Inflation didn’t stop consumers from spoiling Mom this year. While economists anticipated a $2.2 billion dip in Mother’s Day sales in 2024, ecommerce consumer spending remained unchanged from last year.

Many shoppers planned ahead and took advantage of deals leading up to the holiday rather than decrease their spending. More transactions and lower average order values (AOV) suggest more shoppers may have purchased from multiple retailers this year, too.

Mother’s Day offers retailers a huge opportunity to maximize revenue beyond holiday spending. This impact.com Mother’s Day research study provides insightful information to help brands understand consumer behavior and inform their strategies for Mother’s Day 2025.

Methodology

The impact.com Mother’s Day Research conducted on May 13, 2024, tracked key metrics across thousands of North American brands in the Retail and Shopping industry. The year-over-year (YoY) analysis compares Mother’s Day 2024 and Mother’s Day 2023 performance.

Our analysis tracks key performance metrics: average order value, clicks, transactions, conversion rates, consumer spending, and brand spending.

The analysis period includes the four weeks leading up to and including Mother’s Day:

- 2024: April 12 – May 12

- 2023: April 14 – May 14

While the complete analysis of the Retail and Shopping vertical includes various sub-categories, the following popular product categories were highlighted for this report:

- Apparel, Shoes, and Accessories

- Flowers, Food, Gifts, and Drinks

- Health and Beauty

- Home and Garden

- Sport, Outdoor, and Fitness

The Mother’s Day research report offers unique and valuable insights into consumer behavior and significant trends leading up to (and including) Mother’s Day.

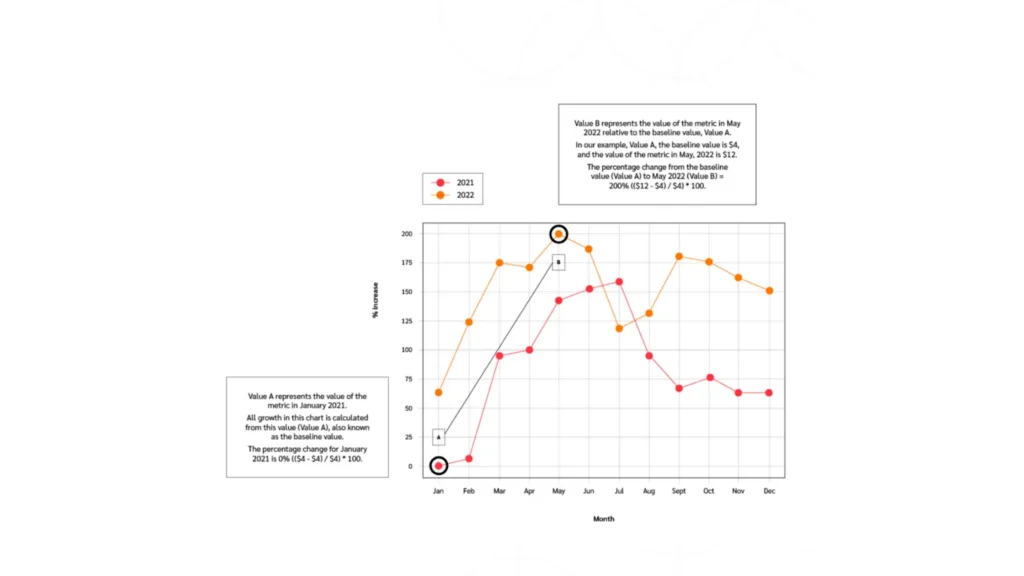

Interpreting the graphs

Unless otherwise noted, the values shown in the trendline graph represent the percentage change in a metric’s value relative to that value at a specific time, also referred to as the baseline value. Our analysis measures all values relative to the baseline—one month before Mother’s Day 2024.

For example:

6 trends shaping Mother’s Day shopping

Understanding these trends—from earlier and more intentional shopping patterns to fluctuating conversion rates and spending habits—can help your brand optimize strategies for future holiday seasons. Unpack these findings to discover how shoppers navigate deals, the impact of ad spend, and the role of partnerships in maximizing sales.

- Clicks rise 38% leading up to Mother’s Day as consumers search for the perfect gift.

- Intentional shopping leads to a 24% dip in conversion rates ahead of Mother’s Day.

- Shoppers spread out their purchases, increasing transactions by 4%

- A 5% AOV decline highlights a shift to buying from multiple retailers

- Consistent spending reflects early shoppers’ strategic approach

- A 3% increase in brand spending reflects a strategic investment in partnerships.

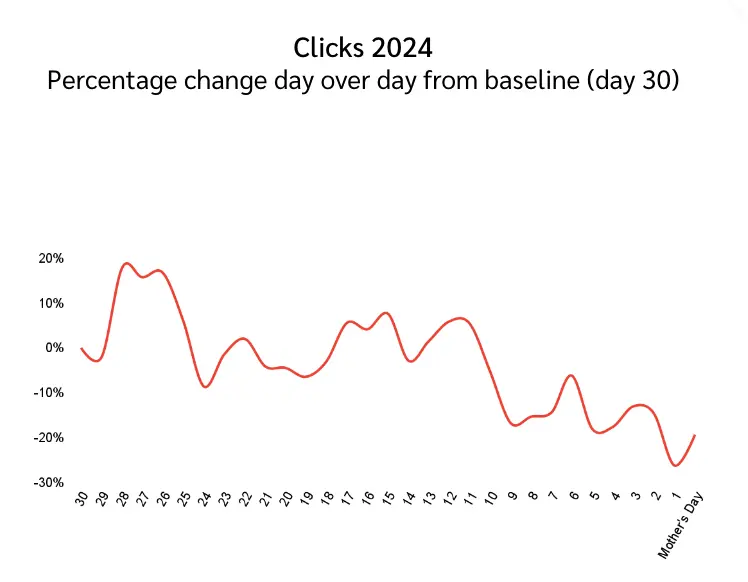

1. Clicks rise 38% leading up to Mother’s Day as consumers search for the perfect gift.

This year’s increase in clicks shows shoppers were intrigued by ecommerce retailers’ deals and sales.

Interestingly, Mother’s Day also showed a substantial 29% increase in clicks. This last-minute increase in clicks suggests retailers may have shared new or more compelling day-of offers for last-minute shoppers.

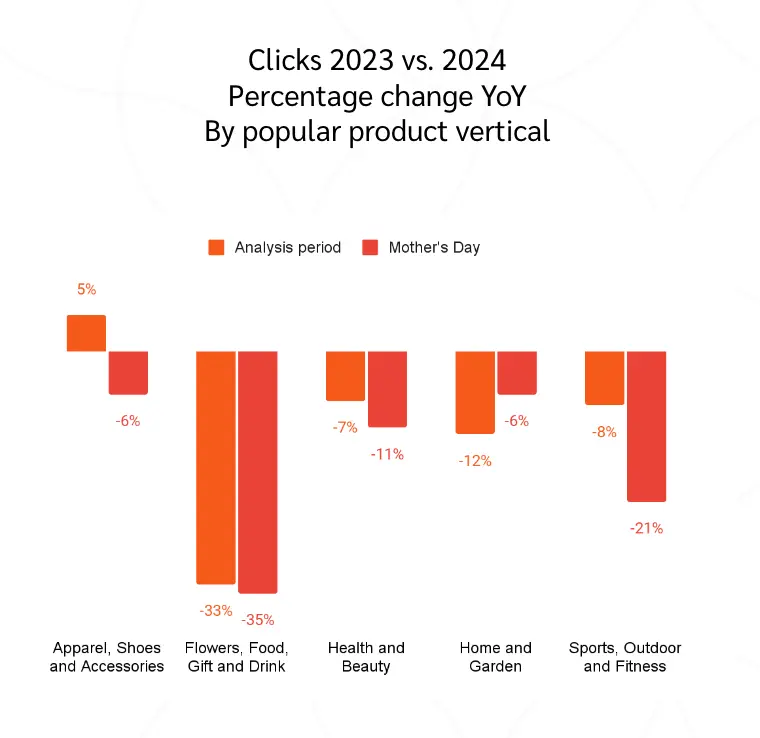

Retailers in an oft-preferred Mother’s Day shopping category—Flowers, Food, Gifts, and Drinks—showed a 33% decrease in clicks this year but a 20% increase in conversion rate.

The hunt for the perfect Mother’s Day gift prompted consumers to explore a more diverse range of products. This shift resulted in fewer clicks for the more “traditional” product verticals.

The 2024 increase in clicks likely shows that more shoppers bought Mother’s Day gifts online compared to 2023. These consumers may have also spent more time researching their options and waiting for the best buying time.

Enhanced online activity indicates an opportunity to collaborate with partners who can help amplify your reach. Additionally, brands can take several steps to optimize future strategies based on these click insights.

Start promotions early: Highlight exclusive early-bird deals to capture proactive shoppers attention.

Maintain engagement throughout the month: To keep your audience engaged, consider running flash sales or limited-time offers leading up to and including Mother’s Day.

Optimize day-off deals: Ensure attractive deals are available to convert last-minute clicks into purchases.

Provide comprehensive product information: Ensure your product listings are detailed, highlighting key features, benefits, and customer reviews. Provide clear, high-quality images and videos to aid in consumer decision-making.

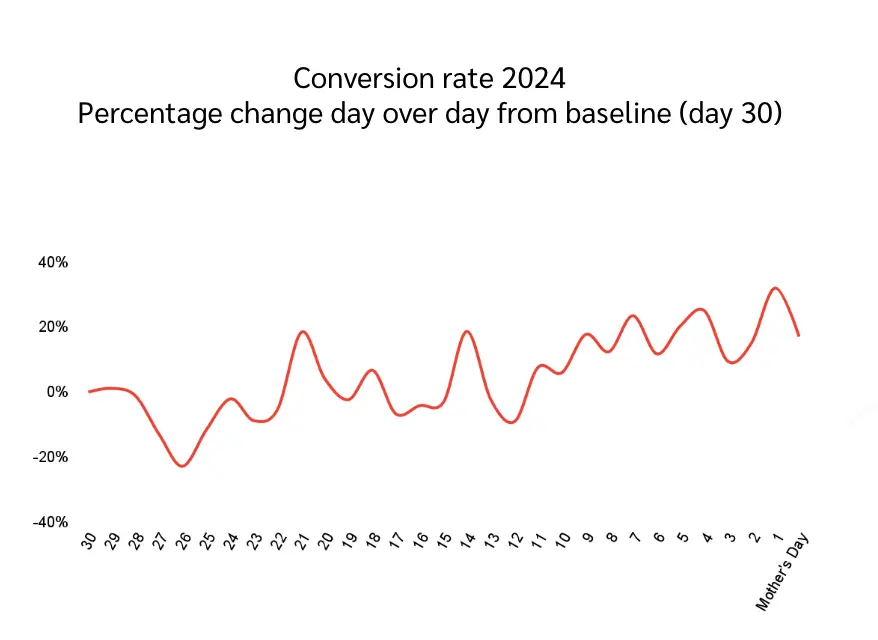

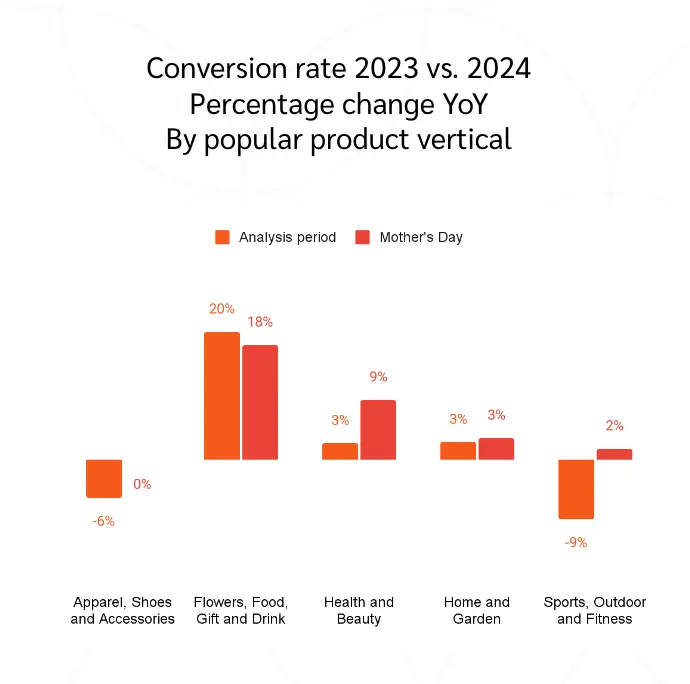

2. Intentional shopping leads to a 24% dip in conversion rates ahead of Mother’s Day.

Consumers may have considered more options before deciding what to buy Mom this year. Despite a substantial increase in clicks, brands saw a 24% lower conversion rate throughout the month leading up to Mother’s Day and the holiday itself.

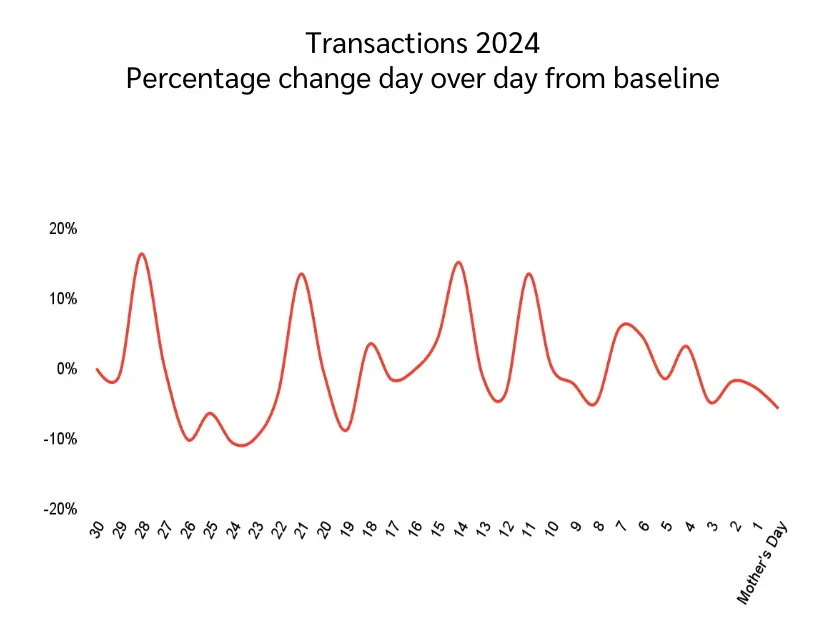

Conversion rates showed increased growth two weeks before Mother’s Day, with the highest conversion rates for the day before. While shoppers did more window shopping than we expected in 2024, they continued to focus on intentional spending and waiting for the best deals throughout the month.

Traditionally, favored categories saw higher 2024 conversion rates.

- Flowers, Food, Gifts, and Drink ⬆20%

- Health and Beauty ⬆3%

- Home and Garden ⬆3%

Higher clicks and lower conversion rates this Mother’s Day suggest that shoppers are exploring their options before committing to a gift for Mom.

For next Mother’s Day (or an upcoming campaign), consider the following:

Offer compelling bundles and promotions: Create bundled offers that combine popular products and use strategic promotions, such as tiered discounts, to encourage larger purchases.

Optimize the user experience: Ensure the purchasing process is intuitive, fast, and mobile-friendly. Implement one-click checkout, personalized recommendations, and easy-to-find customer reviews to build trust and reduce hesitancy.

Strengthen partnership strategies: Partner with content creators to build confidence in your offering with product reviews or secure a spot in a popular publication to provide gift guides for every budget.

Leverage remarketing campaigns: Use personalized ads that remind shoppers of the products they viewed or offer additional incentives, such as discounts or free shipping, to re-engage consumers who have shown interest but didn’t convert.

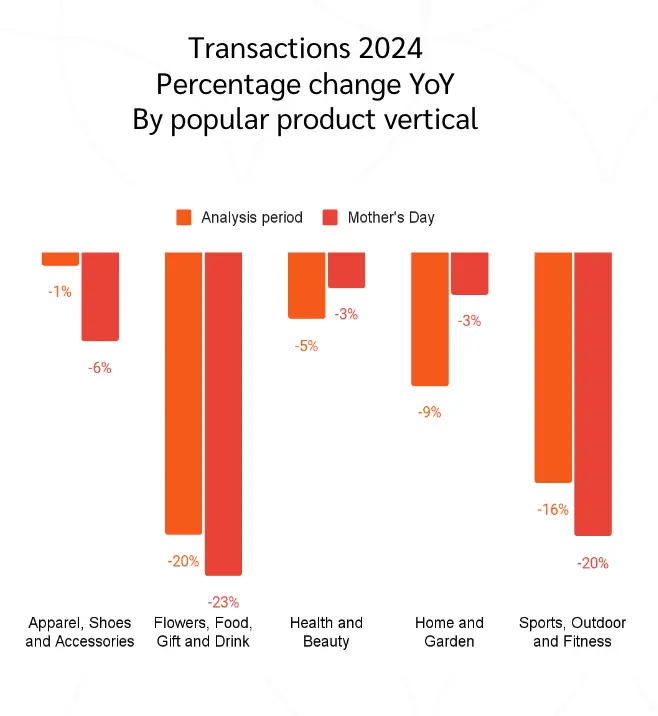

3. Shoppers spread out their purchases, increasing transactions by 4%

Traditionally, popular product categories showed decreased transactions during the analysis period, yet overall transactions increased by 4% before the holiday. This pattern suggests shoppers may have bought Mom multiple items across different categories this year.

Early shopping may be partly to blame for the 2% decrease in transactions on Mother’s Day, but it’s unlikely that’s the only reason last-minute shoppers held off on spending online. The holiday’s 29% increase in clicks reveals shoppers were still intrigued by offers on Mother’s Day but that retailers didn’t offer the significant sales shoppers expected.

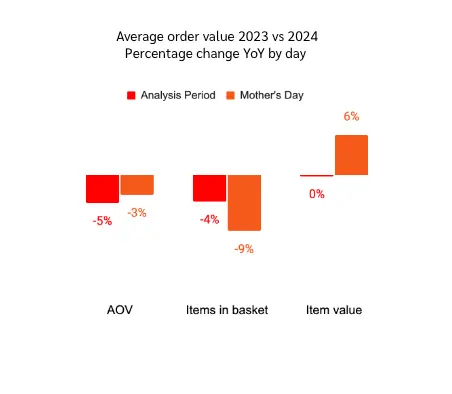

4. A 5% AOV decline highlights a shift to buying from multiple retailers

The National Retail Federation anticipated that shoppers would spend $254.04 on their mothers in 2024, less than last year. While shoppers may have bought multiple items from one shop in previous years, today’s shoppers spread their spending across multiple stores.

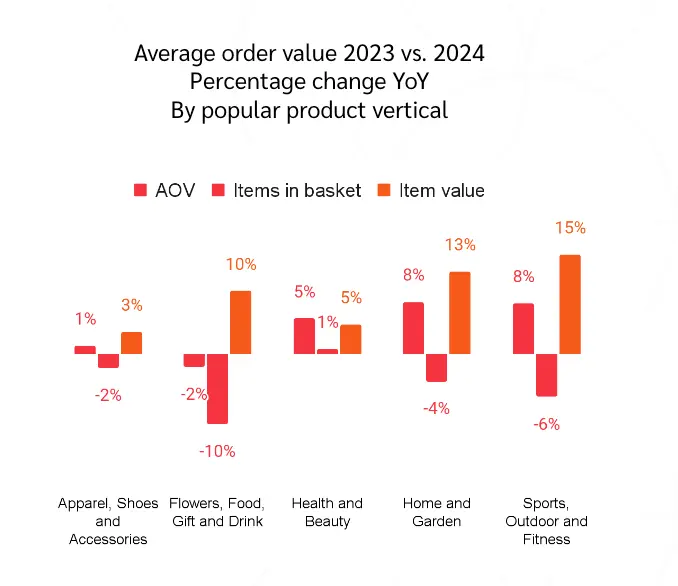

The 6% increase in spend per item on Mother’s Day likely reflects consumer price inflation. However, 2024’s 4% decrease in items per order is responsible for the 5% YoY dip in AOV.

This dip, alongside the year’s 4% increase in transactions, suggests that shoppers bought items of more or less the same value as 2023 in separate transactions or shopped across different retailers for their Mother’s Day gifts.

While item values increased for the traditionally popular categories such as Sports, Outdoor, and Fitness and Flowers, Food, Gifts, and Drink, most shoppers had fewer items in their basket per transaction this year. Only Health and Beauty purchases reflected an increase in items per transaction.

On Mother’s Day, orders included even fewer items—cart sizes dropped 9%. Given the 6% price increase, it’s likely that deals offered on Mother’s Day were not as compelling as those leading up to the holiday.

Next year, continue offering enticing discounts throughout Mother’s Day weekend and implement game-changing moves to your strategy.

Diversify offering and collaborate with other brands: Form strategic partnerships with complementary brands to offer bundled deals or joint promotions. This approach can attract customers looking for variety and convenience, potentially increasing your share of their total spending.

Optimize pricing strategies: Implement dynamic pricing strategies that offer discounts on bulk purchases or bundled items. This incentivizes higher cart values and aligns with consumers’ desire to spread their spending while still feeling they’re getting a good deal.

5. Consistent spending reflects early shoppers’ strategic approach

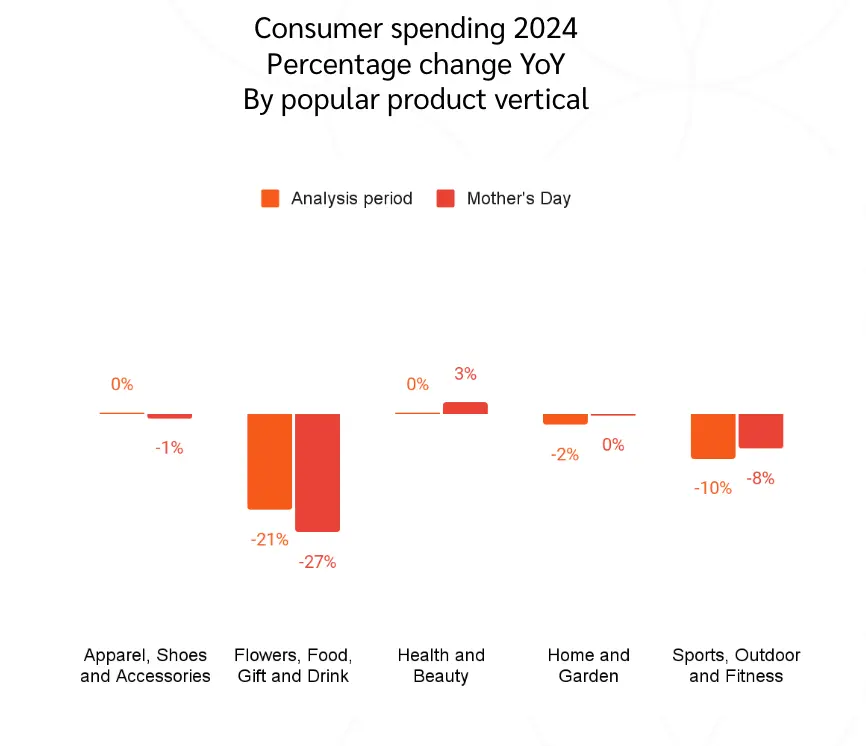

While consumer shopping habits shifted this year, the amount they spent didn’t take the hit retailers expected. The increase in transactions plus lower AOVs meant 2024 Mother’s Day spending was identical to 2023.

The only change was on Mother’s Day, when spending decreased 5%. This may be because fewer deals and higher prices didn’t appeal to shoppers expecting deep discounts over the holiday weekend. Consumers might have capitalized on deals in the weeks leading up to the day, completing their shopping earlier than last year.

Despite higher conversion rates than other categories, Flowers, Food, Gifts, and Drink retailers showed significantly less spending than last year. The only category where spending increased was Health and Beauty on Mother’s Day. However, that increase may indicate the overall 6% price increase the research revealed on Mother’s Day.

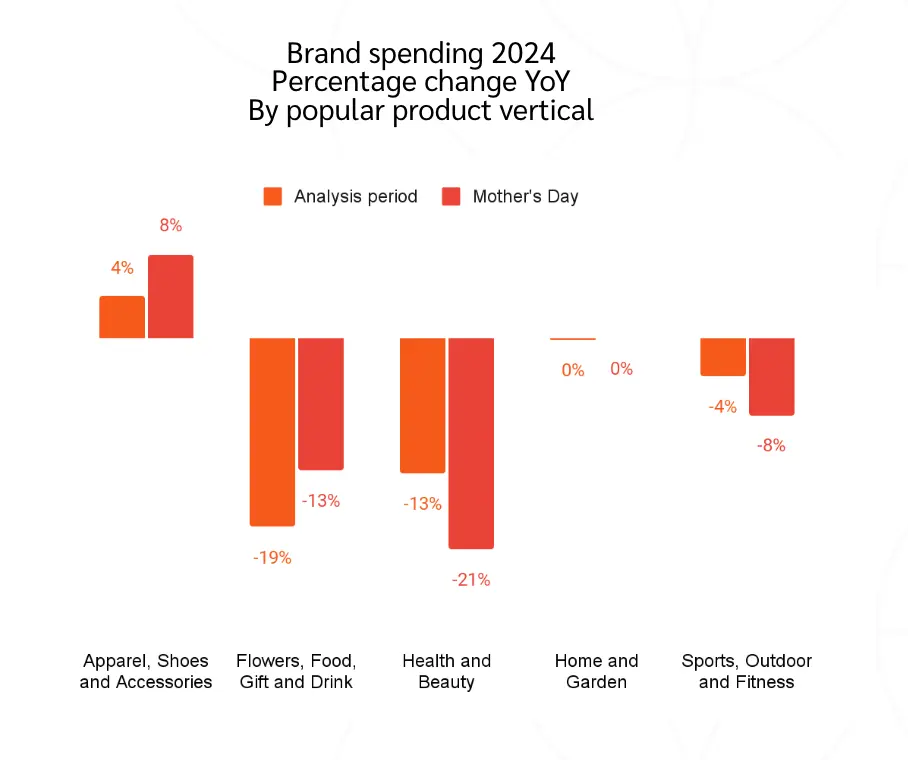

6. A 3% increase in brand spending reflects a strategic investment in partnerships.

Unlike traditional marketing channels, the partnerships channel uniquely operates on a results-driven basis, meaning brands only pay for actual results. This approach aligns brand spending directly with performance, giving brands better control over their budgets.

The 3% rise in brand spend highlights brands’ commitment to leveraging partnerships to capture the attention of increasingly discerning shoppers. This year, consumers demonstrated a more strategic approach to their purchases, researching extensively and seeking the best deals. By paying higher commission rates this year, brands incentivized partners and ensured their products were prominently featured.

Apparel, Shoes, and Accessories brand spending increased by 4%, leading to Mother’s Day and 8% the day off.

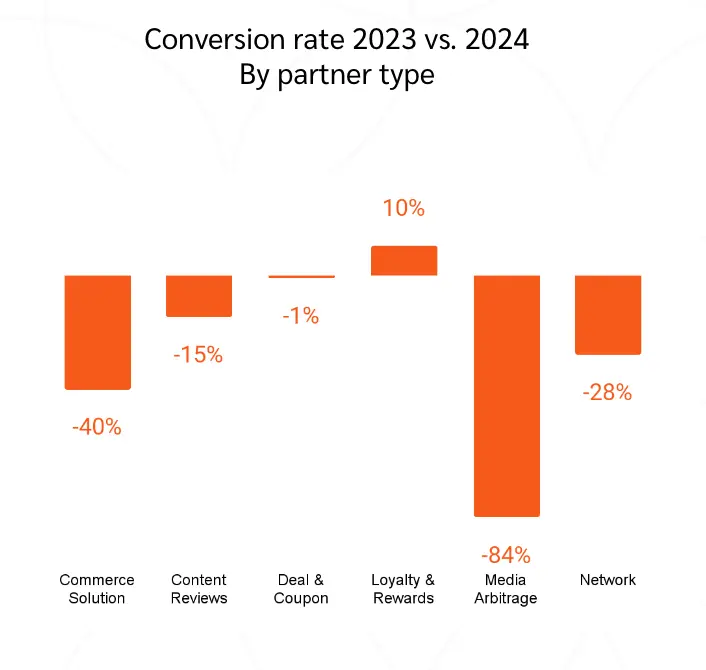

Similar to 2023, loyalty and rewards partners produced the highest number of transactions. This partner type experienced a 10% boost in conversion rates year over year, which shows their importance in the consumer buying journey.

Partnerships powered the sales funnel this Mother’s Day. Loyalty and rewards partners helped seal the deal by contributing to 57% of 2024’s transactions. Network partners were pivotal in driving awareness, reflected by the 41% contribution share in clicks, increasing from 2023. Brands can capitalize on these partner types to drive sales

Broaden the partner mix: Balance your partner portfolio with partners that build awareness and drive conversion traffic.

Align commission with high-performing partners: Use real-time performance data from reporting to identify and invest more in top-performing partner types within your category.

Capture more sales during Q2 with partnerships.

As shoppers continue to spend across multiple brands, getting your brand in front of new customers is essential to capture those transactions. One of the best ways to reach new customers throughout April and May (and beyond) is through partnerships.

Partnerships get your product in front of an eager and ready-to-buy audience. Through partnerships, your brand can build customer trust and promote deals shoppers would otherwise miss—all through partners your audience already knows, likes, and trusts. That way, when Mother’s Day 2025 rolls around, you’re already top-of-mind.