Your affiliate program is a target. As partnership budgets grow — 74 percent of brands are increasing affiliate investment, pushing the channel toward $35.4 billion by 2033—so does fraud. Right now, one in four affiliate traffic sources is fraudulent. That means that, statistically, for every four new partners who apply to your program, one is a scammer.

You’re protecting your budget, and also:

- Your credibility when your CMO asks why conversion rates dropped 40% last quarter

- Your time spent investigating suspicious traffic patterns instead of growing the program

- Your relationships with legitimate partners who watch fraudsters collect commissions they earned

The partnership managers who succeed are building fraud-resistant programs from day one. This guide shows you how, with six prevention strategies that scale from small programs to enterprise operations, plus red flags that help you spot fraud before it costs you.

What is affiliate fraud, and why does it happen?

Affiliate fraud occurs when scammers use deceptive tactics to earn commission payouts from affiliate marketing programs. They fabricate clicks, generate fake leads, or claim attribution for sales they didn’t actually drive.

When this happens, it negatively impacts your program in several ways:

- Your brand pays commissions for worthless traffic.

- Legitimate affiliates lose earnings to scammers.

- Your return on ad spend (ROAS) plummets.

Understanding the causes of affiliate fraud

When there’s money on the table for performance, bad actors will always find ways to game the system. Understanding the root causes helps your brand build more resilient programs from the start. Here are the main causes:

Flawed reward system: Scammers exploit program designs intended to incentivize high performers, making it appear as though their website is driving conversions to earn higher commissions.

Lenient acceptance criteria: Overly relaxed partner vetting can inadvertently introduce scammers into your program, who rely on lenient criteria to slip through the application process.

AI/Bot fraud sophistication: The rise of Generative AI has made fraud detection significantly more challenging. Modern bots mimic human behavior with frightening accuracy, varying click patterns, and rotating IP addresses to appear organic, which allows them to bypass traditional detection systems.

Mobile app fraud/installs: Mobile advertising introduces new vulnerabilities, such as click injection (stealing attribution just before an install) and SDK spoofing (faking in-app events on the server side). Device farms also generate mass volumes of low-quality installs that inflate costs.

8 types of affiliate marketing fraud you should know

Partner program fraud can take many forms, so it’s important to know what to look for. These tactics are the most common types of affiliate fraud that companies face.

| Fraud type | Red flags: What to look for |

| Click spoofing Scammers trigger invalid click events (or non-existent engagement) without user interaction to claim a commission. | – High click volume, zero conversions. – Multiple clicks from the same IP/Device ID. – Clicks from impossible geographic locations. |

| Click fraud Leveraging a network of bots to mimic user behavior, generating thousands of fake click events for paid leads. | – Traffic surges at odd hours. – Low session duration, high bounce rates. – Clicks from data centers/hosting providers. |

| Cookie stuffing Automatically drops a cookie on a user’s browser, claiming credit for a future purchase the user makes. | – High conversions, minimal referral traffic. – Attribution for customers who never clicked links. – Unusually long-duration affiliate cookies. |

| Hidden landing pages Publishers trigger hidden pages with affiliate links to open and drop cookies without the user’s knowledge | – Conversions from partners with minimal visible content. – Suspicious JavaScript/iframe implementations. – Links embedded where users cannot interact. |

| URL hijacking Buying similar domains (typosquatting), triggering a click, and immediately redirecting the user to the actual site to claim credit. | – Typosquatting domains in referral data. – Extremely short time-on-site metrics. – Redirect chains in URL tracking parameters. |

| Malware Malicious software that automatically inserts the scammer’s affiliate code when an infected user makes a purchase. | – Attribution for customers arriving via direct traffic. – Same affiliate ID on unrelated transactions. – Partners with commissions but no marketing presence. |

| Using stolen data Using stolen user data (credit cards, leads) to make affiliate purchases or generate fake leads. | – High chargeback rates. – Lead data from temporary email services. – Geographic mismatch: billing/shipping vs. IP location. |

| Malvertising Purchasing ad space to serve infected code that generates clicks or drops a cookie when a user interacts with the ad. | – User reports of aggressive redirects/downloads. – Attribution from sites known for security issues. – Partners’ ad placements cannot be verified/inspected. |

6 ways to prevent affiliate fraud

Once you understand what affiliate fraud looks like, preventing it becomes a matter of implementing the right processes and tools to address the issue. These six strategic approaches are designed to scale with your program, offering solutions for businesses at every budget level.

1. Establish a multi-layered vetting and enrollment process

The first defense against fraud is controlling who enters your program. Fraudulent accounts often mimic legitimate businesses, but they typically lack professional history, verifiable traffic sources, or proper compliance documentation.

For small and mid-budget programs:

Implement mandatory manual review for every application. Verify the quality of the applicant’s website by checking domain age, content quality, and traffic sources through tools like SimilarWeb or SEMrush. Review their social media presence and confirm that their promotional methods align with your brand guidelines. Require clear disclosure of how they plan to promote your products.

For mid-market and enterprise programs:

Automate initial screening using platforms that analyze website legitimacy, traffic quality, and historical behavior. Require identity verification, such as a tax ID, business license, or corporate documentation, for payouts. Implement graduated approval processes where new partners start with lower commission rates and tighter monitoring before gaining full access to your program.

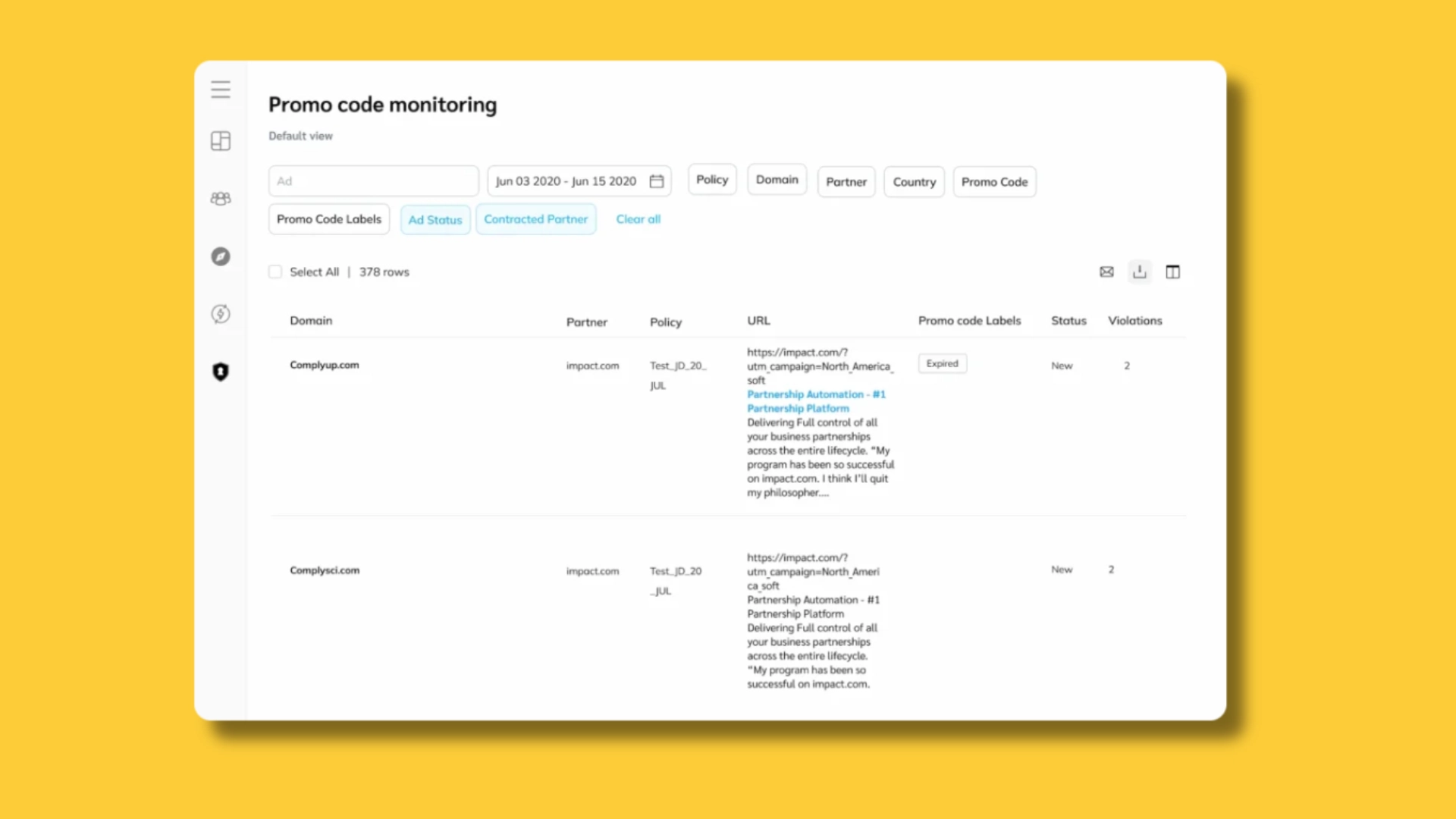

2. Implement robust promotional code monitoring

Unauthorized coupon code usage undermines your pricing strategy and damages relationships with legitimate coupon partners. Fraudsters frequently scrape valid codes intended for specific channels—like email exclusives or influencer campaigns—and post them publicly on deal sites, stealing attribution and diluting your brand’s value.

For small and mid-budget programs:

Assign unique, trackable codes to specific partners or channels. This creates accountability and makes unauthorized sharing immediately visible. Regularly search major coupon aggregation sites, such as RetailMeNot and Honey, for your brand name to spot unauthorized code postings. When you find violations, document them and follow up with warnings or termination per your program terms.

For mid-market programs:

Set up automated Google Alerts for your brand name combined with terms like “coupon,” “promo code,” and “discount” to get daily notifications of new code postings. Invest in coupon monitoring services that track code usage across hundreds of deal sites and provide regular reports on compliance.

Advanced platforms offer tools like Promo Code Monitoring to automatically detect and flag unauthorized use of your promotional codes across the web. This protects relationships with legitimate partners and ensures you only pay commissions for compliant usage.

impact.com’s Promo Code Monitoring

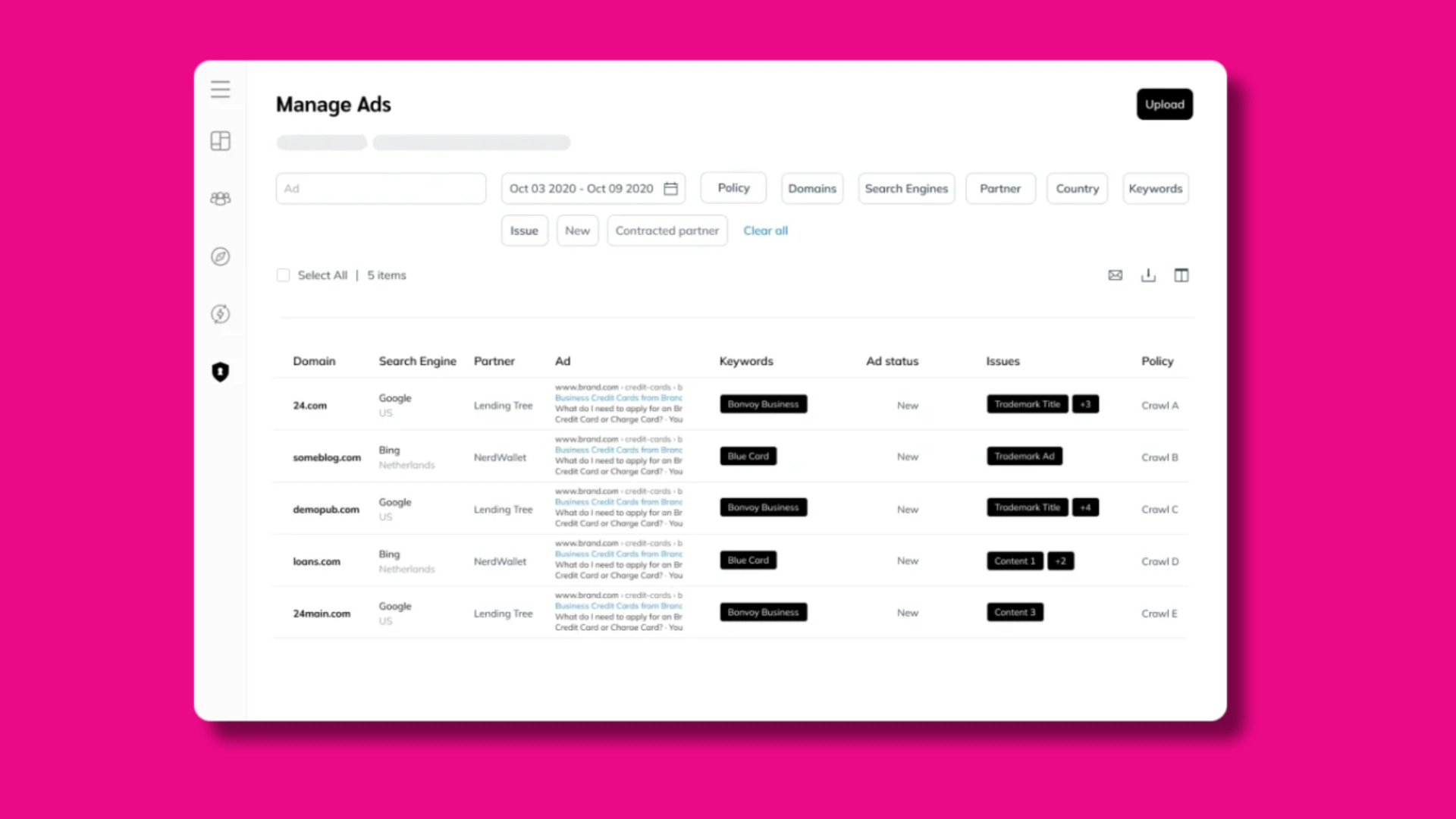

3. Proactively monitor search and web activity

Fraud often manifests through URL hijacking, brand bidding on your protected keywords, or placing your affiliate links next to controversial content—all of which can damage your brand and inflate costs.

For small and mid-budget programs:

Use free tools like Google Alerts to monitor your brand name paired with terms such as “coupon,” “review,” and “sale.” Periodically search the top results pages for your core brand terms to ensure only authorized partners are ranking. If you run paid search campaigns, manually check that affiliates aren’t bidding on your brand terms.

For mid-market programs:

Invest a few hours monthly in comprehensive SERP (search engine results page) audits. Document which partners appear for your brand terms and compare against your affiliate agreements. Use tools like SEMrush or Ahrefs to identify who’s bidding on your brand keywords and at what cost.

Integrate tools that perform search monitoring to automatically catch brand bidding violations before they drain your budget. Dedicated web monitoring goes further by detecting unauthorized copyright use, unapproved link placements, and content scraping —providing the evidence you need for enforcement conversations.

impact.com’s Web Monitoring

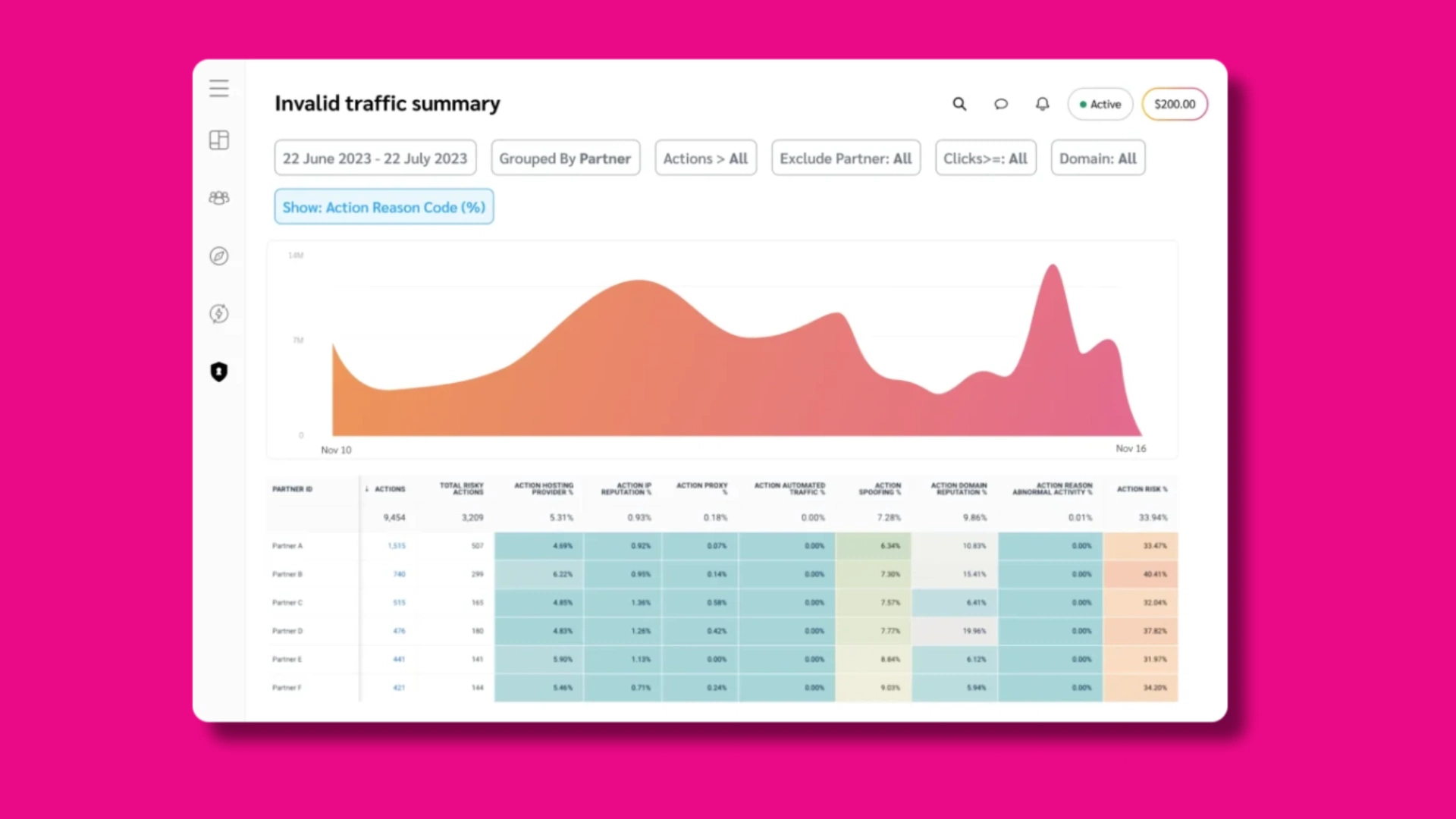

4. Enforce strict data validation and event risk thresholds

Fraudulent clicks and conversions exhibit patterns that human behavior rarely follows. These patterns include identical timing intervals, suspicious IP addresses from known data centers, impossibly high action velocity, or transactions that don’t make business sense.

For small and mid-budget programs:

Implement post-conversion checks before commissions are paid. Flag transactions with suspicious characteristics, such as:

- Bulk purchases of single low-value items.

- Multiple orders from the same IP address in short timeframes.

- Shipping and billing addresses in different countries.

Create a manual review queue for any conversion that meets your risk criteria and investigate before paying commissions.

For mid-market programs:

Build custom rules in your analytics platform to automatically flag high-risk conversions. Track device fingerprints, IP reputation scores, and user journey completeness. Consider implementing a holding period for commissions from new partners—pay out after 30 or 60 days once you can verify the transactions aren’t chargebacks or returns.

Management platforms such as impact.com offer the Event Risk feature to analyze dozens of parameters in real-time for every click, install, and conversion. High-risk events can be automatically blocked or flagged for review, preventing fraudulent payouts without manual intervention.

5. Utilize placement reports for performance audits

Full transparency into where an affiliate places your links can uncover hidden landing pages, non-compliant placements, or traffic from unexpected sources like spam email lists or misleading ads.

For small and mid-budget programs:

Explicitly require affiliates to detail exact placements—specific URLs and pages—when they apply to your program or in monthly performance reports. If a partner drives high volume without disclosing the source of the traffic, request documentation before approving additional payouts. Make site audits a condition for continuing the partnership.

For mid-market programs:

Build quarterly business reviews into your partner management process. During these reviews, ask partners to walk through their promotional strategies and provide proof of placement. Use screenshot verification or request live demonstrations of how they’re promoting your offers.

Leveraging advanced reporting will enable you to gain real-time insights into suspicious traffic sources, with prompt identification of high-risk events, from bot clicks to cookie stuffing.

Sophisticated Invalid Tracking detection

6. Maintain consistent communication and program transparency

Deterrence is one of the most powerful prevention tools available. When fraudsters know you’re actively monitoring and enforcing policies, the risk-reward calculation shifts dramatically. Clear communication about fraud prevention encourages compliance from genuine partners and discourages bad actors from even attempting to join.

For small and mid-budget programs:

Dedicate a section of your affiliate agreement that:

- Highlights examples of fraud and their associated consequences.

- Explicitly states the consequences: immediate commission reversal, program termination, and potential legal action.

- Requires affiliates to detail exact placements (specific URLs and pages) when they apply or in monthly reports.

- Makes site audits a condition for continuing the partnership.

- Stipulates that a manual review will occur for any conversion that meets your risk criteria (e.g., bulk low-value purchases, multiple orders from the same IP, shipping/billing address mismatches) before commissions are paid.

Send periodic “compliance reminders” to all partners, highlighting your fraud detection capabilities and recent enforcement actions (without naming specific partners). This demonstrates you’re paying attention.

For mid-market and enterprise programs:

Use an automated platform to notify partners promptly when potential violations are identified. Link alerts directly to the specific policy they may have violated and give them a chance to explain before taking action. This creates accountability while preserving relationships with partners who may have made honest mistakes.

Implement a tiered warning system:

- First offense: Receives education and a warning.

- Second offense: Triggers commission holds or review.

- Third offense: Results in termination.

Document everything to build a clear history that protects you legally and demonstrates fair enforcement.

Using fraud detection and prevention software

Once you’ve tightened up your manual processes and partner agreements, the next step is layering on technology that can scale with your business. Fraud detection and prevention software automates monitoring and uses advanced techniques to catch sophisticated attacks that human auditors can miss. Choosing the right tool depends entirely on your program size and budget.

Tier 1: Platform-native tools and manual audits

If you’re running a smaller affiliate program or working with budget constraints, start by maximizing the tools you already have access to through your affiliate network or tracking platform. Most platforms include basic fraud prevention features—you just need to know how to configure and use them effectively.

What this tier includes:

- Built-in tracking and reporting dashboards in your affiliate software

- Free tools like Google Analytics for traffic validation

- Manual periodic audits using spreadsheet analysis

- Google Alerts and basic search monitoring

- Custom conversion rules and approval workflows

Best for: Programs with fewer than 50 active affiliates, limited budgets, or businesses just starting their fraud prevention journey.

Limitations: Labor-intensive, reactive rather than proactive, can miss sophisticated fraud techniques, and doesn’t scale as your program grows.

Tier 2: Integrated partnership automation solutions

As programs mature, integrated platforms [such as impact.com and Everflow] that combine affiliate tracking with built-in fraud prevention deliver the best value. These solutions automate detection, provide real-time monitoring, and integrate directly with your existing partnership workflows. This means no disconnected tools or manual data transfers.

What this tier includes:

- Real-time fraud scoring and risk analysis

- Automated promo code monitoring across coupon sites

- Paid search compliance tracking and brand bidding detection

- Web monitoring for unauthorized link placement and content scraping

- Device fingerprinting and IP reputation analysis

- Machine learning models that improve detection over time

- Comprehensive reporting with detailed evidence for enforcement

Best for: Programs with 50 to 500+ active affiliates, mid-market brands with growing fraud concerns, and companies ready to automate their fraud prevention but not ready for specialized enterprise solutions.

Limitations: Requires significant investment in licensing fees and implementation resources

Tier 3: Specialized third-party fraud detection

For enterprise brands running massive affiliate programs across multiple platforms, or companies in industries with exceptionally high fraud rates, specialized third-party fraud detection solutions provide the deepest level of protection. These tools [such as CHEQ and Spider AF] focus exclusively on fraud prevention and integrate with your existing tracking platforms.

What this tier includes:

- Advanced bot detection using behavioral analysis

- Device fingerprinting at the hardware level

- Cross-platform fraud identification across multiple marketing channels

- Predictive fraud modeling using vast datasets

- Custom machine learning models trained on your specific program data

- Dedicated fraud analysts and support teams

- Integration with payment processors to prevent fraudulent payouts

Best for: Enterprise brands spending millions on affiliate marketing annually, programs dealing with persistent sophisticated fraud, or industries with historically high fraud rates (gambling, financial services, supplements).

Limitations: Typically require significant investment—both in licensing fees and implementation resources. They make sense when fraud prevention becomes a dedicated function within your organization, not just one responsibility among many.

What advanced affiliate fraud detection features should I look for before purchasing a prevention tool?

When evaluating fraud prevention software, not all solutions offer the same capabilities. Here are the six non-negotiable features your fraud prevention tool must include to provide comprehensive protection:

✅ Advanced and compliant tracking tools: Provide accurate and compliant tracking of conversions, installs, and user journeys. This prevents fraudsters from stealing credit or masking their activities.

✅ Partner discovery and vetting tools: Offers detailed profiles, traffic statistics, and verified media properties to enable informed decisions and reject applicants who exhibit red flags before they cost you money.

impact.com’s Marketplace and discovery tools

✅ Dynamic payment controls: Helps prevent fraud by allowing you to automatically adjust commissions based on factors like customer status, order size, or product margin, ensuring you only pay for measurable, high-value results.

✅ Engagement and brand control tools: Provides a controlled environment for partners by hosting approved creative and current offers in a central spot and issuing unique, secure coupon codes. These tools also streamline content approvals and proof of posting.

Streamline creatives and offer management with impact.com

✅ Real-time analytics and anomaly detection: Immediately alerts you to data anomalies that signal suspicious activity, such as sudden traffic spikes or unusual conversion rates, allowing you to prevent future failures.

✅ Full-stack protection and automated remediation: Applies monitoring and remediation across the entire consumer journey to automate the resolution of issues and achieve brand safety.

impact.com’s Paid Search Monitoring

FAQs

Affiliate marketing fraud happens when scammers manipulate tracking systems to earn commissions they didn’t actually generate. It includes tactics like fake clicks from bots, cookie stuffing without consent, and fabricated leads or sales. These schemes distort your data, waste ad spend, and damage relationships with legitimate partners, ultimately driving up your customer acquisition costs.

Common types of affiliate marketing fraud include:

- Click fraud: Bots mimic real visitors to generate thousands of clicks.

- Cookie stuffing: Secretly installs tracking cookies on users’ devices without their consent.

- Click spoofing: Reports non-existent engagement or triggers invalid click events.

- URL hijacking: Uses lookalike domains to redirect users and steal attribution.

- Malware: Malicious software injects affiliate codes automatically when a user makes a purchase.

- Click injection: A mobile scam where a fraudulent click is injected just before a legitimate app install to steal attribution.

- SDK spoofing: A mobile scam that fakes in-app events like purchases or sign-ups server-side.

- Using stolen data: Scammers use stolen user data (e.g., credit card info) to make affiliate purchases or generate fake leads.

- Malvertising: Purchasing ad space to serve infected code that generates clicks or drops a cookie when a user interacts with the ad.

Preventing and detecting affiliate fraud are both essential. You can stop affiliate marketing fraud by following these key strategies:

- Start by vetting partners before approval and setting clear compliance rules.

- Monitor traffic for unusual spikes or conversion patterns.

- Combine manual reviews with automated fraud detection tools that analyze clicks and conversions in real time.

- Conduct regular audits of promo codes, paid search, and placements to identify suspicious behavior promptly and enforce accountability.

The most effective fraud prevention strategies focus on verification, monitoring, and automation. Verify partner identities and traffic sources, and use tools that track IP reputation, device fingerprints, and conversion behavior. Review campaign data for anomalies like sudden traffic surges or high chargeback rates. Ongoing audits and real-time scoring help you identify fraudulent conversions before payouts are made, reducing loss and maintaining partner trust.

Yes, and you should. Machine learning models can analyze vast amounts of data in seconds, detecting suspicious activity based on IP patterns, device data, conversion timing, and behavioral signals. Automated systems flag or block fraudulent activity before commissions are paid. Platforms like impact.com build this technology directly into their partnership management tools, offering seamless, always-on protection.

Build an affiliate program you can trust

Affiliate marketing success no longer relies solely on recruitment and growth; security is just as critical. Preventing affiliate fraud doesn’t require becoming a cybersecurity expert. It requires implementing the right combination of processes, policies, and technology that work together to deter fraudsters, detect violations early, and take action. Start with strict vetting, clear terms, and regular performance audits to create a foundation that discourages casual fraud.

Because manual monitoring cannot keep pace with modern fraud sophistication, you must layer on technology that scales with your program. Investing in advanced management solutions such as impact.com, arms your brand with the tools to detect and prevent affiliate fraud.

With powerful technology at your fingertips, you can focus on what matters most: developing strong partnerships and building an affiliate program that drives revenue. Request a demo to see impact.com’s Ad Fraud Protect and Monitor in action. To learn more about shielding your program against fraud, check out PXA’s Protect and Monitor course.

Ready to outsmart the scammers? Check out these impact.com fraud prevention resources:

- Addressing quality and brand safety in performance marketing: Partnership strategies that deliver results (blog)

- Safeguard your brand with always-on Social Monitoring (one-sheet)

- 6 affiliate tracking methods [+ the outcomes of getting it right] (blog)

- Grow partnerships while mitigating compliance risk (one-sheet)

- How modern marketers can boost campaign effectiveness with performance marketing attribution (blog)