People revealed with their 2023 spending habits that brands should be more strategic to impact these budget-conscious decisions. American shoppers are adjusting their buying habits, reserving discretionary spending for sales-heavy seasons.

Yet these new habits present an unexpected opportunity for retailers. Now that four in five Americans are embracing more affordable brands and better discounts, they have more cash in their pockets and are willing to splurge more than in recent years.

However, brands must convince shoppers that their product is worth the investment.

In this economic climate, partnerships offer less recognizable brands the chance to compete against household names by increasing awareness with the help of trusted partners, reducing purchase risk by offering discount codes, and more.

To capitalize on this trend, brands must understand changing buyer behaviors and identify the most effective ways to tap into them.

The 2023 Consumer Trend Benchmark research study by impact.com analyzes consumer spending throughout 2023 compared to 2022. These insights offer brands the data they need to reach today’s budget-conscious shoppers with a strong partnership strategy this year.

Methodology

The impact.com Data Science team conducted a study in January 2024 to examine 2023’s prominent consumer shopping trends.

Our analysis benchmarked partnership performance metrics such as:

- Average order value (AOV)

- Clicks

- Transactions

- Conversion rates

- Advertiser spend

- Consumer spend

Researchers tracked these KPIs by comparing same-store, year-over-year (YoY) data from brands that actively used the impact.com platform in 2022 and 2023.

While the complete analysis of the Retail and Shopping vertical includes various sub-categories, we highlight the following product categories in this report:

- Apparel, shoes, and accessories

- Arts and entertainment

- Computers and electronics

- Health and beauty

- Home and garden

- Sport, outdoor, and fitness

The data offers valuable insights into consumer behavior and more significant trends in the retail industry.

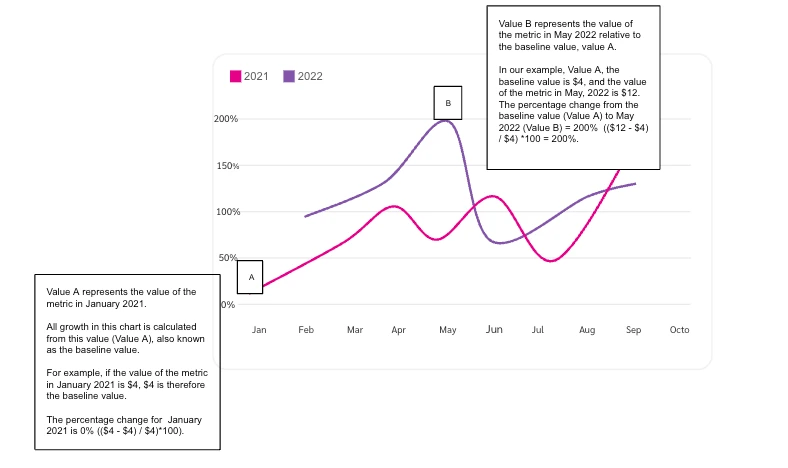

Interpreting the graphs

The values shown in each graph represent the percentage change in a metric’s value relative to that value at a specific time, also called the baseline value.

Our analysis measures all values relative to the baseline value from January 1, 2022.

For example:

5 insights into consumer spending behavior in 2024

1. As prices rise, shopping behaviors shift

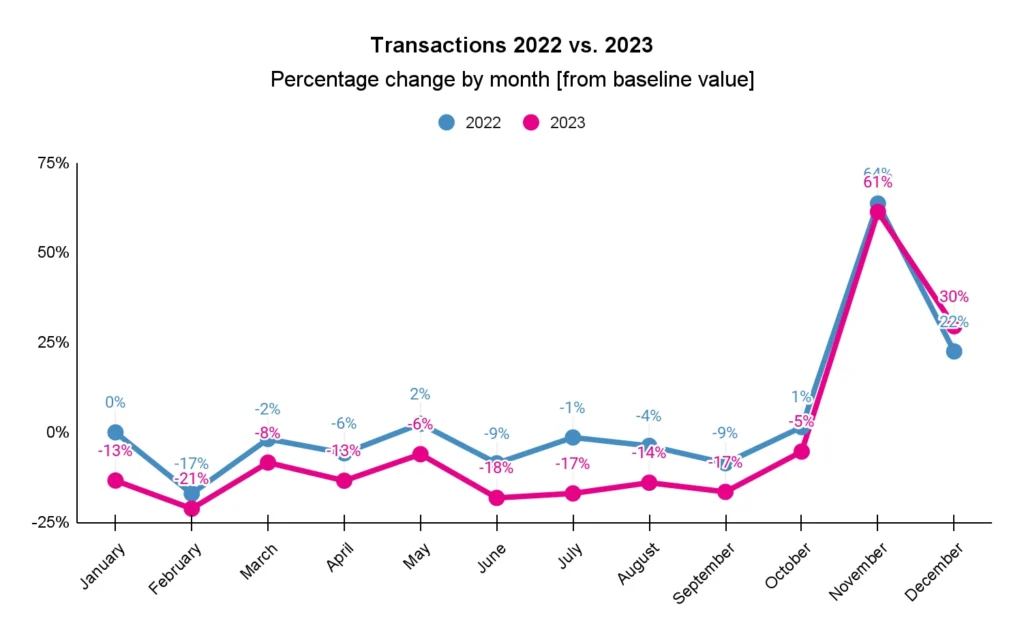

People continued the post-pandemic trend of reducing their shopping by making 7% fewer purchases in 2023. As shoppers geared up to spend more on essentials such as groceries and gas, many cut back on discretionary spending.

This uncertainty led to ongoing lower transactions for most of 2023 compared to 2022. Only December saw a 6% increase YoY.

Those who splurged waited for the best deals during key holidays such as Mother’s Day, Memorial Day, or Cyber Week. As expected, a third of the year’s transactions occurred in Q4. Roughly 33% of all 2023 transactions occurred during this period, increasing slightly from 2022.

Yet even during Cyber Week, consumer concerns about finances changed shopping habits. Nearly half of shoppers used a Buy Now Pay Later option to expand their purchasing capabilities. This allowed them to splurge in discretionary spending categories such as arts and entertainment or home and garden when the best holiday deals were available.

Offering multiple pay methods may inspire more discretionary spending as inflation continues to steady in 2024.

2. Window shopping is out and intentional buying is in

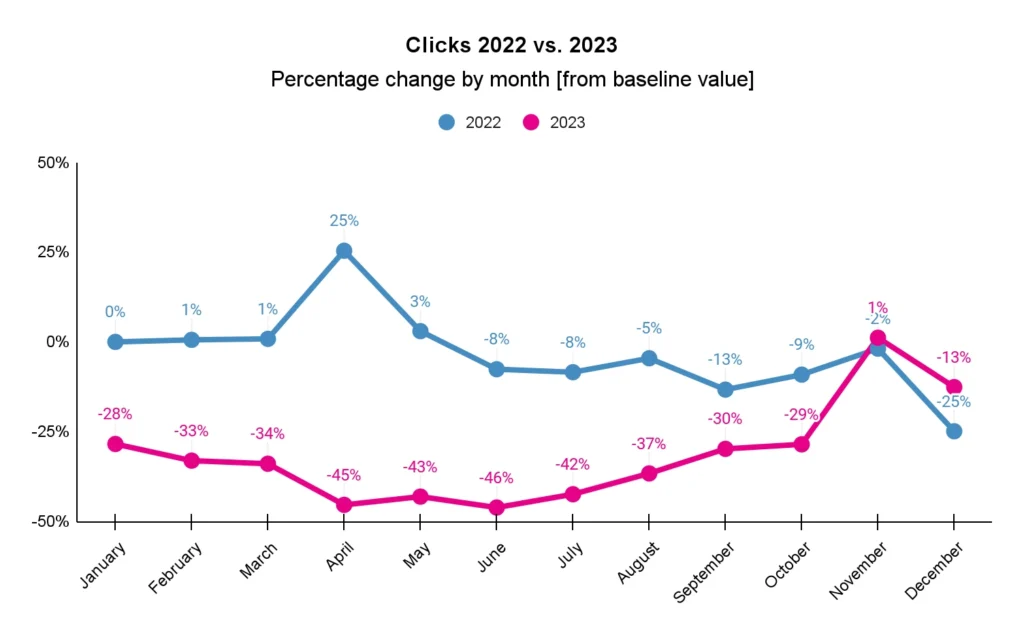

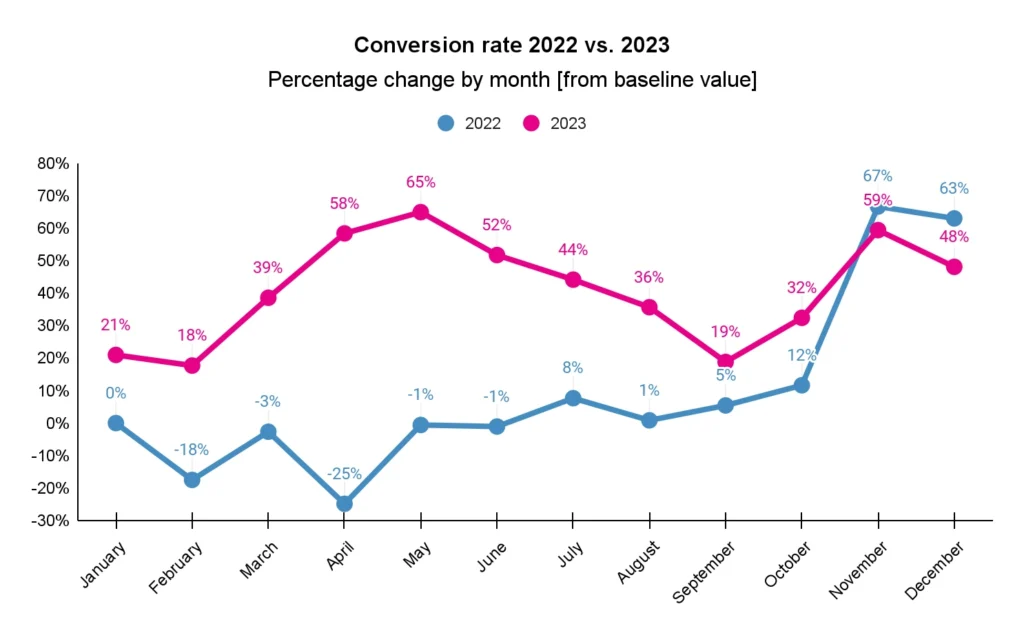

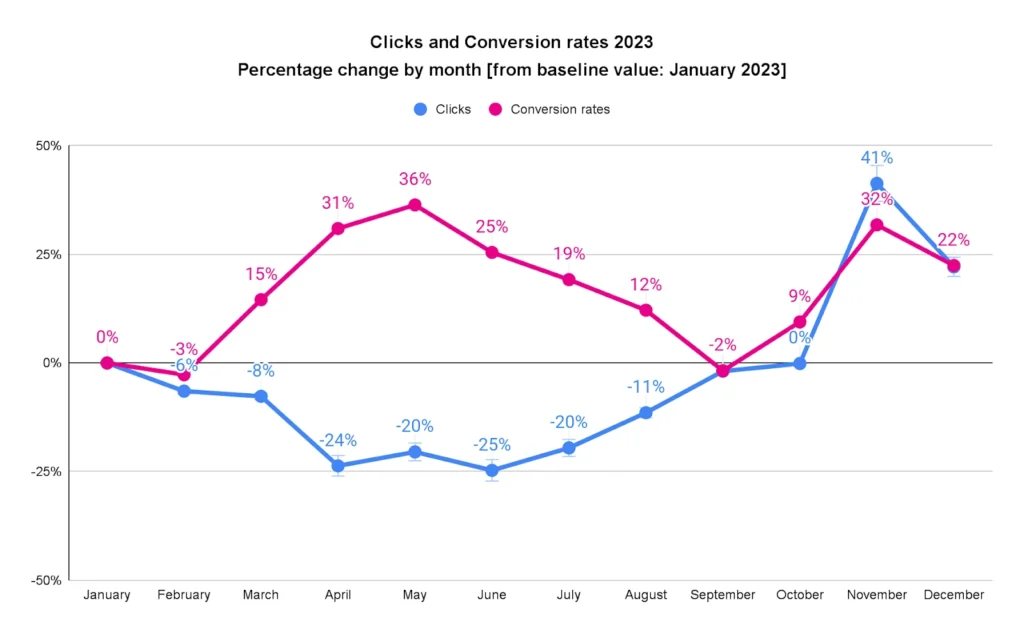

Consumer research and window shopping looked a little different this past year. Brands saw a 32% increase in conversion rate despite a 29% decline in clicks in 2023.

Popular sale events around Mother’s Day, Father’s Day, and Easter also saw fewer clicks than the previous year, ranging from a 56% decrease in April to a 42% decrease in June.

Meanwhile, April to May had similar conversion rates to what we’ve seen over the November holiday period in 2023. In April, conversion rates increased by over 100% compared to April 2022 and by 66% in May compared to May 2022.

These stats reveal consumer purchase intent was higher in 2023. Overall, people made fewer purchases and may have spent less time browsing or making impulse buys. Instead, they focused on getting deals for items already on their wish lists.

Partnerships may have helped people curate their wish lists before sales began, saving them the time and effort of window shopping.

November and December deviated from the rest of the year, with more clicks and lower conversion rates YoY. Buyers made a third of their 2023 purchases during Q4, indicating that more people might have been shopping online this past year—-whether they were looking to make planned purchases, complete their holiday shopping, or spoil themselves.

Deloitte reported over half of consumers planned to take advantage of as many deals as possible during this period. Yet, despite clicks being up and more people looking to buy, they were still searching for the best deals on wish list items, preparing to purchase as deals rolled out.

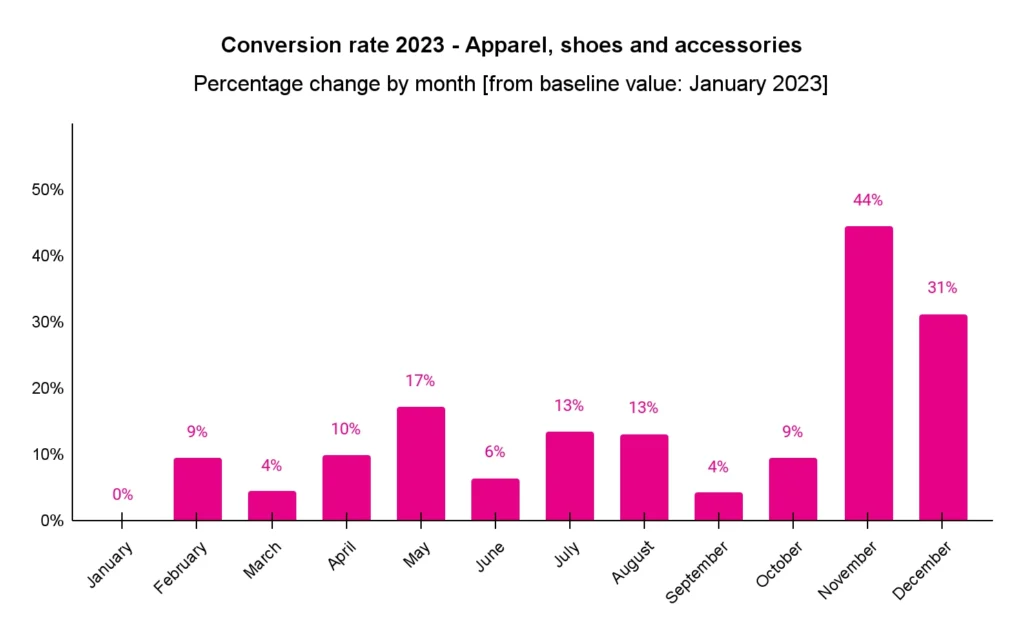

Semi-discretionary spending categories such as apparel, shoes, and accessories saw huge conversion rate boosts in November and December 2023 compared to the rest of the year. According to Deloitte, 70% of consumers planned to focus on this category, as they expected to find the best deals.

As shopping behaviors shift, it becomes even more critical for brands to capture consumer attention and earn a coveted spot on wish lists before big retail events.

3. Inflation drives up cart values

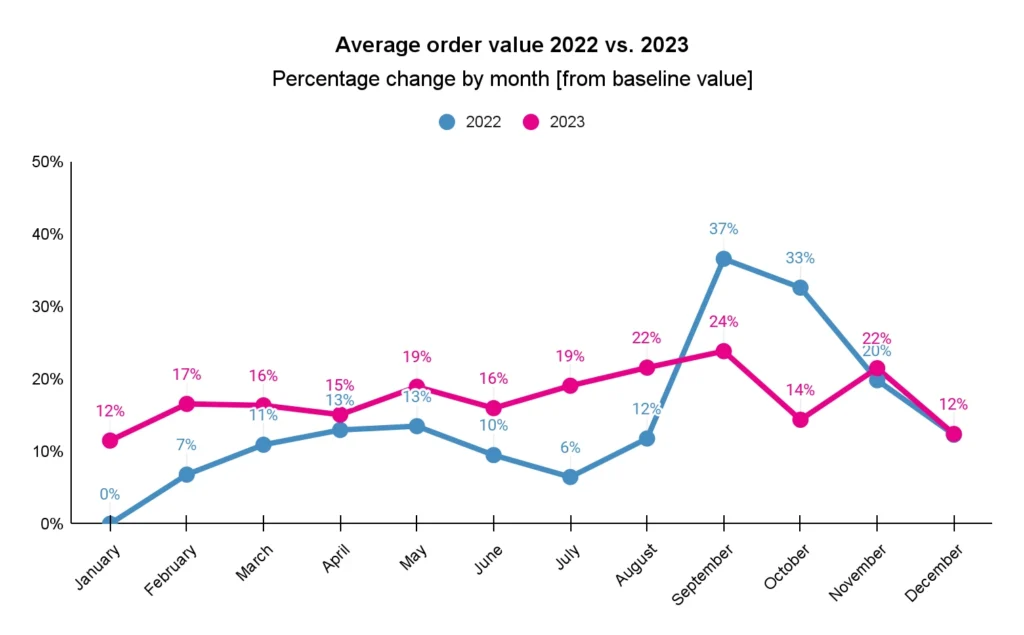

Even as budget-conscious shoppers limited their spending, average order value (AOV) continued to increase.

The meager 2% yearly increase in AOV suggests that price inflation may be driving cart values up—not that people are necessarily buying more items. That can explain why consumer spending in categories such as health and beauty saw a 13% drop despite a 19% AOV increase.

Those who needed to buy more items may have leveled their spending by looking for other ways to cut costs. One in four shoppers reported switching to lower-priced brands in 2023, while one in two were willing to buy in bulk to save money. Others reported switching to smaller pack sizes that were more affordable.

These trends could explain why AOV remained more stable than usual and experienced a slight dip during Q4’s heavy sales season. However, the decline in end-of-year AOV may also be due to brands offering significant discounts to motivate purchases.

As consumers looked for ways to save money on essentials throughout the year, many also splurged in categories such as arts and entertainment—revealing unprecedented AOV levels since the pandemic started. Arts and entertainment saw an 89% YoY AOV increase in October and a 29% increase for the year compared to 2022.

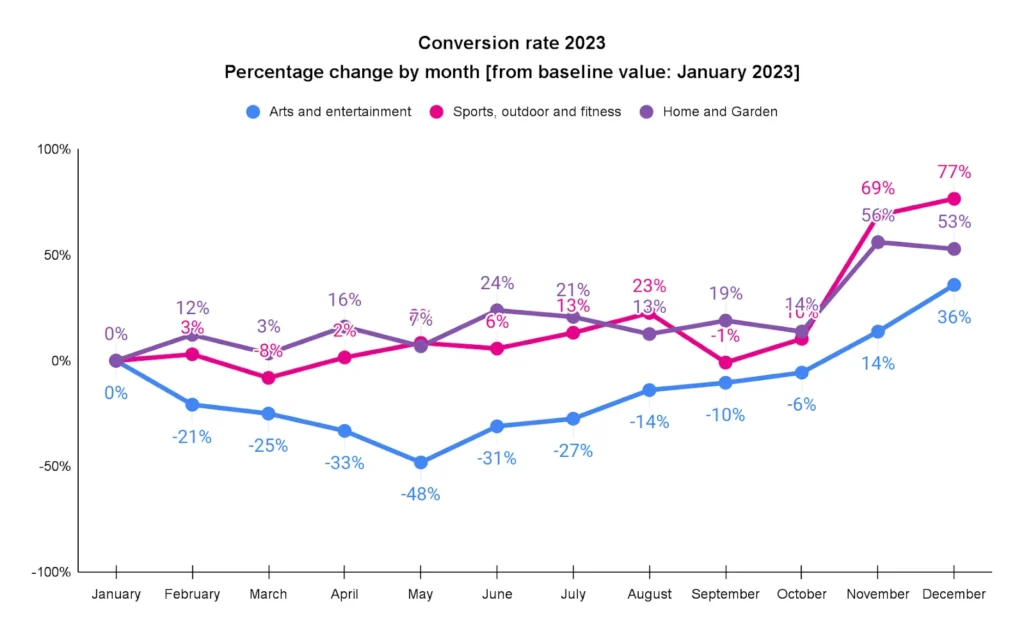

Purchase intent for this category experienced a significant surge, with conversion rates soaring 69% higher than the previous year. This steep increase could indicate that arts and entertainment brands strategically aligned with suitable partners, positioning themselves in front of audiences more likely to make such purchases.

4. Strategic splurging gives consumers access to luxuries

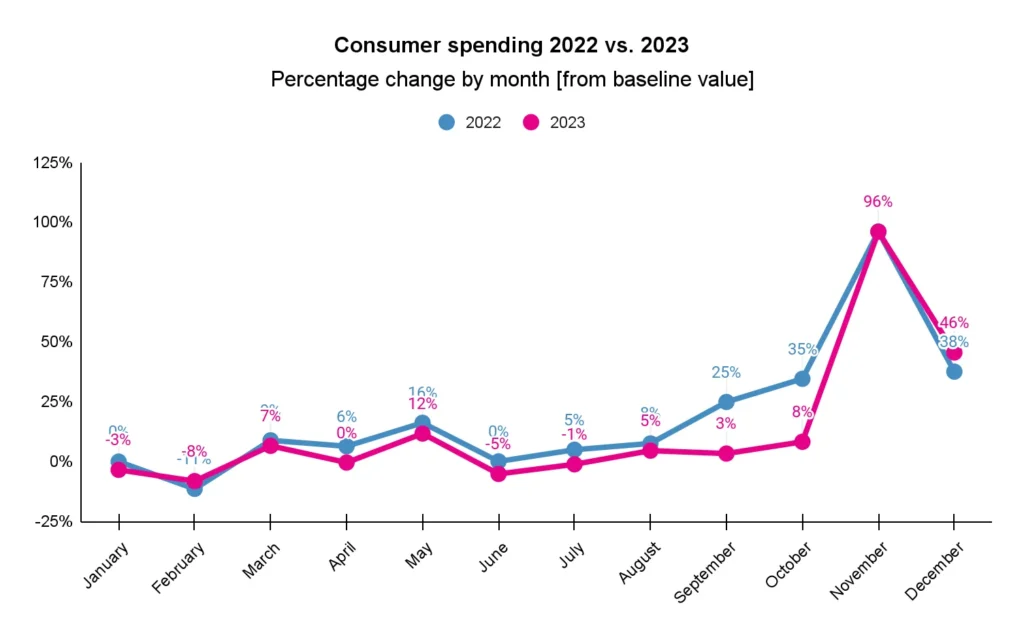

Rising prices didn’t stop 40% of shoppers from intending to splurge on selective purchases, such as high-end grocery items or travel. While overall consumer spending dropped 5% YoY, some categories saw unexpected boosts in spending.

For instance, arts and entertainment consumer spending rose 36%, while home and garden and sports, outdoor, and fitness brands all saw a 6% increase.

These brands also saw unprecedented conversion rate increases in Q4. This demonstrates how strategic spending throughout the year allowed shoppers to splurge on non-essentials when they saw the right opportunity and offer.

Decelerated consumer spending during Q3 showed shoppers might have been gearing up for the big discounts they’ve come to expect during retail events and holiday sales. Categories that often offer exceptional deals during Cyber Week—such as apparel, shoes, and accessories —saw higher conversion rates and consumer spending than usual in Q4,

Brands may want to offer big discounts throughout the year instead of waiting for holidays and shopping events. With fewer competing deals, brands can inspire buyers to make nonessential purchases and boost yearly revenue.

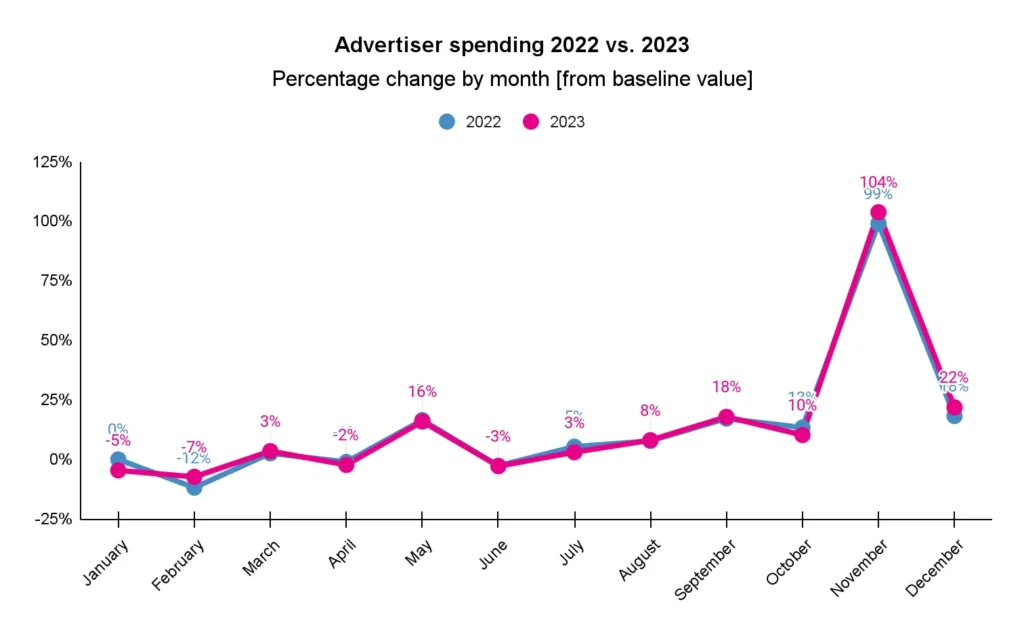

5. Slight increases in advertiser spending add up

While advertiser spending patterns remained largely consistent, brands slightly increased partner commission rates in 2023. However, this extra investment paid off with higher conversion rates for some product categories.

Both home and garden and sports, outdoors, and fitness brands saw a proportional 6% increase in consumer spending following a 6% advertising boost. Meanwhile, a 7% higher advertising spend produced 36% higher consumer spending for arts and entertainment brands.

As advertising costs increase, brands may seek to maximize ROI through performance-based channels, such as partnerships. Given shifting buyer behaviors, partnerships offer a cost-effective way to increase brand awareness, boost purchase intent, and motivate even the most selective shoppers to convert.

Secure a spot on shoppers’ wish lists with partnerships

Last year‘s shopping habits show that today’s discerning consumer is more willing to spend than brands might expect. Rather than pushing people to spend more, brands have an opportunity to help them shop more strategically through partnerships.

Performance-based partnerships allow brands to reach new customers, gain more clicks, drive sales, and only pay for results. By working with partners, brands can increase awareness and build credibility to earn a coveted spot on shopper wish lists.

Paying partners based on results helps maximize brand advertising budgets and increase ROI—all while building trust with new customers. As inflation drops and consumer spending increases, partnerships can ensure your brand remains top-of-mind when shoppers are ready to buy.

2024 is the year of opportunity for retail partnerships

A desire to save on essentials drives shoppers to new brands, offering a huge opportunity to reach new customers. Meanwhile, these savings allow consumers to spend more on splurges, too. In both cases, shoppers want an easy way to find brands they can trust. That’s where the power of partnerships comes in.

Partnerships aren’t just a “nice-to-have” anymore. They’re the primary way brands can drive revenue in today’s tumultuous economy. See how partnerships can help you maximize ROI today.