As a customer acquisition agency, Spark ROAS works with a variety of fast-growing brands focused on increasing subscriptions via affiliate partnerships. Over the years, we have used the analytical and reporting capabilities of the Impact platform to identify several strategies that are vital to bringing in new subscribers for our clients. Here are four that any subscription-based business should consider:

1. Know your affiliate partners

Which affiliate partners deliver top-of-funnel conversions vs lower-funnel conversions?

How do your affiliate partners generate their traffic? Is it with organic search, paid search, paid social, organic social, email lists, or apps?

“Affiliate partners can contribute to every stage of your customer acquisition funnel and can dramatically increase the visibility of your brand or product at various points in the purchase process.”

Affiliate partners can contribute to every stage of your customer acquisition funnel and can dramatically increase the visibility of your brand or product at various points in the purchase process. Understanding how these partners drive traffic for your subscription business and how to measure value is important. There’s no one-size-fits-all approach,, but using Impact’s advanced reports and assessing how different affiliates contribute to your overall media mix is a good starting point.

Consider breaking partners into several tiers:

- True discovery and content = top of funnel with a strong contained brand and voice from the affiliate partner. This could be a strong influencer, large publisher like Business Insider, or a more industry-specific blogger.

- Consideration and review = product review sites, YouTube reviewers, loyalty or points platforms.

- Checkout = coupon and deal sites.

We generally encourage our clients to work with partners at all stages of the funnel and assign value to each level. The most challenging is often the checkout level of coupon and deal sites. A good rule of thumb here is to set a commission payout that takes into account the acquisition cost of other channels further up the funnel and the average conversion rate of customers who visit a coupon site before reaching checkout vs those who do not.

2. Leverage your payout structures

Our philosophy when it comes to deploying a public payout level is to start low and increase as needed. Depending on your company and the types of affiliates you’re looking to work with, you’ll likely need to increase your baseline payout and shift to a CPA model for certain partners.

Once you’ve developed a rough outline of where each partner fits in your customer conversion funnel, you can start to assign general rules for commissioning partners in these tiers. Furthermore, if you identify partners who can increase volume from added placements like newsletters or push notifications, don’t be afraid to pay upfront fees with quality partners.

We take a portfolio investment approach to securing quality content or campaign activations for our clients. The most successful brands we work with approach every new partnership expecting it to fail or underperform (even after due diligence). But when we identify partners who overperform, they are quick to accelerate the partnership and lock in a closer ongoing relationship.

“The most successful brands we work with approach every new partnership expecting it to fail or underperform (even after due diligence). But when we identify partners who overperform, they are quick to accelerate the partnership and lock in a closer ongoing relationship.”

3. Use new customer promotions

This isn’t a new strategy, and most brands offer some sort of new customer discount; 10%-15% seems to be the average for DTC businesses. With a subscription business, however, it’s possible to get much more aggressive.

We’ve had success running first-purchase discounts of up to 95%. This strategy isn’t without its risks and abuse by people looking for a cheap one-time purchase. Even abuse by existing customers is a concern, although it can be somewhat mitigated by creating limits on redemptions until you’re able to understand the average LTV of customers who redeem those types of offers. However, if you have calculating your LTV and contribution margin metrics dialed in, running a new customer promotions initiative can be a key driver of new subscriptions.

4. Know your subscription customer value

We generally see the highest growth rates for subscription businesses when we have a strong understanding of average customer acquisition costs (CAC) across channels, average LTV of a subscription customer, and contribution margins on each subscription order. With these metrics in hand, we can build out a program that gives our clients room to scale confidently, knowing how and when they will start to earn a profit on a new subscription.

When working with multiple affiliates at CPAs that might be higher than the value of the first purchase, it’s ideal to create customer cohorts by affiliate partner. But for brands just getting started, your average LTV for a subscription is a good starting point.

Measuring customer value: an example scenario

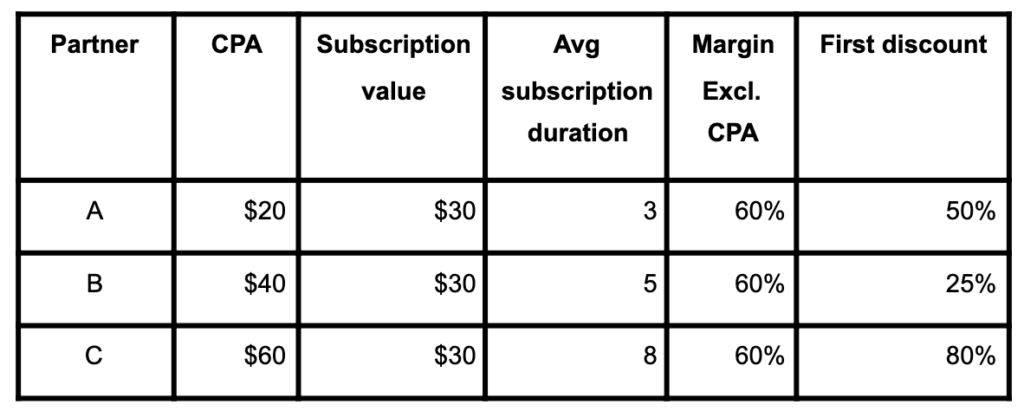

In the example below, the most important data point is average subscription duration. You can find an average for your business as a whole, for your partnership channel in general or, as we’ve done, for the average subscription duration of customers referred from each partner. By getting more granular with your analysis, you’ll find more latitude in giving discounts and payouts which at first don’t appear profitable.

With a 60% margin on every item sold, this business has $18 to acquire a new customer and maintain profitability. However, this is a subscription business, so technically they have $18 x the average number of renewals. After working with affiliate partners A, B and C, we were able to determine the average subscription duration (number of renewed purchases) they were able to drive.

The case for aggressive discounts and payouts

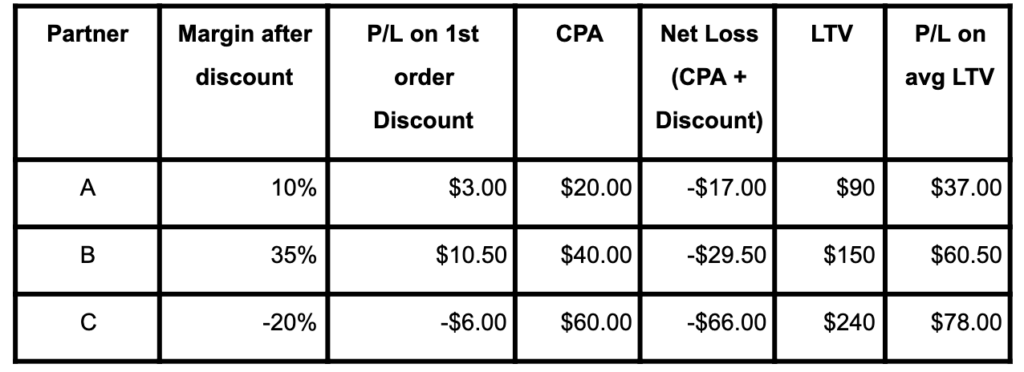

Once we take into account average order contribution margins, the first order discount, and the CPA payout to each partner, we can then calculate our net profit or loss on the first order, we’ll call this Net Loss since in our example we’re not profitable on our first order. As you can see, the net loss on your first order when offering customer discounts and aggressive CPA payouts to affiliate partners is something that would generally not be sustainable to typical D2C brands.

However, with a subscription model in place and an understanding of the average LTV of customers from each affiliate partner, you can afford to be more liberal with payouts to top partners. To calculate the LTV for each affiliate, we simply take the average subscription duration and multiply it by the value of each subscription order (to keep things simple we have a single priced subscription model). It’s important to note that average subscription duration is constantly in flux and should be analyzed on a weekly to monthly basis depending on how much volume each affiliate is generating. These payment structures can quickly go sideways if the quality of customers from a specific partner starts to degrade.

This does not yet take into account our contribution margin or the initial costs to acquire the customer. We’ll take the average LTV for each affiliate, multiply it by our contribution margin of 60%, and then subtract the initial Net Loss (CPA + Discount Value) to achieve a final profit or loss of an average customer from each affiliate.

“Growing the affiliate channel for a subscription business isn’t drastically different than for any other business. Your focus should be finding great partners and working closely with them to unlock value for both parties.”

In sum, growing the affiliate channel for a subscription business isn’t drastically different than for any other business. Your focus should be finding great partners and working closely with them to unlock value for both parties. However, subscription businesses have the opportunity to leverage more aggressive CPA payouts and new customer discounts (when it makes sense) that might be unprofitable for other businesses.

About the author

Michael Griffith is the founder of Spark ROAS, a customer acquisition agency that leverages extensive partnerships with large publishers, key shopping portals, apps, and even other brands to help its clients expand brand reach and credibility via third-party validation. The Spark team relies on Impact Partnership Cloud to manage partnership programs for brands at any stage of growth.

Want to spark growth in your subscription affiliate and other partnership programs? Contact an Impact growth technologist at grow@impact.com.