Unprecedented sales figures show shoppers were ready to spend—and save—for the 10th annual Prime Day event.

This year’s event, which lasted July 16 and 17, showed an encouraging reprieve from the inflation-related belt-tightening that has driven consumer buying habits in recent years. Digital sales across US retailers surged 11% during the 48-hour event, setting a new record of $14.2 billion in purchases—over $1.3 billion more than shoppers spent for Prime Day 2023.

Amazon reported that the 2024 event resulted in record-breaking sales and more items sold than any previous year. The brand also shared that independent small and medium businesses thrived this year, selling over 200 million products on the Amazon platform.

As customers regain confidence in the economy, brands have even more opportunities to benefit from Prime Day’s popularity. However, high advertising costs mean brands still need data-driven insights to create reliable campaigns that convert.

The impact.com Prime Day research compares year-over-year (YoY) data to reveal evolving customer behavior trends that can help brands refine their 2025 Prime Day—and future partnerships—strategy.

Methodology

The impact.com Prime Day research conducted during July 16 – 17, 2024, tracked and analyzed key metrics across thousands of North American brands in the Retail and Shopping industry. The year-over-year (YoY) analysis compares Prime Day 2024 and Prime Day 2023 performance.

While the complete analysis of the Retail and Shopping vertical includes various sub-categories, the following popular product categories were highlighted for this report:

- Apparel, Shoes, and Accessories

- Flowers, Food, Gifts, and Drinks

- Home and Garden

- Sport, Outdoor, and Fitness

- Mattress

Our analysis tracks key performance metrics: clicks, transactions, average order value (AOV), consumer spending, and brand spending. Researchers tracked these KPIs by comparing same-store, YoY data from brands that actively used the impact.com platform in July 2023 and 2024.

4 trends Retail and Shopping brands must know to turn shoppers into buyers

- Content review partners drove 1 in 3 clicks in 2024

- Higher conversion rates drove more transactions

- Better deals led to a lower average order value (AOV)

- Increased transactions led to higher action-based payouts for brands

As shopping patterns shift, understanding key trends will help brands stay ahead. Consider the following Prime Day trends for deeper insight into:

- How consumers engaged in online shopping during the Prime Day event

- How the economy impacted consumer spending choices in 2024 compared to 2023

- How businesses can capture consumer attention during Prime Day 2025

1. Content review partners drove 1 in 3 clicks in 2024

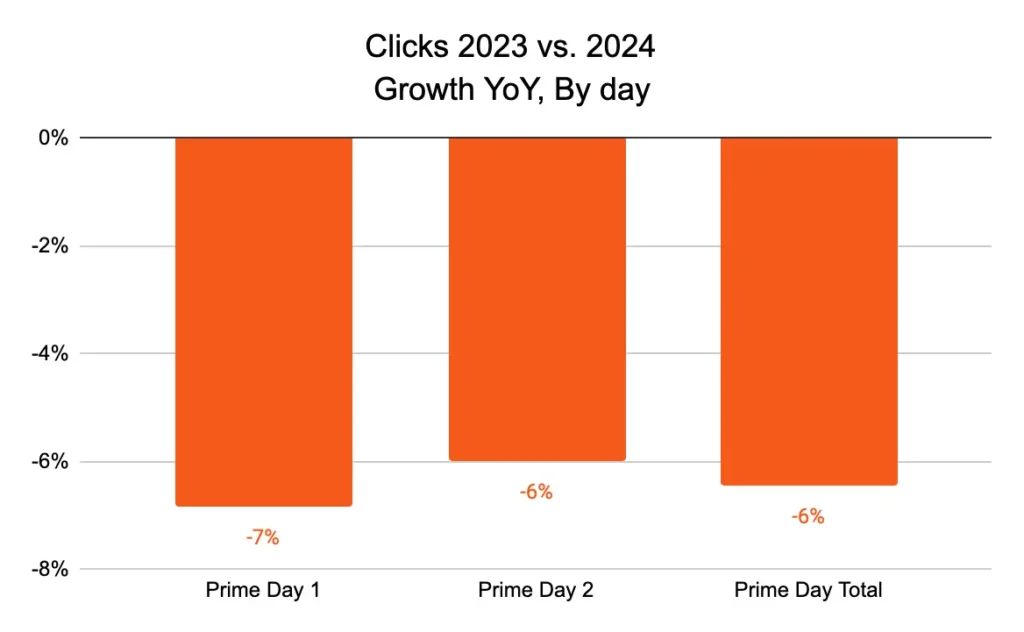

In 2023, clicks increased by 52% compared to 2022 as inflation-weary shoppers searched for the best prices. This year, clicks dropped 6% across both days, suggesting customers spent less time comparing prices and products. The first day saw a 7% decrease in clicks, suggesting shoppers may have been more impulsive this year, too.

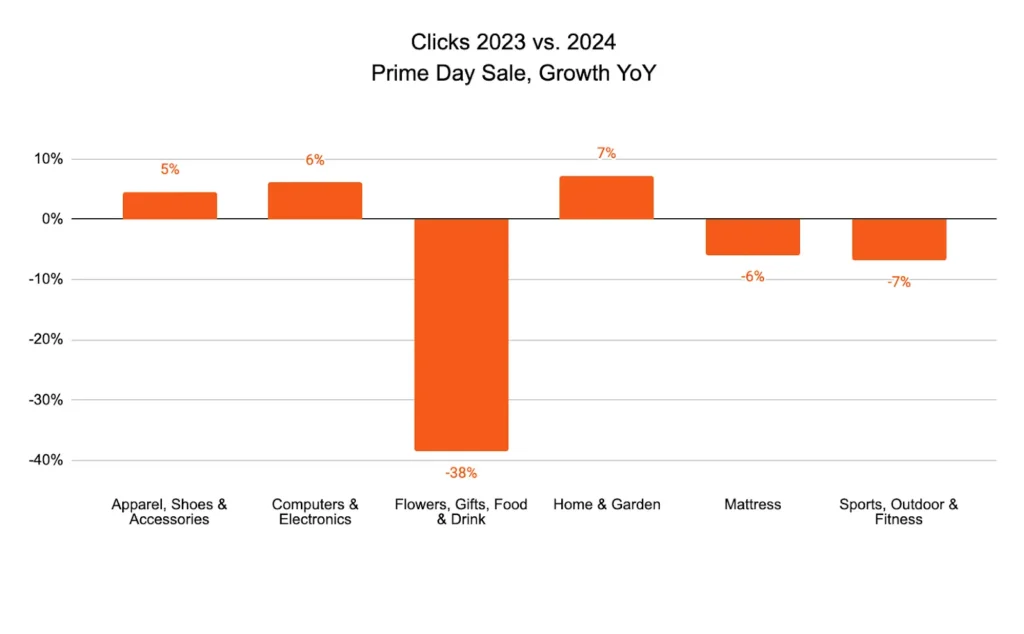

Customer spending trends showed a preference for big-ticket items, with significant purchases of electronics and furniture. This shift suggests that consumers diligently researched the best Prime Day deals, as evidenced by a 6% rise in clicks for Computers and Electronics brands and a 7% uptick for Home and Garden brands—highlighting savvy shopping behavior on the day of the event.

The 38% YoY decline in clicks for Flowers, Gifts, Food, and Drink indicates that shoppers were less inclined to use Prime Day sales for smaller value items.

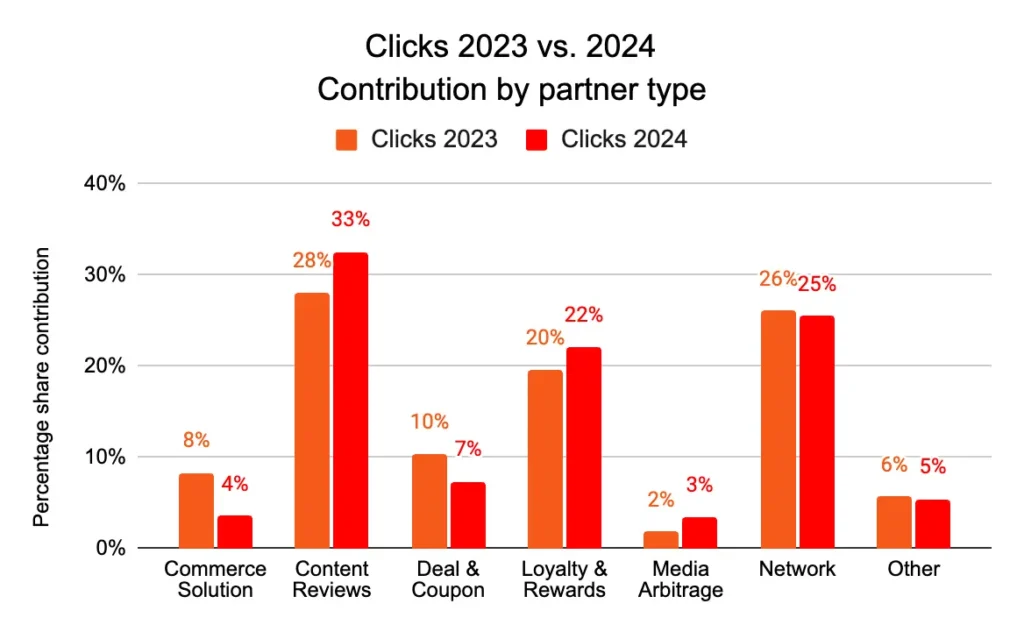

A third of all clicks during the Prime Day event were attributed to content review partners. Content review partners, such as Tripadvisor or Dog Food Advisor, provide unbiased evaluations and endorsements of a brand’s products or services to enhance credibility and drive customer trust. This trend suggests that shoppers showed a strong preference for partners who provided valuable insights to help them make informed purchasing decisions and navigate their buying choices.

Like last year, 1 in 4 clicks were attributed to network partners, while 22% were attributed to loyalty and rewards partners, such as Klarna, BeFrugal, or TopCashbacks.

With informative and trustworthy content—such as editorial reviews, influencer endorsements, or comparison articles—becoming more important, brands can make the following strategy adjustments to drive future customer behavior:

Strengthen relationships with high-performing partners.

Identify and develop long-term partnerships with top-performing partners by offering exclusive deals for their audience and early access to product information.

Enhance content quality.

Supply partners with rich, detailed product information to craft more compelling and accurate reviews. Encourage the use of high-quality images, videos, and interactive content to make product reviews more engaging and informative.

Boost engagement through social proof.

Partner with influential reviewers who can provide authentic endorsements and reach wider audiences, such as social media influencers. Also, consider turning satisfied customers into advocates.

2. Higher conversion rates drove more transactions

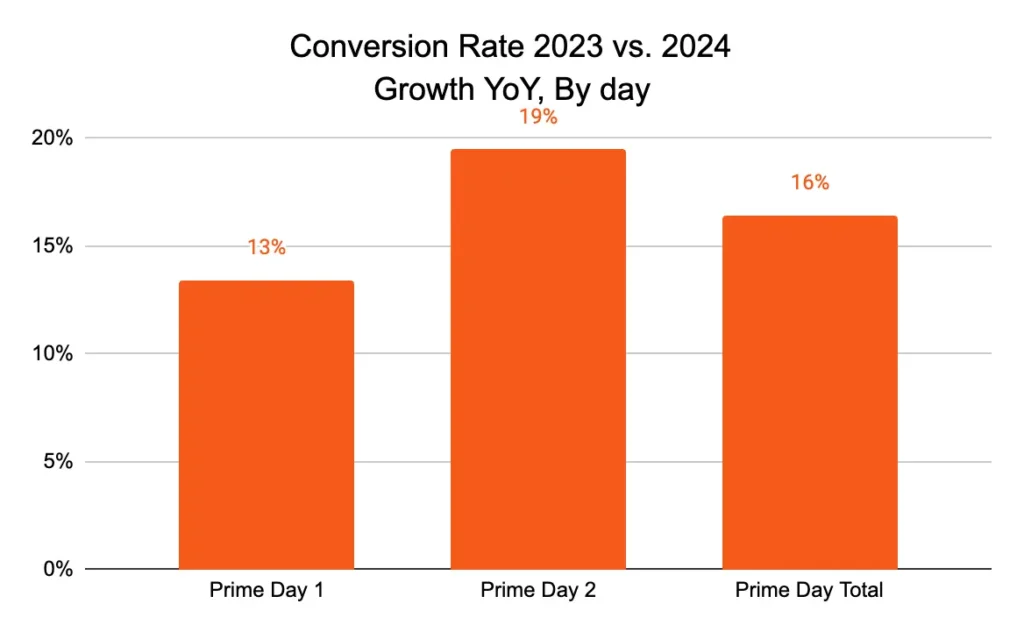

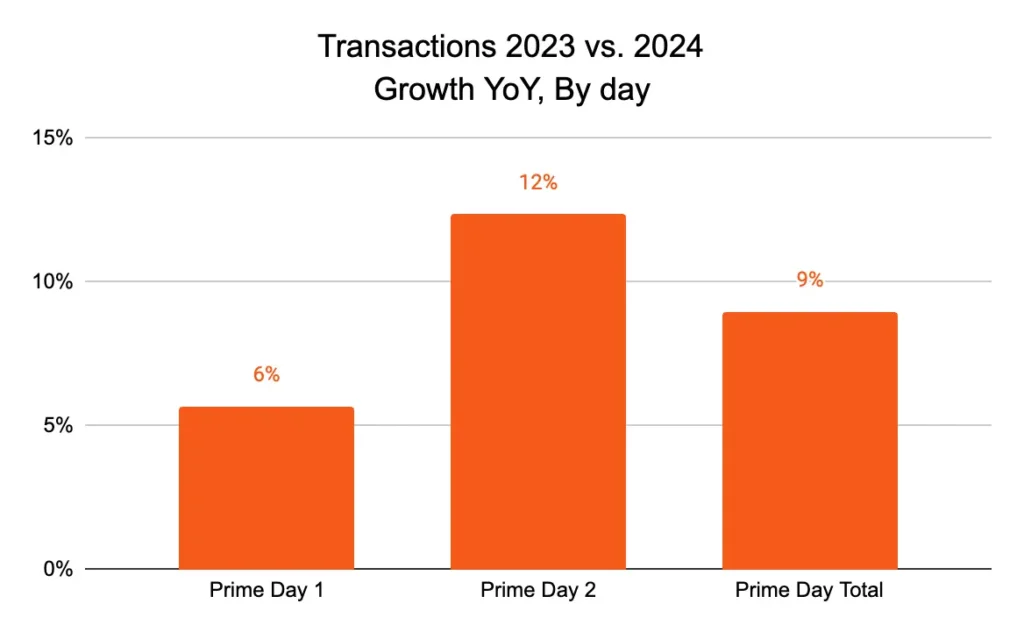

While Day 1 was the star for higher conversion rates and transactions for Prime Day 2023, this year, shoppers found Day 2 deals more appealing.

Day 2’s impressive 19% increase in conversion rates led to a 12% YoY increase in transactions. These second-day boosts contributed to the event’s 9% transaction growth.

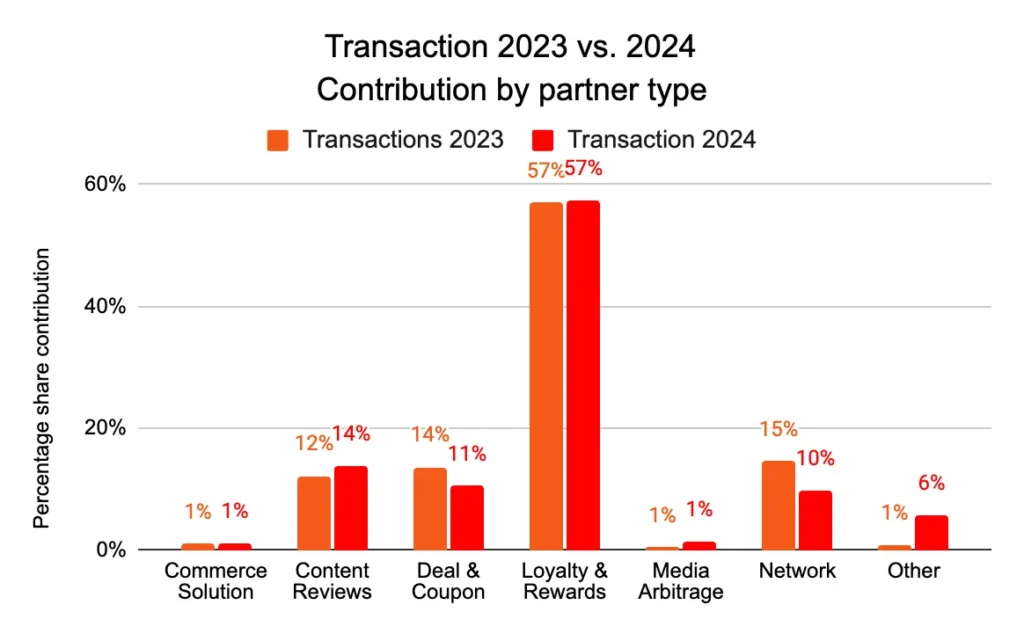

Like last year, nearly 3 in 5 (57%) transactions were attributed to loyalty and rewards partners. After years of trying to maximize savings, most shoppers have become accustomed to leveraging these partners to find the best deals amidst the sea of sales.

The heightened conversion rates and transactions suggest brands may have had more competitive prices this year than last year, drawing even more shoppers to the two-day event.

Implement enticing promotions throughout the sales period and create seamless shopping experiences.

Intensify Day 2 promotions.

Allocate more budget and marketing efforts towards the second day of Prime Day. Highlight exclusive Day 2 deals to create urgency and attract last-minute shoppers. Use targeted advertising to remind customers about extended deals, ensuring they return for additional purchases.

Optimize for impulse purchases.

Streamline the checkout process to reduce friction and capitalize on impulse buying behavior. Use countdown timers and flash sales to create urgency, encouraging shoppers to complete their purchases promptly.

Elevate partner collaborations.

Encourage partners to produce various content formats, such as live shopping events, unboxing videos, and detailed product reviews, to appeal to different segments of your audience.

3. Better deals led to a lower average order value (AOV)

Cooling inflation not only made shoppers more likely to buy more—it also led to less expensive products and made better deals possible during the two-day event. Numerator reports that 63% of shoppers were extremely or very satisfied with Amazon’s Prime Day deals, possibly contributing to 60% of shoppers completing two or more orders during the event.

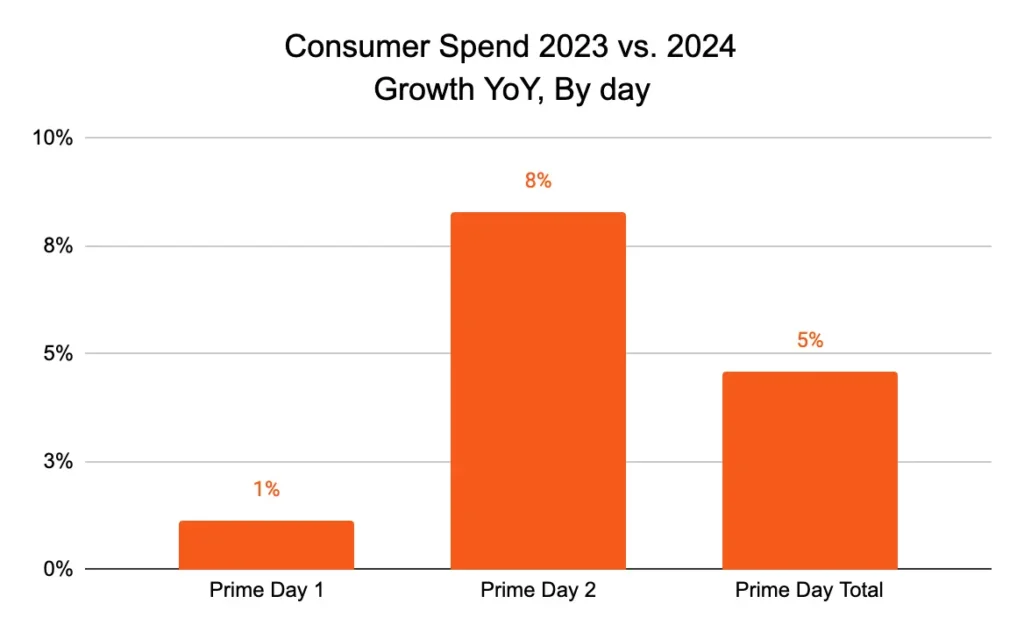

Better Day 2 deals may have contributed to shoppers making additional orders for low-cost impulse purchases, driving an 8% increase in consumer spending on the second day and a 5% spending increase overall.

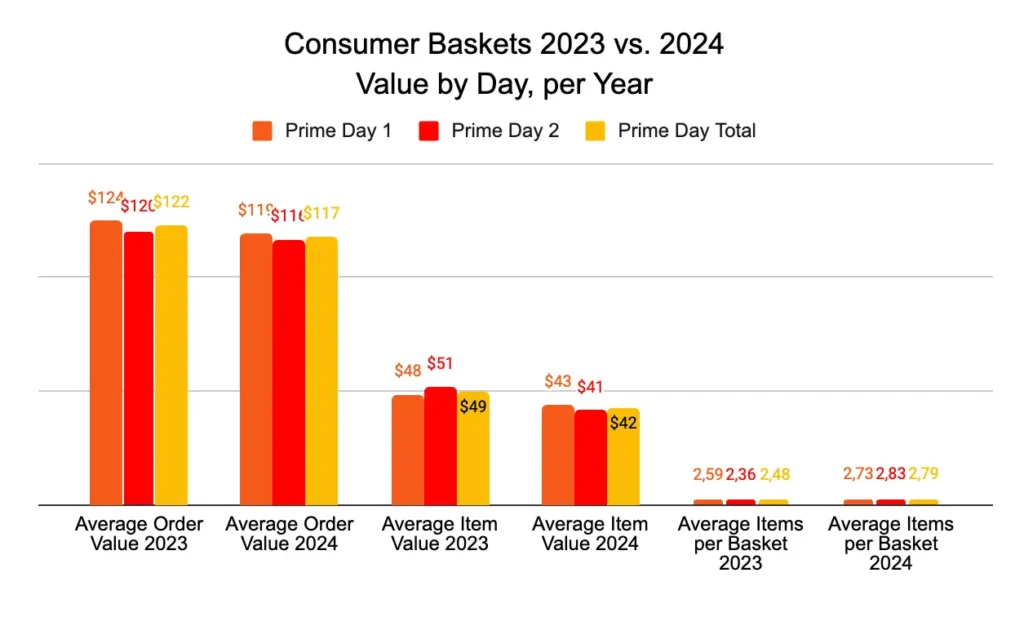

This may explain why AOV decreased by 4%, despite shoppers buying 13% more items this year. The value of these items also dropped 15%, showing that the combination of lowering inflation and great deals presented opportunities shoppers couldn’t resist.

Here are the key changes in consumer spending this year:

- Loyalty and rewards partners’ attribution to consumer spending increased from 50% to 52%.

- Consumers purchased more items per order this year, increasing 13% from last year.

- Consumers bought lower-value items and spent less per order than last year but made more transactions, resulting in increased overall consumer spending.

Consider making game-changing moves to your strategy and leveraging attractive discounts for Prime Day 2025:

Focus on volume-based promotions.

Create attractive bundle deals that encourage customers to purchase multiple items together, increasing the total transaction value. Additionally, tiered discounts can be offered, where the savings increase with the amount spent, incentivizing shoppers to add more items to their carts.

Optimize cross-selling and upselling.

Highlight complementary products on the product page and during the checkout process to encourage cross-selling. Suggest higher-value alternatives or add-ons that enhance the primary product’s functionality or experience.

4. Increased transactions led to higher action-based payouts for brands

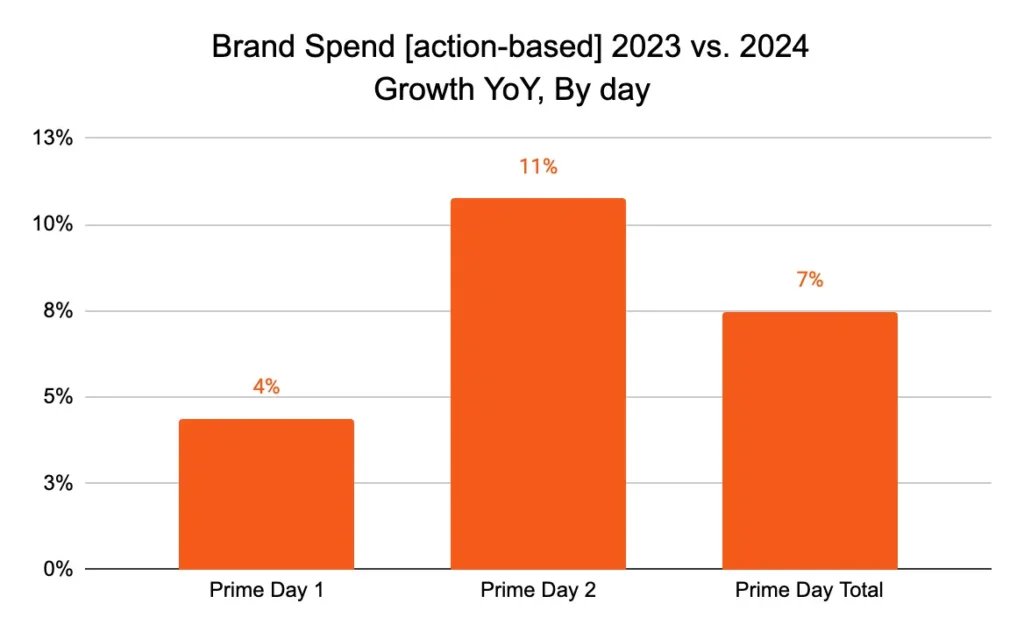

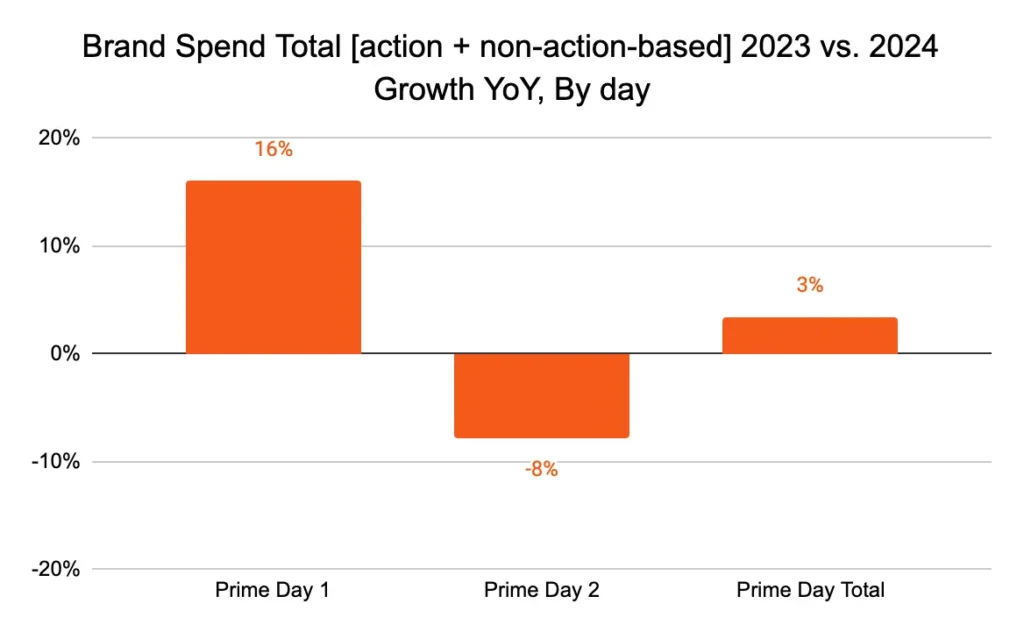

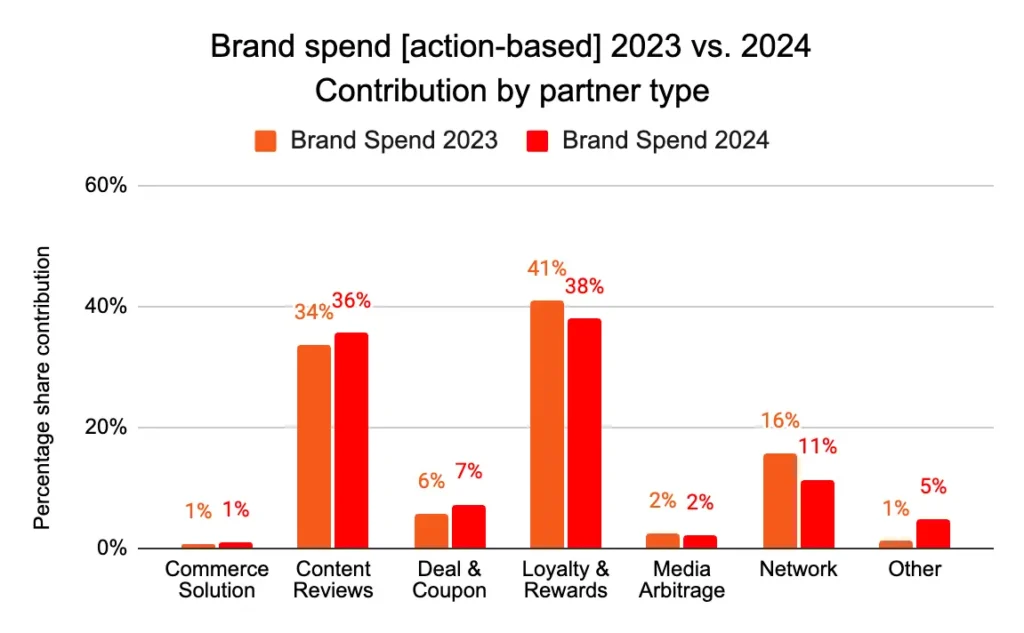

Better partner performance—in the form of higher conversion rates and transactions—translated into a 7% increase in action-based payouts. While this bump may seem steep, total brand spending only increased by 3% due to a 32% YoY decrease in non-action-based payouts.

The partners’ performance significantly boosted the success of Day 2’s deals during Prime Day, driving an 11% increase in action-based spending compared to last year.

Higher commission rates also contributed to the increase in action-based spending. Partner commission rates increased by 3% compared to 2023, which is an encouraging indicator of effective collaborations during the event.

Similar to last year, most action-based commissions were attributed to loyalty and rewards partners, and content review partners.

Next year, move the needle forward with notable upgrades to your partnership strategy:

Diversify your partner mix.

Increase collaboration with various partner types, such as influencers, content review sites, loyalty programs, and deal platforms. A diverse partner mix can help you reach your audience at different funnel stages. Experiment with new and emerging partners who show potential for high performance. This can open up new avenues for creating awareness and driving transactions.

Focus on action-based incentives.

Consider implementing Dynamic Payout models that adjust commissions based on partner performance metrics, encouraging continuous improvement.

Prime Day 2024 shows hope for another record year in 2025

This year’s increase in transactions and consumer spending reveals a long-awaited shift in consumer confidence. A return to more casual, consistent spending is on the horizon, and another successful Prime Day seems more likely than ever in 2025. With these insights, your brand can create the partnerships you need to thrive during Prime Day 2025.