can be precisely controlled—turned on and off at will—affiliate links and content continue to drive value long after publication.

This persistence creates a fundamental measurement challenge: some of the most valuable partner content remains active for years, creating attribution windows that extend far beyond conventional 30-day lookback periods.

The implications of this persistence are significant:

- Content created months ago may actively influence today’s purchases

- Partners often contribute to more revenue than they’re directly credited for

- Traditional last-click models systematically undervalue long-tail content

Beyond simple touchpoint counting

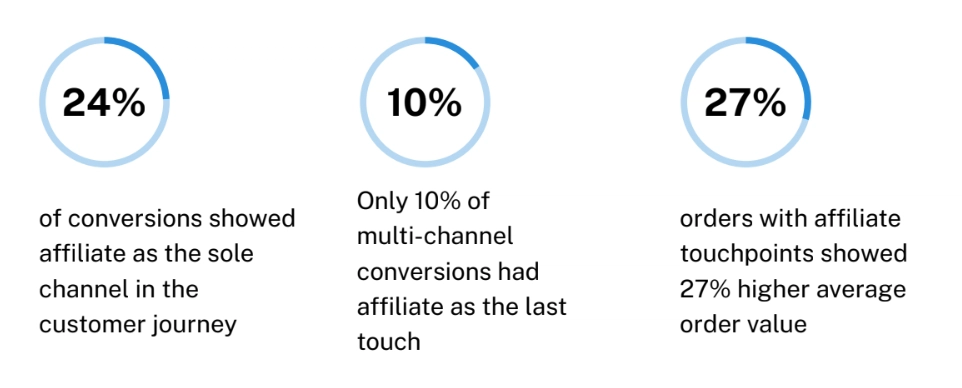

The multiple touchpoint reality isn’t just about quantity—it reveals fundamental shifts in consumer behavior. A revealing case study from DMi Partners’ analysis of an eBay company in the incrementality playbook demonstrates this complexity:

- 24% of conversions showed affiliate as the sole channel

- Only 10% of multi-channel conversions had affiliate as last touch

- Orders with affiliate touchpoints showed 27% higher average order value

Source: Revealing the true value: The marketing leader’s guide to affiliate marketing incrementality

These patterns suggest that partner interactions create compound value rather than simple linear attribution. When consumers engage with partner content at multiple stages of their journey, each interaction builds upon previous touchpoints, creating a sophisticated value chain that traditional attribution models fail to capture.

The cross-channel value chain

The reality of cross-channel influence reveals that partners often contribute significantly more revenue than they’re directly compensated for. Unlike other paid channels where brands pay for every interaction, partnership value frequently accumulates across multiple touchpoints without corresponding costs.

The same piece of partner content may serve multiple roles throughout the consumer journey. What serves as discovery content for one consumer could act as validation content for another, or even drive final conversion for a third. This multiplicity of value creation defies simple attribution models designed for more linear marketing channels.

Decathlon Canada’s success illustrates this cross-channel dynamic. Using detailed behavioral analysis, they found that partnership value accumulates across multiple touchpoints. By analyzing customer behavior at multiple levels—including partner, ad, partner group, and deal interactions—they improved team efficiency by 20% and increased affiliate revenue by 533% within six months.

Source: Decathlon Canada and Seven Square Media teamed up with impact.com to grow affiliate revenue by 533%

This suggests brands need to fundamentally rethink how they measure partnership value. Rather than trying to force partnership measurement into traditional incrementality frameworks, organizations need approaches that can capture value across time, channels, and consumer journeys.

The incrementality gap: Beyond traditional attribution models

While attribution challenges point to the complexity of modern customer journeys, the incrementality gap reveals another underlying measurement problem. Traditional approaches fail to answer the essential question: would this sale have happened without the partnership touchpoint?

The last-click illusion

Traditional last-click attribution isn’t merely incomplete—it critically misunderstands how partnerships create value. When Zenni Optical refined its measurement approach to look beyond last-click, it uncovered $1.5 million in previously hidden partnership value. This dramatic finding reveals how conventional attribution can systematically undervalue partnership contributions.

Similar insights emerged when Rugs Direct moved beyond last-click attribution. By implementing multi-touch attribution, they discovered that tracking only last-click had systematically deflated performance for key marketing channels. Their shift to U-shaped attribution, which rewards partners at both the top and bottom of the sales funnel, led to 600% revenue growth and enabled them to onboard over 200 new partners in just one year.

Source: Rugs Direct increased revenue by 600% YoY with impact.com

Modern partnerships drive value in ways that transcend simple click tracking:

- Partners influence purchases across multiple stages of consideration

- Customer journeys frequently include multiple partner touchpoints

- Higher-value customers often engage with more partner content before purchase

The measurement control challenge

Traditional incrementality measurement relies on the ability to “turn off” marketing channels to gauge their impact. This approach fundamentally breaks down with partnerships because:

- Partnership content continues driving value even after program deactivation

- Consumer journeys may break when legacy partnership links are blocked

- The diverse nature of partnerships means no single partner can represent channel value

- Different types of partnerships create value in fundamentally different ways

Forward-thinking brands are addressing these challenges through new measurement approaches that recognize the unique characteristics of partnership marketing. Rather than applying conventional incrementality frameworks, they’re developing sophisticated models that can capture both immediate and long-term partnership value.

Rethinking partnership value measurement: A new framework for incrementality

Having established why traditional measurement approaches fall short, mature brands are developing new frameworks that better capture the true value of partnership marketing. This measurement change doesn’t solely focus on better tracking. Brands are reconceptualizing how we understand partnership value.

The contribution analysis revolution

Traditional attribution models try to assign credit for conversions to specific touchpoints. Contribution analysis takes a radically different approach, examining how partners participate in customer journeys, regardless of where they appear in the conversion path.

This shift reveals surprising insights:

When analyzing partnership contribution patterns, DMi Partners’ A/B testing revealed that deal and coupon partners delivered three times higher customer lifetime value compared to content and influencer partnerships. This fundamentally challenges traditional assumptions about partnership value and represents a crucial misunderstanding of how different types of partnerships contribute to long-term revenue.

Understanding total partnership touchpoints

Modern measurement frameworks need to capture three distinct types of partnership value:

- Direct attribution: Conversions where partners are the last or only touchpoint

- Contribution value: Revenue influenced by partner touchpoints across the journey

- Assisted revenue: Sales where partners play a supporting role without receiving direct credit

Mapiful’s experience demonstrates the power of this approach. Using contribution analysis to assess partner incrementality, they identified partners who added value across every touchpoint of the customer journey. This comprehensive understanding of partnership value led to the successful onboarding of 13,000 new partners and a 1,200% revenue boost within a year.

Source: Mapiful ventures toward 12X revenue growth by customizing its influencer marketing strategy

Beyond solo vs. assisted: Understanding partnership relations

The most sophisticated measurement frameworks recognize that the real value of partnerships often lies in how they interact with other marketing channels:

- Intra-channel connection: How different partners work together across the customer journey

- Cross-channel amplification: How partnership content enhances the effectiveness of other marketing channels

- Long-term value creation: How partnership touchpoints correlate with customer lifetime value

Brands can no longer look at whether a partner drove a conversion alone or helped another channel. They need to understand the complex ways partners create and amplify value throughout the customer journey.

Future-proofing your measurement approach

As consumer behavior continues to evolve, measurement approaches must adapt to capture increasingly sophisticated purchase journeys. Our research revealed several emerging trends that will shape the future of partnership measurement and concrete steps brands can take to stay ahead.

Emerging measurement challenges

The convergence of digital and physical shopping experiences is creating new measurement complexities. Our research shows that 83.8% of retail dollars are still spent in-store, yet these purchases are heavily influenced by digital touchpoints. This creates three key challenges for future measurement:

Mobile-first attribution

The rise of in-store mobile research isn’t just changing how consumers shop—it’s fundamentally altering how we need to think about attribution. When consumers research products on their phones while standing in store aisles, traditional channel separation breaks down. Brands need measurement approaches that can capture this fluid interaction between digital research and physical purchase.

Social commerce integration

Social platforms are evolving from discovery channels into full commerce environments. This shift creates new measurement challenges as the lines between content, commerce, and community blur. Partnership measurement must evolve to capture value creation across these integrated experiences.

Content value persistence

Partnership content increasingly creates value long after publication. As Todd Crawford notes, “The links are out there, some years old, still getting traffic and driving value.” Future measurement frameworks must account for this extended value creation while maintaining accurate attribution.

Actions marketers can take to improve program performance

Immediate steps:

- Audit your current measurement approach against modern consumer behavior patterns

- Implement contribution analysis to capture total partnership touchpoints

- Develop frameworks for measuring long-term content value

- Integrate mobile and in-store measurement capabilities

Strategic considerations:

- Move beyond last-click attribution to understand full partnership contribution

- Develop measurement approaches that capture cross-channel synergies

- Create frameworks for evaluating long-term partnership value

- Build flexibility into measurement systems to adapt to emerging channels

Resource allocation guidance:

Success in this evolving landscape requires strategic resource investment in three key areas:

- Technology infrastructure: Implement systems capable of tracking complex, multi-touch journeys

- Data integration: Build capabilities to combine online and offline customer behavior

- Analysis capabilities: Develop sophisticated approaches to understanding partnership value

From measurement to value: a new framework for partnership success

The evidence is clear: traditional last-click attribution is systematically undervaluing partnership marketing’s impact. When Zenni Optical moved beyond last-click measurement, they uncovered $1.5 million in previously hidden partnership value. Similarly, Rugs Direct’s shift to multi-touch attribution led to 600% revenue growth and successful onboarding of 200+ new partners. These aren’t isolated cases. They represent a fundamental shift in how successful brands measure and optimize partnership value.

Further resources:

Incrementality 101: Understanding incrementality to optimize affiliate partnerships

3 reasons why measuring partner and channel incrementality benefits your brand

FAQ: Understanding Partnership Marketing ROI

Partnership marketing ROI measures the return generated from collaborations between brands, affiliates, or tech partners. It reflects the mutual benefits achieved when both parties reach a mutual audience and share value across campaigns.

A strong ROI indicates that both partners effectively contributed to lead generation, deal size growth, and brand reach—forming the complete picture of performance that traditional single-channel metrics often miss.

Measuring partner marketing ROI requires tracking multiple customer touchpoints across digital and physical channels. Marketers can calculate ROI using performance metrics such as engagement rate, conversion rate, and net-new leads.

To achieve an accurate calculation, leading companies use relationship management tools, partner portals, and data integration platforms that combine analytics from all sources to produce an accurate picture of true performance.

Pro tip: Measure ROI per single campaign and aggregate data quarterly for clearer trend analysis.

Several factors affect partnership ROI, including partner alignment, proper communication, content quality, and shared goals. Unaligned goals or inconsistent messaging can reduce performance.

Strong ROI often comes from long-term collaborators with an ideal customer profile match and a history of generating high-quality leads. Content type, deal size, and the marketing stack integration also impact ROI accuracy.

Key takeaway: The better the strategic and audience alignment, the higher the partnership return.

The common challenge in measuring partnership ROI is tracking multi-touch attribution across partner campaigns. Traditional tools often fail to connect online and offline results, creating an incomplete or delayed view of ROI.

Overcoming this requires marketing benchmark comparisons, using relationship management tools, and enabling transparency through partner portals. Establishing clear performance KPIs and timelines ensures an accurate picture of contribution.

Example: Technology marketers use custom tech content and tech webinars to trace engagement throughout B2B campaigns, improving attribution accuracy.

To enhance partner marketing campaigns, focus on better alignment, co-created content, and training tools that empower partners.

Brands that share insights, host partner events, and develop multi-vendor technology collaborations often achieve higher ROI due to broader exposure and shared value creation.

Continuous optimization—such as improving partner incentives and refining the marketing stack—ensures scalable ROI gains.

Best practice: Regularly review marketing benchmarks and identify high-performing partners to replicate success.

Partnership ROI directly contributes to business growth by expanding reach to a wider audience and improving engagement rate across multiple channels.

When optimized, partner programs drive more net-new leads, stronger conversion rates, and measurable long-term revenue lift.

For tech brands and B2B marketers, ROI insights also refine audience targeting, helping scale campaigns that reach broader audiences and enhance lifetime customer value.

Quick fact: Leading tech partners report a 3× increase in qualified leads after aligning ROI goals with mutual benefits and shared analytics.

Compared to traditional advertising or paid campaigns, partner marketing ROI often yields higher efficiency due to cost-sharing, shared expertise, and data-driven optimization.

Unlike isolated B2B campaigns, partner programs leverage mutual benefits—each partner contributes unique assets such as content, data, or distribution channels.

The result is a more accurate calculation of value generated through tech partner marketing, often outperforming standard media buys or single-channel outreach.