Despite economic uncertainty and inflation concerns, consumer spending power remains surprisingly resilient heading into the 2025 holiday season. While brands face mounting pressure from supply chain costs and competitive pricing, shoppers are demonstrating both confidence and sophistication in their purchasing decisions.

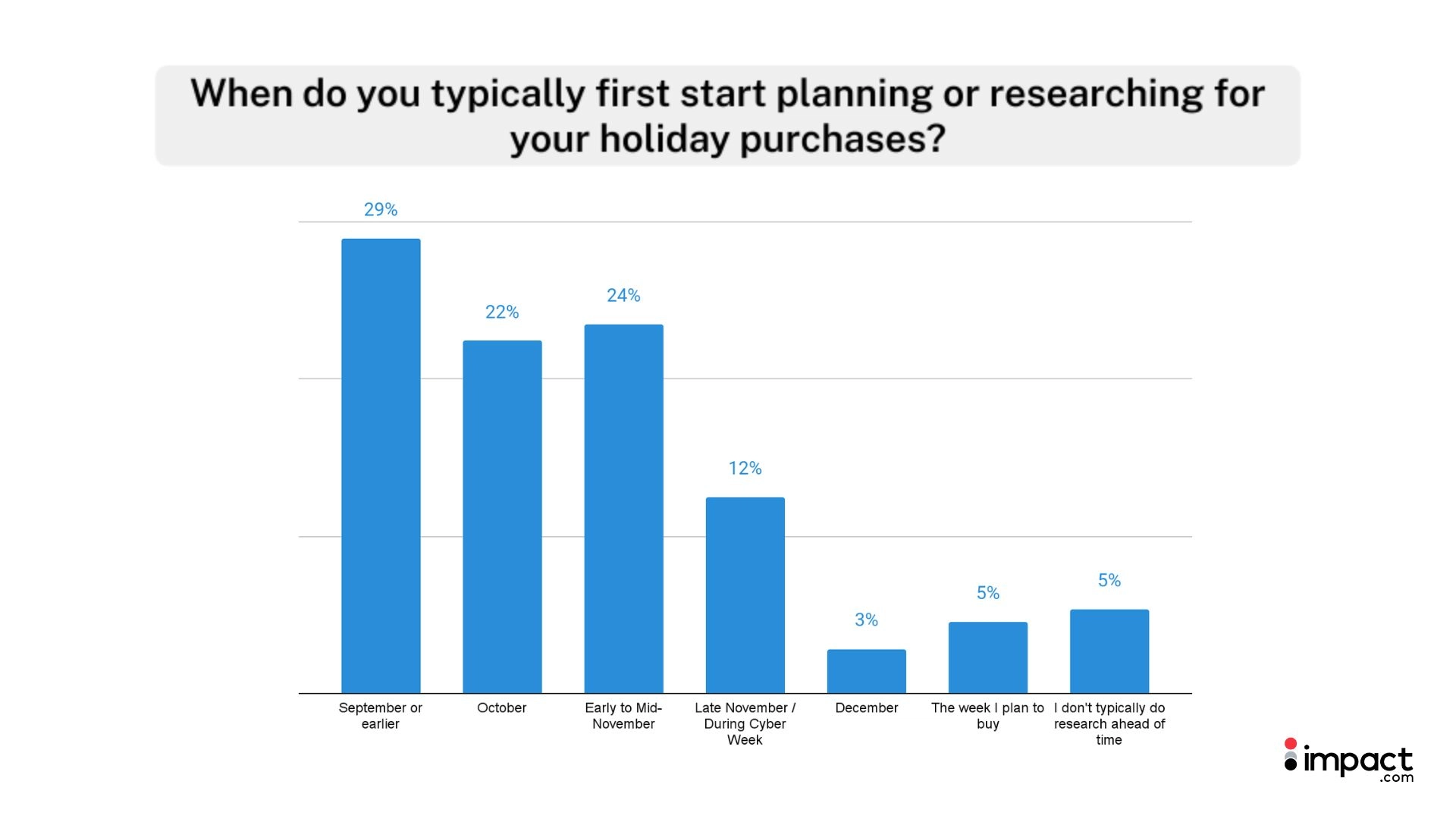

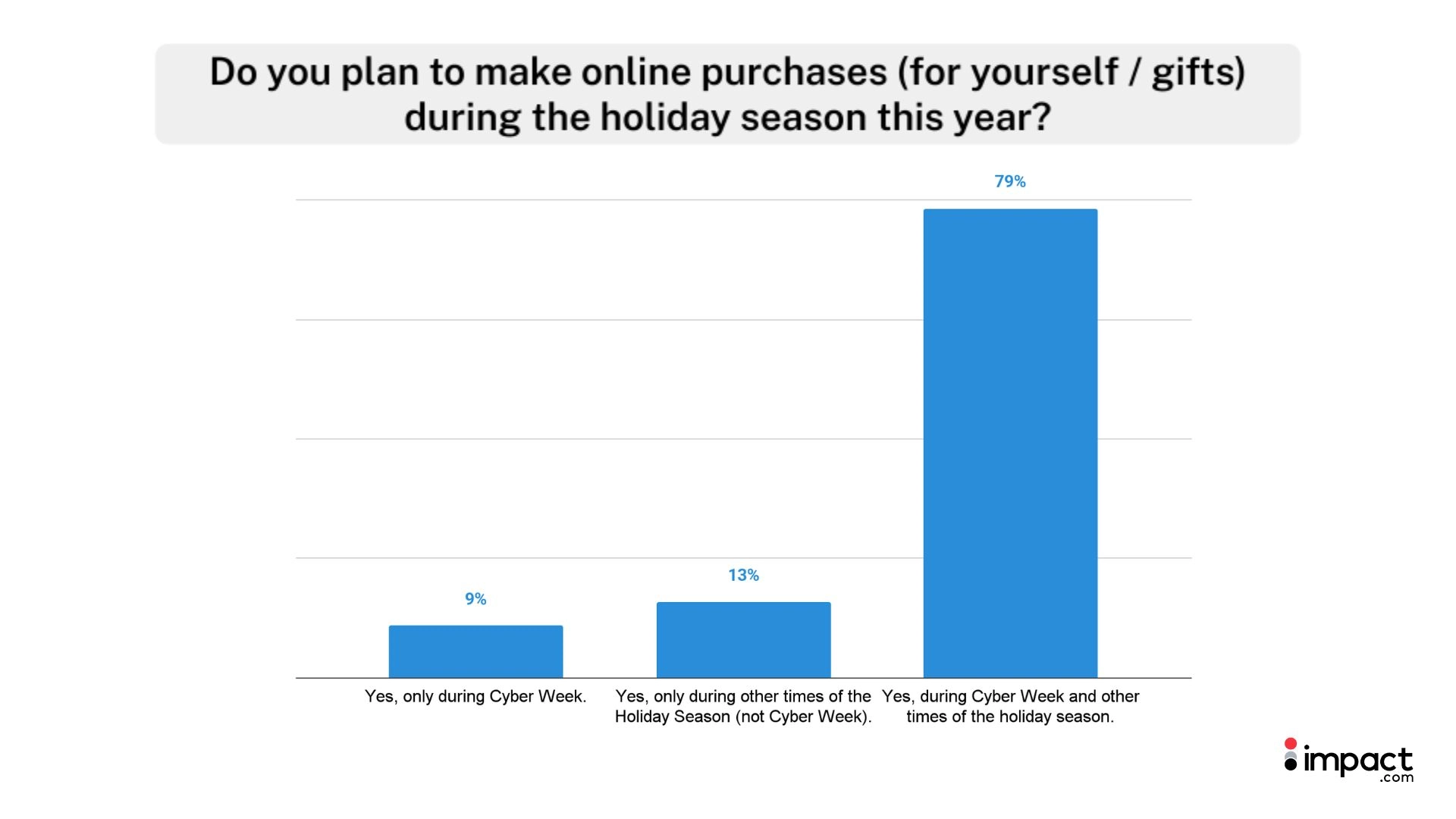

The challenge: Today’s consumers have fundamentally changed how they shop. They’re no longer rushing through last-minute holiday purchases—instead, they’re conducting months-long research processes across multiple channels. 75% now start researching before mid-November, and 79% spread their purchases throughout the entire November-December period. This extended, strategic approach means brands can no longer rely on traditional Cyber Week blitz campaigns to capture holiday revenue.

The opportunity: US shoppers aren’t pulling back on spending. In 2024, they spent a whopping $15.8 million every 60 seconds during the first two hours of Cyber Monday—crushing previous records. Even more encouraging, over a third of shoppers expect to spend more during the 2025 holiday season, signaling continued consumer confidence despite broader economic headwinds.

The solution: Brands that adapt to this new reality will capture disproportionate market share. Success requires understanding exactly when consumers start researching, where they discover products, and what ultimately drives their purchase decisions. The 2025 impact.com consumer research study surveyed over 1,000 US shoppers to uncover these critical insights, revealing three data-backed strategies that can transform how brands approach the extended holiday shopping season.

Methodology

The impact.com market research team carried out a Cyber Week study in June-July 2025, surveying more than 1,000 US consumers aged 18 and older who shop online. These consumers stated their intention to shop online during the 2025 holiday season.

For this report, the holiday season refers to the period from November through December, including Cyber Week.

This research uncovers:

- Where consumers discover deals and the types of offers they value most.

- When shoppers are most likely to research and buy.

- How evolving shopping behaviors can help brands refine partnership and marketing strategies.

3 data-backed consumer insights to power your Black Friday and Holiday strategy

To stand out this Black Friday and Holiday season, brands must understand how shoppers think through their shopping. Our analysis, based on 2025 data, provides key insights that reveal when consumers plan, what drives their deal choices, and how they shop across different channels.

Understanding these behaviors can flip the switch from marketing blindness to adding your products to their carts.

1. The planning and researching revolution (discovery phase): holiday shopping starts earlier and lasts longer

Holiday shopping isn’t limited to a last-minute rush anymore. It’s a months-long process. Three-quarters of consumers start planning before mid-November, with almost a third kicking off as early as September. Only 12% wait until late November and Cyber Week to begin, and a mere 3% hold off until December.

Once the season starts, shoppers don’t stop at Cyber Week. 79% plan to buy during Cyber Week and throughout the November-December holiday season. While Cyber Week remains crucial (88% plan to purchase), 92% will make purchases at some point outside of the Cyber Week window.

Most consumers (74% combined) make purchases multiple times throughout the season, rather than completing their shopping in one or two trips.

When it comes to spending, consumers aren’t afraid to reach for their wallets. Nearly half of consumers (46%) intend to spend “about the same” as they did last year. Just over a third (35%) expect to spend “more” this year.

The data above shows positive consumer spending sentiment with purchases spread across the entire holiday season, rather than a single major spending spike.

Red hot retailer tips:

- Start early and build buzz. Months in advance, launch teaser campaigns, countdowns, and sneak peeks to attract early planners and secure sales before the market fills up.

- Stagger your promotions. Keep shoppers coming back with flash sales, tiered discounts, and limited-time offers. Amplify with email, social, and retargeting ads.

How shoppers do their homework before buying

When it comes to research, today’s shoppers are thorough. They consult three to four sources on average when researching products. The top 3 most popular sources for product research are:

- Expert content such as online articles, gift guides, and product reviews (59%)

- Retailer websites and mobile apps (51%)

- Friends and family recommendations (45%)

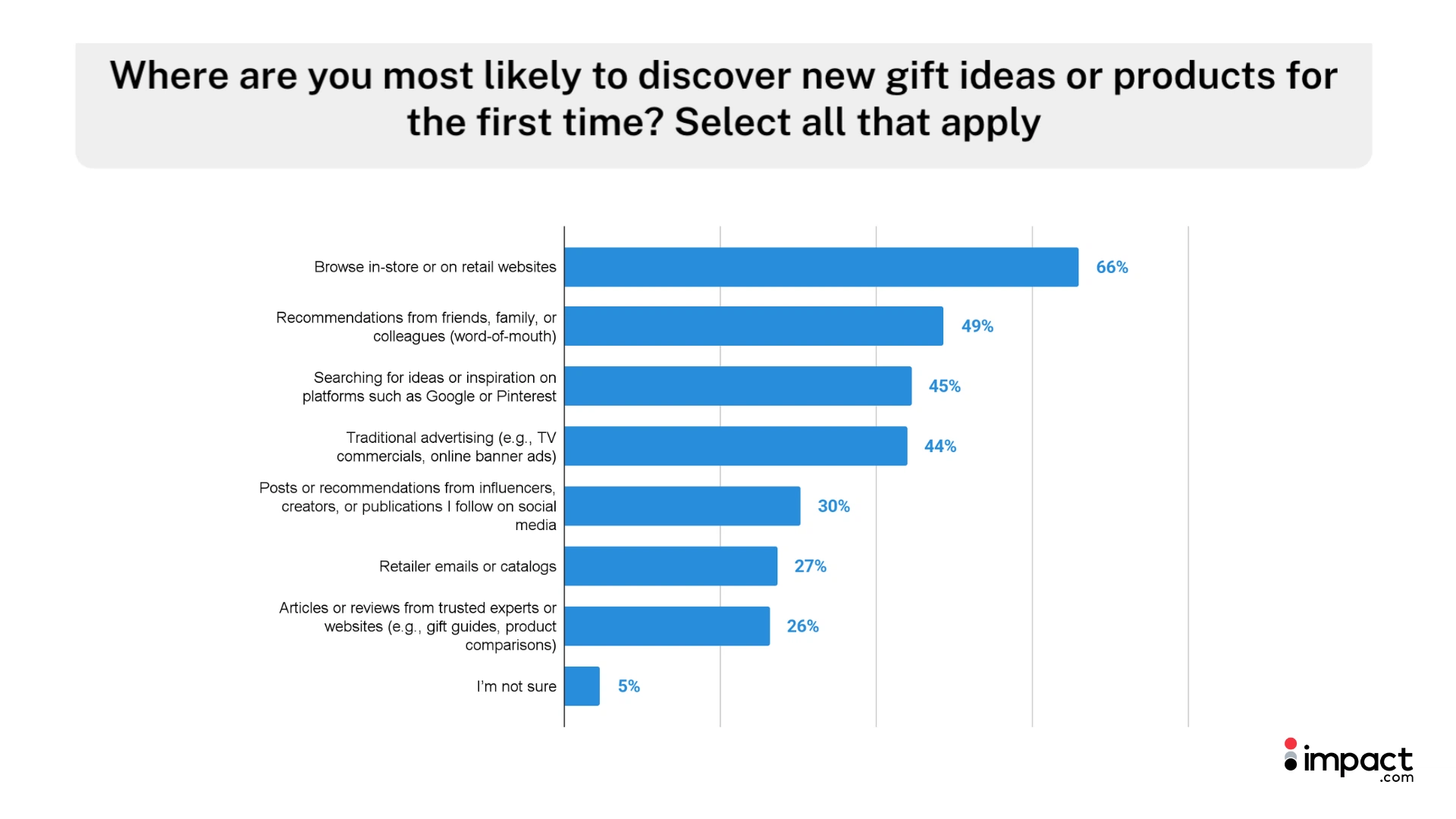

Discovery also comes from browsing: 66% find new gift ideas in-store or on retail websites, while 49% rely on word-of-mouth. Platforms like Google, Pinterest (45%), and traditional ads (44%) round out the list of top sources. These findings show that brands can’t rely on a single channel. Winning this season means being visible early, everywhere, and across multiple touchpoints.

Red hot retailer tips:

- Tap into UGC creators and partners. Expert content is the most trusted resource for nearly half of shoppers when conducting product research. Encourage reviews after purchase and work with bloggers and creators on gift guides and unboxing videos.

Vici Collections works with UGC creators to show off their maternity collection.

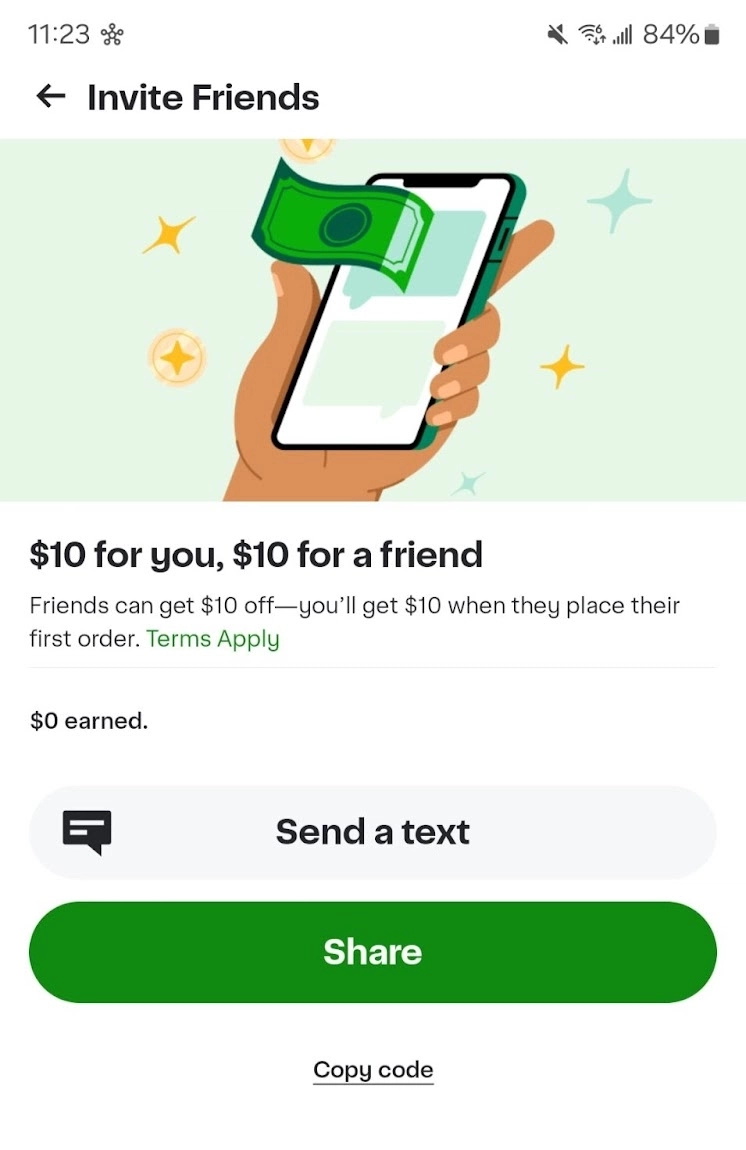

- Turn referrals into revenue. Since 45% of consumers value personal recommendations from friends and family, a referral program is a great way to reach more customers. Make referral programs visible and reward sharing across all channels.

Instacart uses in-app messages to drive referral program visibility.

- Track and optimize in real time. To find out which partners drive product discovery, use a partnership platform. Then, focus on high-performing partners and tweak campaigns as needed.

Why age matters in product discovery and holiday budgets

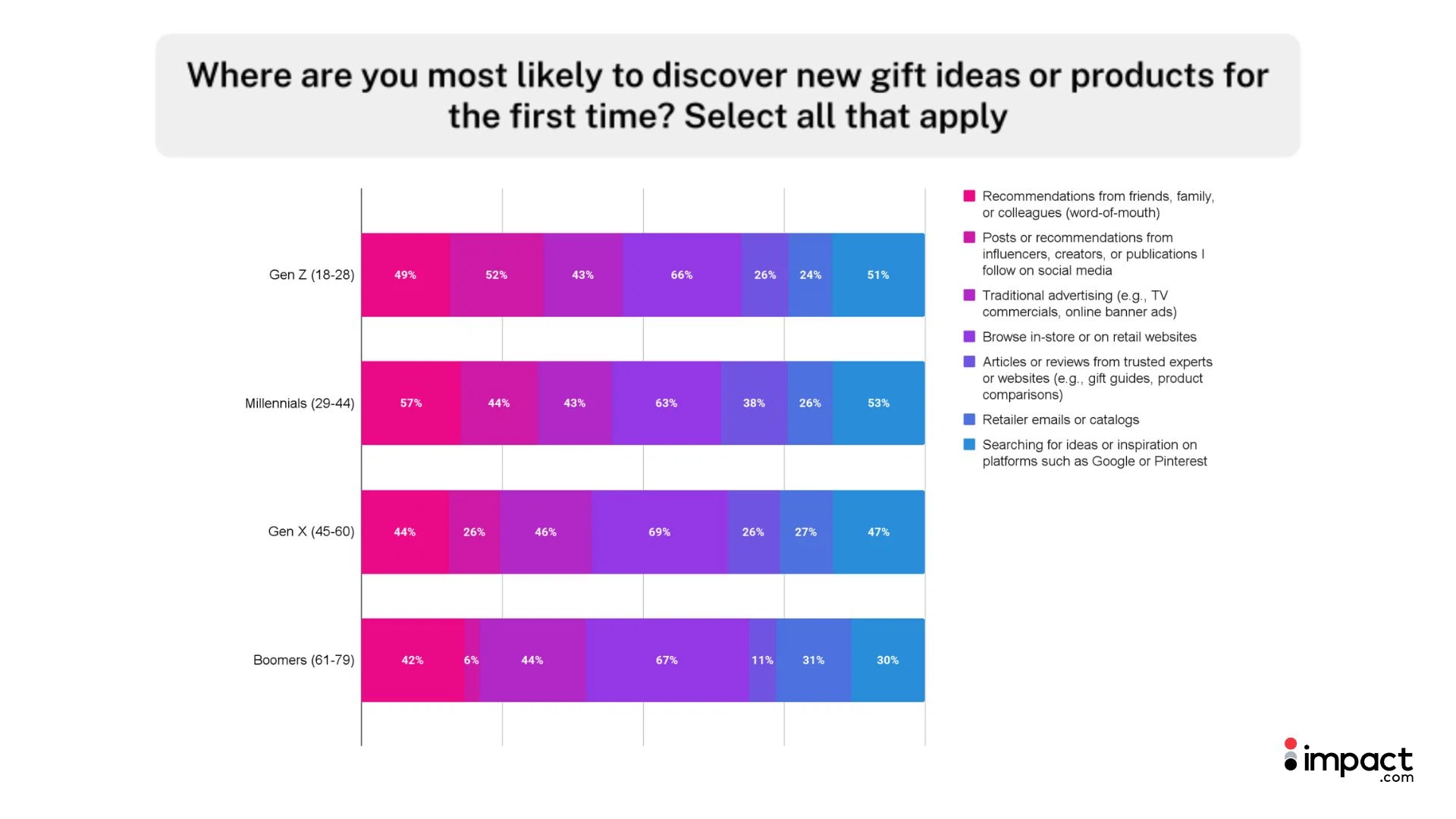

How shoppers find products and gift ideas varies widely by age, and younger generations are leaning heavily on digital channels:

- Gen Z (18-28): 52% discover products on social media (vs. 30% overall), and 51% turn to platforms like Google and Pinterest for inspiration.

- Millennials (29-44): 44% discover via social media, 53% use search, and 38% rely on articles and expert reviews.

- Discovery on social media declines to 26% for Gen X consumers and to just 6% for consumers ages 61 and older.

- Searching for ideas on Google or platforms like Pinterest is also lower for Gen X (47%) and Boomer shoppers (30%) compared to Gen Z and Millennials.

Red hot retailer tip:

- Target younger audiences with digital channels: Brands looking to capture younger consumers should double down on social, search, and peer-driven recommendations.

2. The deal evolution (conversion phase): Seal the deal with free shipping and flash sales

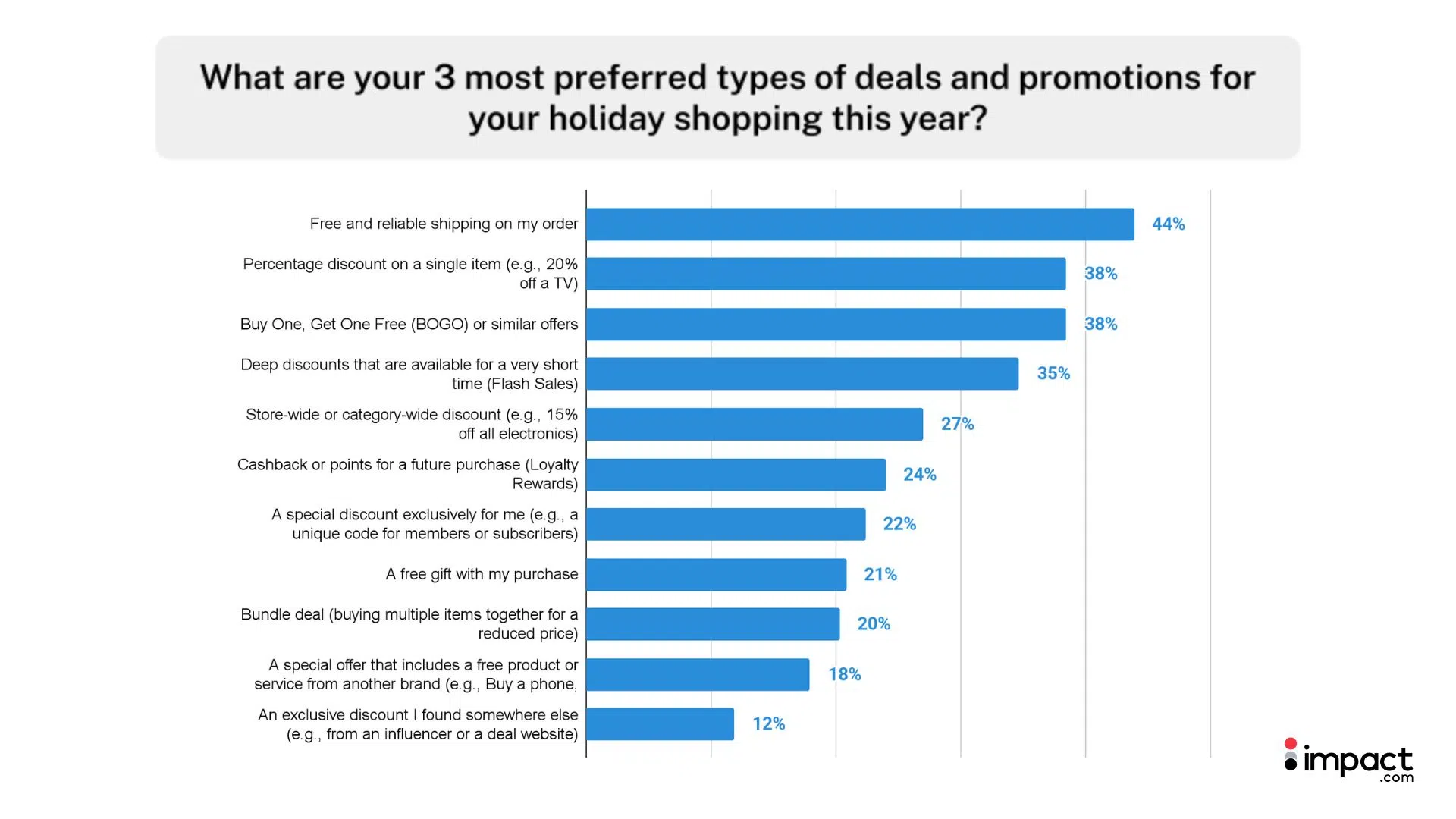

When it comes to holiday promotions, not all deals are created equal. Shoppers have clear favorites. The 3 most selected deal types preferred by consumers are:

- Free and reliable shipping (44%)

- Percentage discounts on single items (like 20% off a TV) (38%)

- Buy One, Get One Free (BOGO) offers (38%)

Flash sales also earn attention—35% of consumers value short-term deep discounts, ranking just behind the top three.

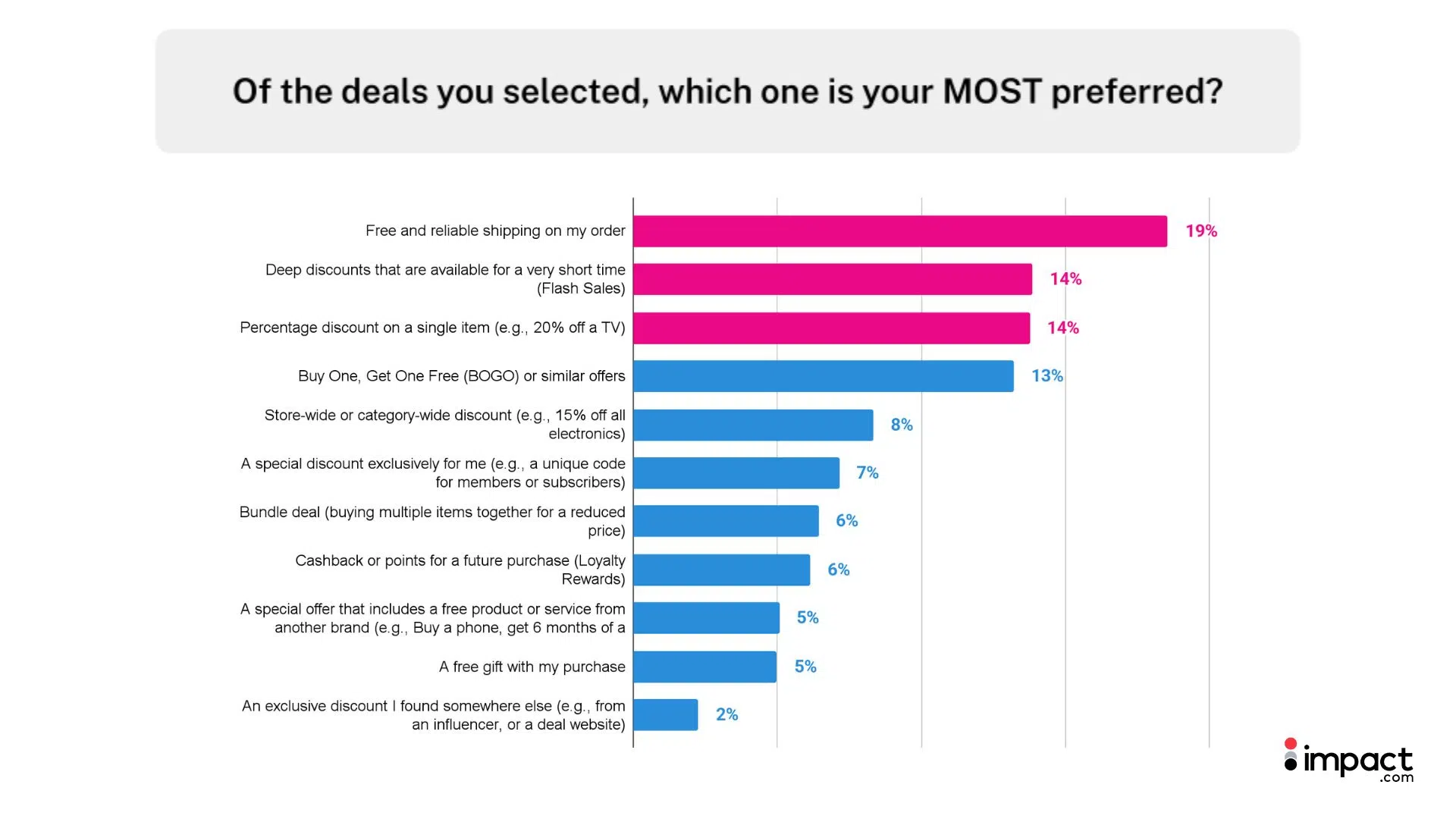

When pressed to pick a favorite deal out of the 3 most preferred deals above, consumers chose:

- Free delivery came first (19%)

- Flash sales followed (14%)

- Percentage discounts rounded out the top three (14%)

Red hot retailer tips:

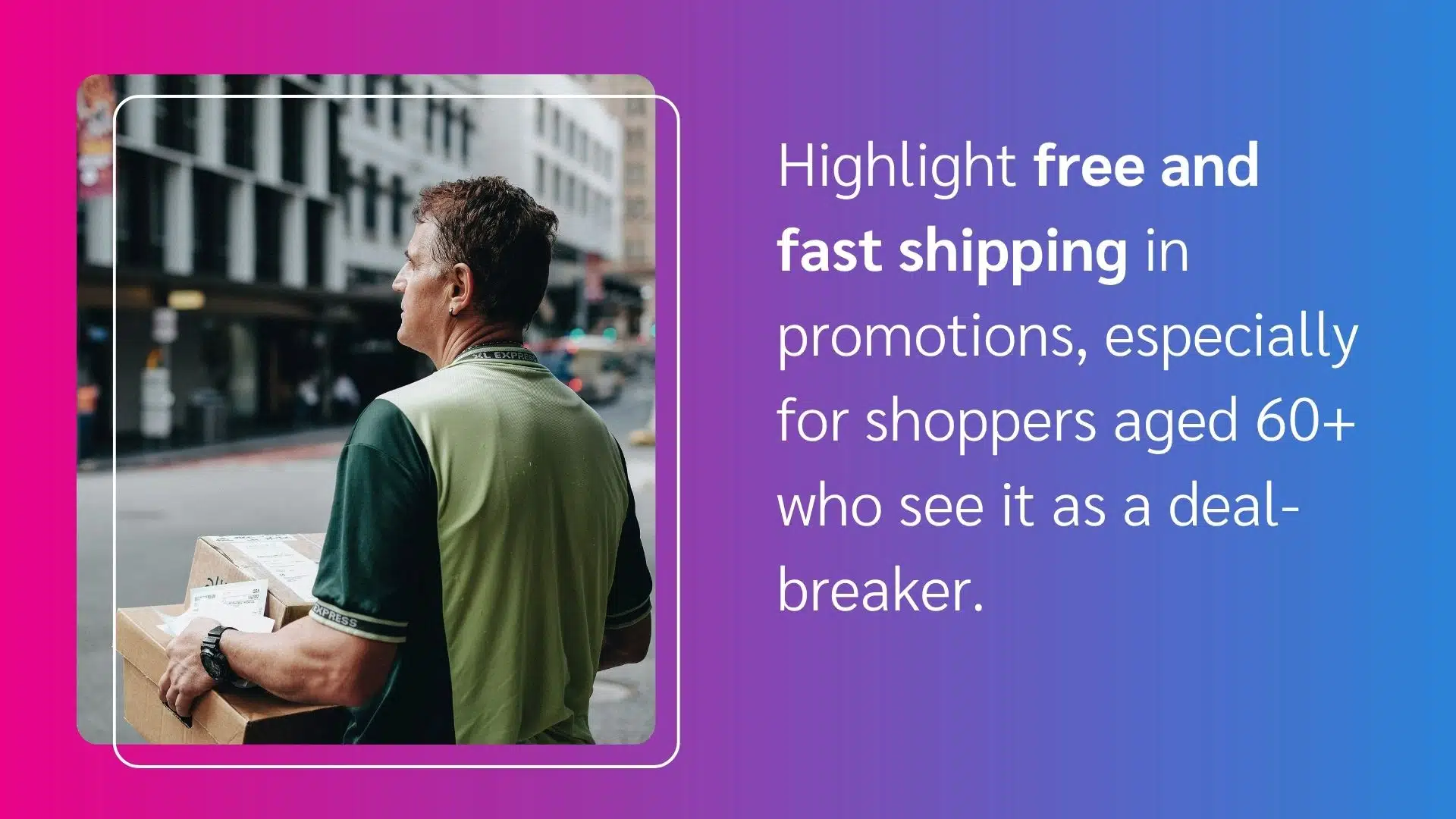

- Make free and fast shipping non-negotiable. Highlight it in every promotion. This is especially important for older shoppers (61 and older) who consider it a deal-breaker.

- Lean on percentage discounts. Big-ticket items become irresistible when paired with substantial percentage-off promotions.

- Use BOGO for lower-cost products. Clothing, cosmetics, and everyday essentials work well for buy-one-get-one-free offers. These deals boost consumer consumption without putting a big dent in budgets.

- Level up your loyalty program. Offer members early access, bonus points, or exclusive discounts to boost engagement. Team up with cashback, loyalty, and price-tracking platforms to attract deal hunters.

- Attract new customers with exclusive offers. Use referral links and discount codes, welcome offers, or personalized newsletter discounts to attract new buyers.

Tanit reinforces urgency with language like “Join the VIP Early Bird List ” and “Be the First” before its Black Friday sale.

Consumers cash in on coupon codes

Shoppers are savvy about stacking savings, and coupon codes play a big role:

- 43% will definitely use a code if they come across one easily.

- Millennials (29-44) are the most proactive with 24% likely to actively search for a code before making a purchase and 48% using a code they stumble upon.

- Boomers (61-79) are more skeptical since 16% said they’ll never use a discount code from these sources, and only 9% say they’d actively look for a code. Despite their caution, a significant portion (41%) would still use a code if it were easy to find and apply.

Red hot retailer tips:

- Focus on coupon promotion and education: With coupon codes becoming more popular among younger consumers, brands should entice these groups with easy-to-find and redeem coupons. For older consumers, a little education on the use of coupon codes could go a long way.

- Collaborate with deal sites. Partner with coupon platforms to spotlight time-sensitive offers. Phrases like “Valid for 24 hours only” can push shoppers to act fast.

Deal sites like Honey drive product discovery by giving brands a platform to market special offers.

The basics still win: shipping, stock, and speed

Beyond discounts, the basics matter. Consumers say the biggest drivers of a positive shopping experience are:

- Affordable or free shipping (68%)

- Product availability (60%)

- Simple checkout process with preferred payment options (49%)

Different deals for every generation

Holiday deal preferences aren’t one-size-fits-all. Each age group has its own priorities, and tailoring promotions accordingly can make the difference between browsing and buying:

- Gen Z (18-28): Most are drawn to percentage discounts on single items (18%).

- Millennials (29-44): While their most preferred deal is percentage discounts on a single item, they’re more likely than any other group to prefer exclusive member discounts (10%) and cashback or loyalty rewards (10%).

- Gen X (45–60): Favor flash sales and BOGO offers, showing urgency and value drives this segment.

- Boomers (61-79): 32% cite free and reliable shipping as their top preference, far above other deal types.

Red hot retailer tip:

- Tailor deals by generation. Use the above data points to tailor marketing tactics by age group. For instance, engage Gen Z and Millennials with percentage discounts, Gen X with flash sales and BOGO offers, and boomers with free shipping. This plan of action gives you the best chance of converting across all age brackets.

Flexible payments power holiday splurges

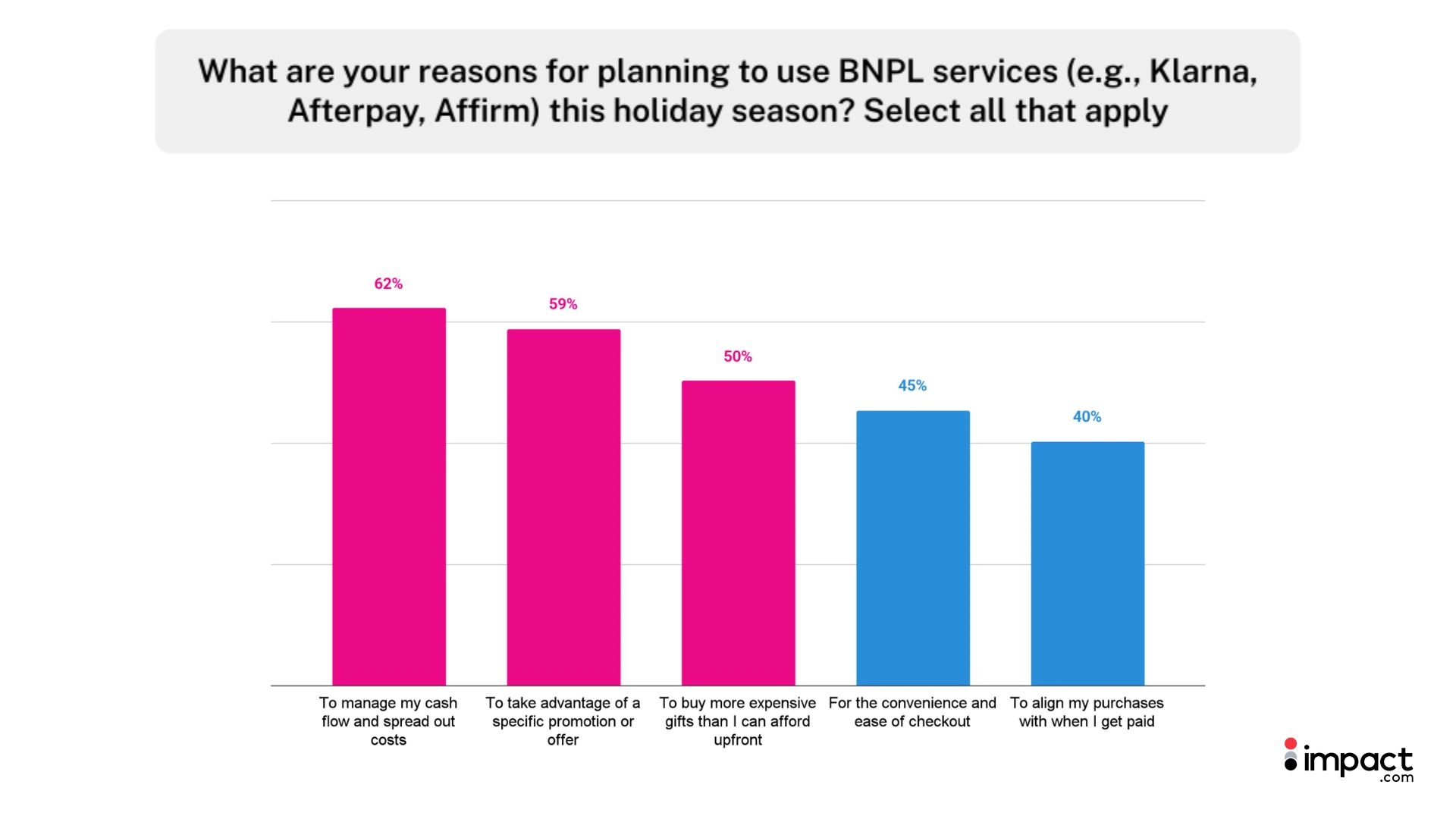

Nearly a third of shoppers (32%) plan to use Buy Now, Pay Later services this holiday season. For many shoppers, BNPL is the key to making holiday spending more manageable. Half of consumers use it to buy more expensive gifts, turning big-ticket items into more manageable purchases. For many, it offers financial flexibility:

- 62% use BNPL to manage cash flow and spread out costs

- 40% align purchases with their payday

Red hot retailer tip:

- Offer a variety of BNPL options at checkout. Adding popular BNPL options helps prevent cart abandonment and boosts average order value by enabling consumers to purchase larger ticket items that they wouldn’t be able to afford otherwise.

Using BPNL options like PayPal’s Pay in 4 gives consumers greater spending power.

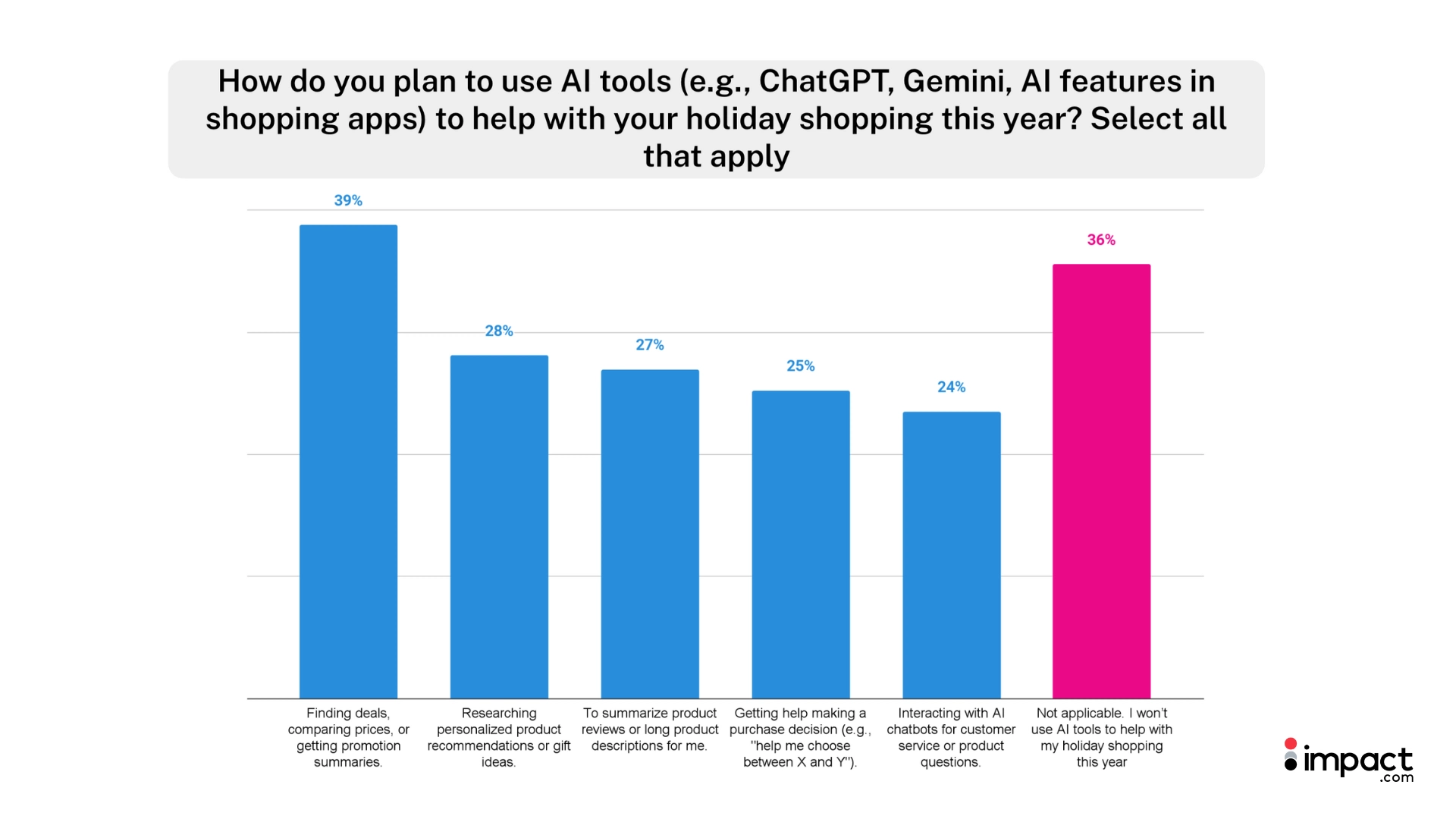

3. The technology integration (emerging behaviors): AI and omnichannel product discovery on the rise

AI becomes a big piece of Cyber Week strategies

AI has become a go-to holiday shopping tool. Nearly two-thirds of shoppers (64%) plan to use AI this season.

The most popular uses are:

- Finding deals, comparing prices, and getting promotional summaries (39%)

- Researching personalized product recommendations or gift ideas (28%)

Enthusiasm for AI decreases with age. The percentage of consumers planning to use AI for their holiday shopping declines among older age groups. For example, only 19% of Gen Z and Millennials said they won’t use AI for their holiday shopping, compared to 36% of Gen X and 62% of Boomer consumers.

Red hot retailer tips:

- Optimize for AI. Use conversational queries, FAQs, schema markup, and accurate product feeds with strong visuals. Add AI chatbots for smoother support and build trust with reviews and testimonials.

- Target intent-driven searches. Long-tail keywords (“best Cyber Week gaming laptops under $1,000”), detailed descriptions, and comparisons guide AI engines and help shoppers make informed decisions.

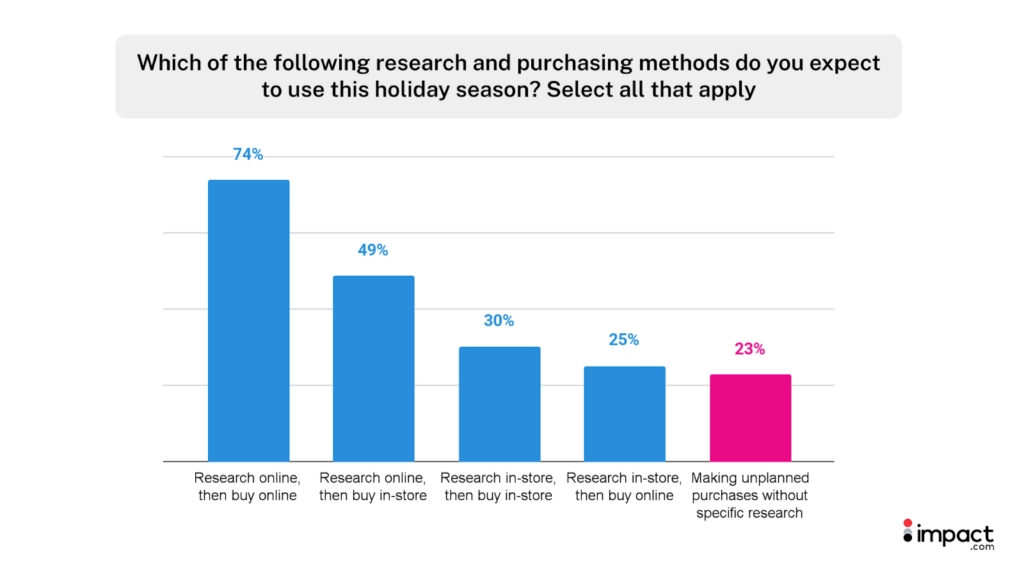

From online to in-store (and back again)

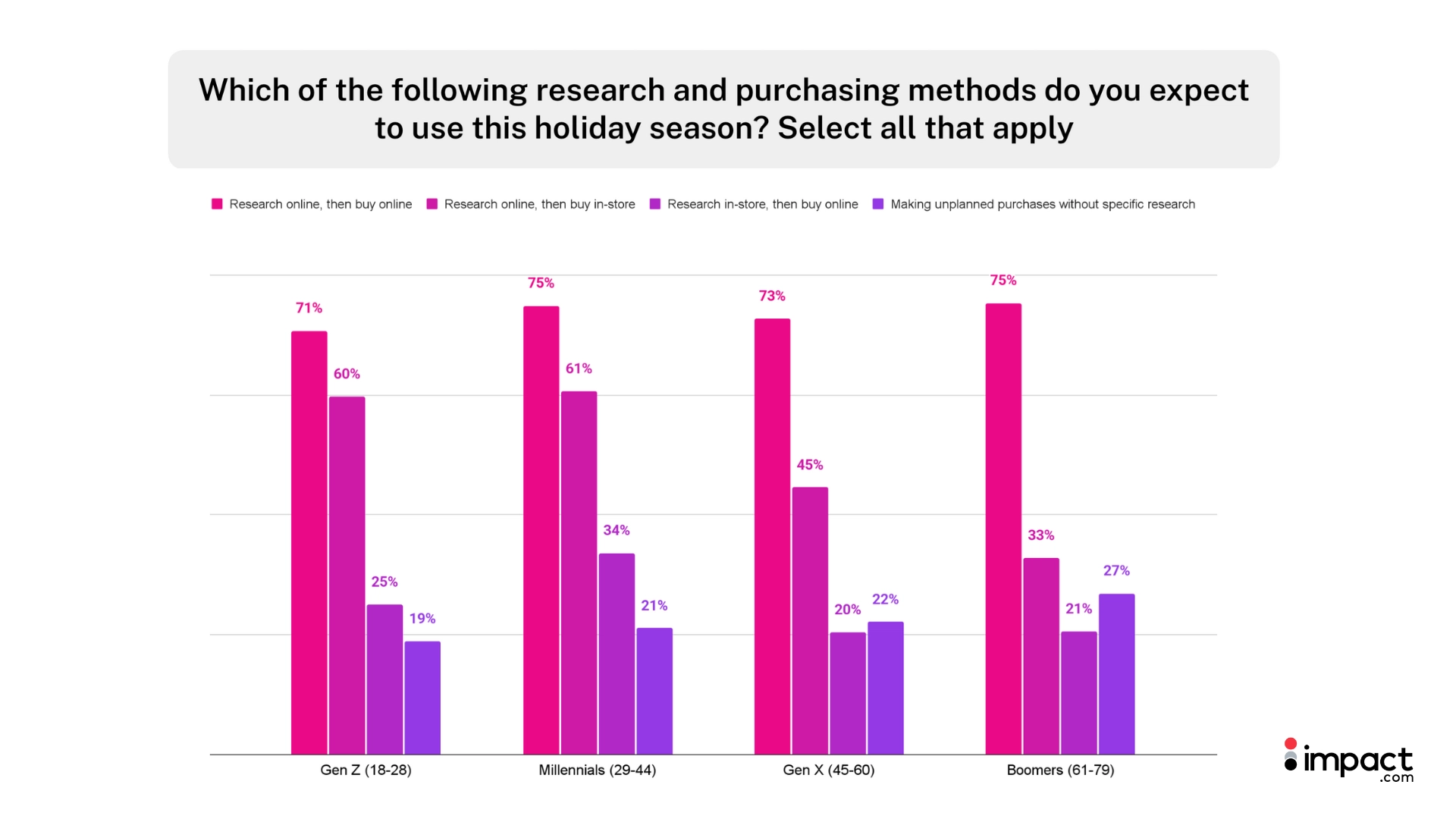

Omnichannel is the new normal. While the majority of shoppers (74%) research and buy online, in-store shopping remains vital:

- 49% research online, then buy in-store

- 25% research in-store, then buy online

The above data show that digital and physical channels are no longer separate journeys—they’re deeply intertwined.

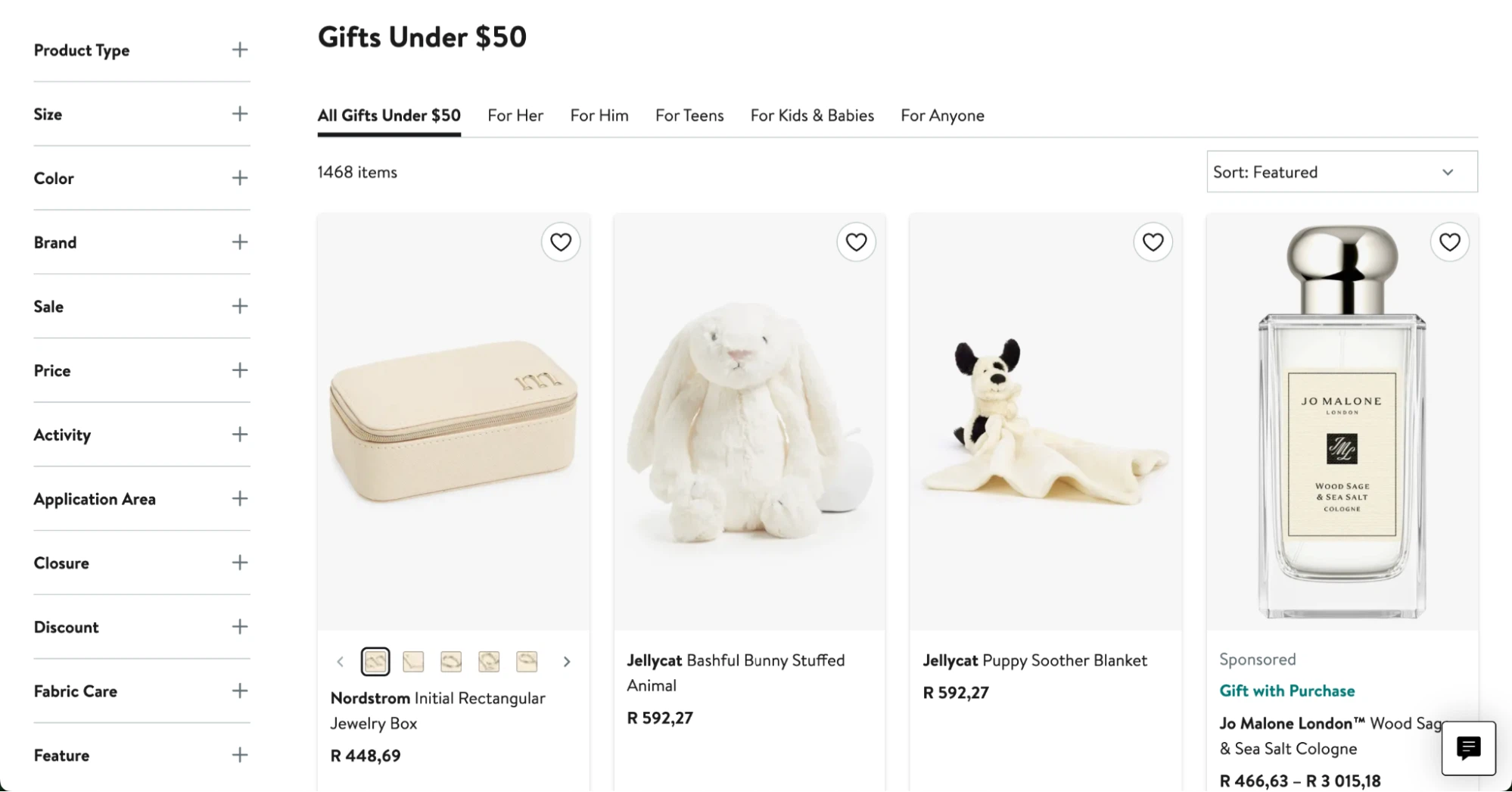

Red hot retailer tip:

- Curate the offline and online journey. Gift guides, “Top Picks,” and filters like “Under $50” or “For Him/Her” make browsing easy and inspire quicker purchases in-store and online.

Nordstrom filters gifts according to price range—ideal for shoppers with a specific budget in mind.

Older shoppers flip the script

Contrary to expectations, older consumers (61 – 79) are the most likely to research and purchase online. They’re also the most impulsive shoppers, as 27% report making unplanned purchases—higher than any other age group.

Red hot retailer tip:

- Market products that Boomers will love. Highlight simple, recognizable offers and focus ad spend on products that resonate with this group, who are more prone to impulse buys.

What retailers need to prioritize for Black Friday and Cyber Week 2025

Cyber Week 2025 will see steady spending and earlier planning. There’s a big shift from impulse buys to more intentional shopping.

Consumers are entering holiday shopping with confidence—they have more options than ever and a clear plan for when and how to spend.

For retailers, the playbook involves:

- Investing early in logistics, tech, and marketing that speak to different generations.

- Extending promotions beyond Cyber Week to capture early and late-season buyers.

- Leaning on urgency with limited-time offers and compelling social proof.

- Delivering a seamless shopping experience across online and in-store touchpoints.

Learn more about Cyber Week/Black Friday trends and how to use partnership marketing to drive conversions this festive season:

- 5 Black Friday shopping trends to boost affiliate revenue for publishers and creators in 2025

- Cyber Week 2024: Consumers plan to research early and spend more

- Cyber Week 2024: how top brands achieved 23% higher conversion rates through strategic partnerships

- Cyber Week cheat code: Level up with key customer insights

FAQs

75% of consumers start researching before mid-November, with 22% beginning as early as October. Only 12% wait until late November/Cyber Week to start planning.

For items under $50, most consumers expect 16-25% discounts. For mid-range items ($50-$200), the minimum expected discount is 26-40%. For expensive items over $200, 42% of consumers need discounts of 41% or more.

Free and reliable shipping is the #1 preferred deal (chosen by 19% as most important), followed by flash sales with deep discounts (14%) and percentage discounts on single items (14%).

64% of shoppers plan to use AI tools for their 2025 holiday shopping, with 39% using AI to find deals and compare prices. Usage drops significantly with age: only 19% of Gen Z and Millennials said they won’t use AI for their holiday shopping, compared to 36% of Gen X and 62% of Boomer consumers.

Consumers consult an average of 3-4 sources when researching holiday purchases. The top research sources are expert reviews, gift guides and articles (59%), retailer websites or mobile apps (51%), and recommendations from friends and family (45%).

74% research online and buy online, but omnichannel shopping is common: 49% research online then buy in-store, and 25% research in-store then buy online, showing that 74% of shoppers use multiple channels.