After a year that has seen ups and downs like no other in history, no one knew exactly what to expect from Black Friday/Cyber Monday (BF/CM) this year. Impact has been tracking partnership benchmarks since the beginning of the pandemic, and it’s provided insights into changing consumer behavior. So what happened during Cyber Week this year?

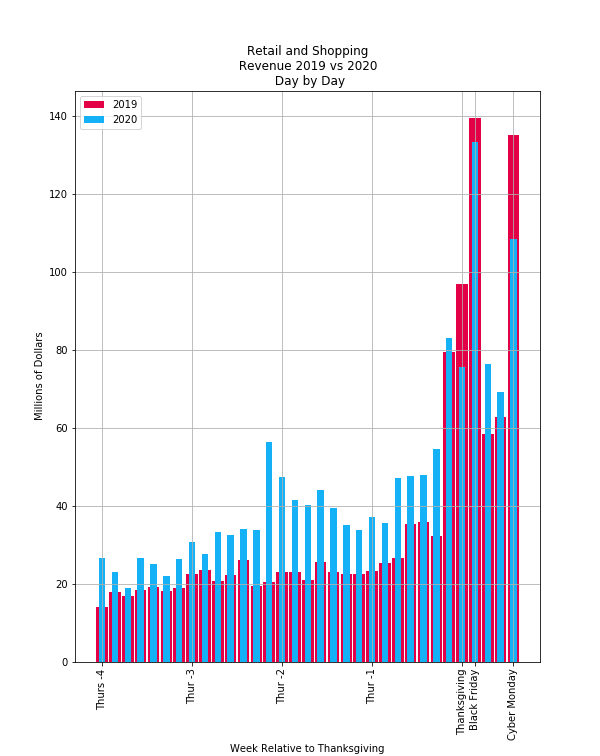

Impact’s data scientists took a look at key metrics during 2019 and 2020’s BF/CM shopping period to find out. They discovered that Impact’s retail and shopping clients saw their revenue grow from partnerships during 2020’s peak shopping season. Brands experienced revenue growth in the weeks leading up to Cyber Week, despite the upsets that the COVID-19 pandemic brought.

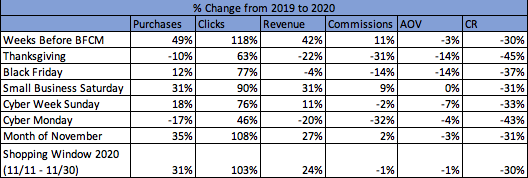

Key findings from the research include:

- Consumers shopped earlier as Black Friday and Cyber Monday deals were promoted earlier, causing the “holiday shopping window” to shift and expand in 2020.

- Shoppers spent more time shopping around for deals in 2020 compared to 2019.

- The weeks leading up to Cyber Week outperformed Black Friday and Cyber Monday in 2020.

The methodology behind the benchmarks

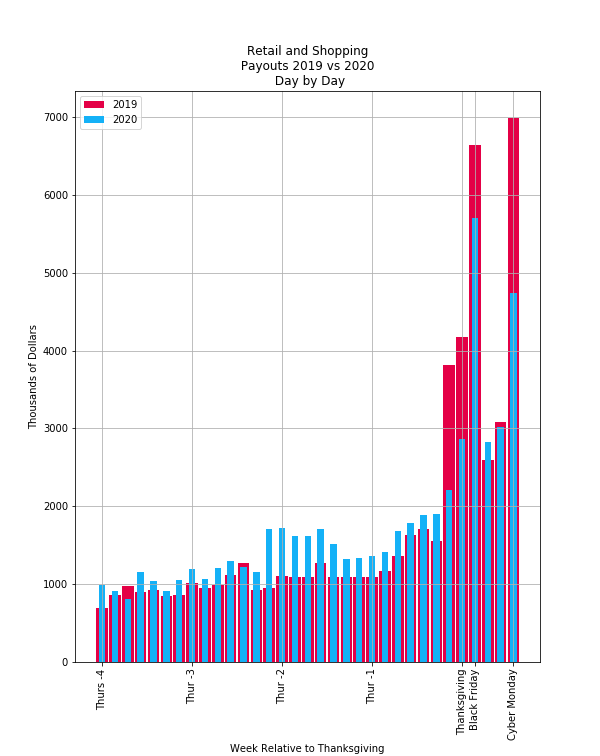

Impact tracked year-over-year (YoY) by day benchmarking across retail and shopping verticals to compare 2019 and 2020 Cyber Week YoY growth. Our data was pulled using a cohort of hundreds of brands within the retail and shopping verticals that contained the same store data year over year. Impact’s analysis began four weeks before Cyber Week, on October 29, 2020, and ended on Cyber Monday, November 30. This time frame offers a full window into consumer behavior leading up to and including Cyber Week.

6 trends to note from Cyber Week data

1. Consumers shopped earlier, as Black Friday and Cyber Monday deals began earlier.

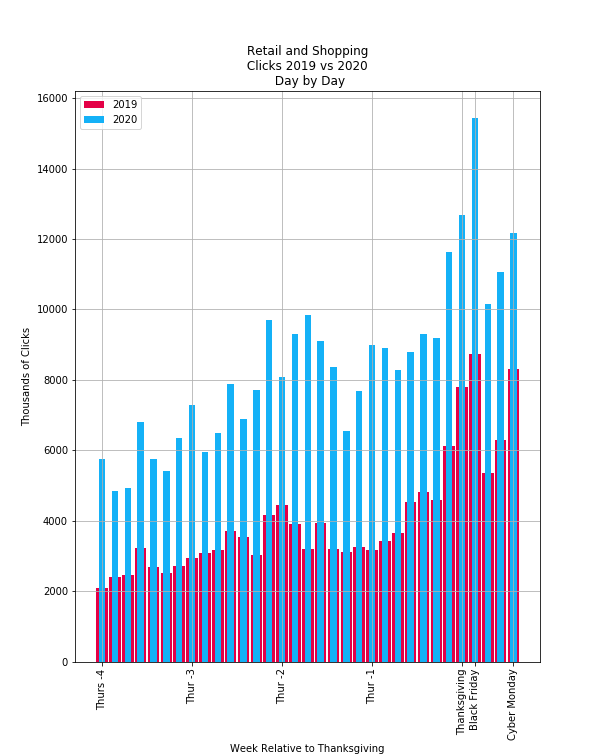

- Clicks were up by an average of 118% across each day leading up to Cyber Week 2020. In some cases they rose by as much as 290% compared to 2019.

- Clicks saw an increase of 77% and 46% on Black Friday and Cyber Monday, respectively.

- Overall, clicks were up 108% in the month of November compared to 2019.

Key takeaway

With COVID-19 potentially discouraging shoppers from flooding into stores before sunrise on Black Friday, retailers had to adjust their 2020 game plan in advance. Most released their Black Friday deals weeks in advance, hoping to get as much wallet share as possible.

2. Consumers did significantly more buying in the weeks leading up to Black Friday and Cyber Monday 2020 compared to 2019.

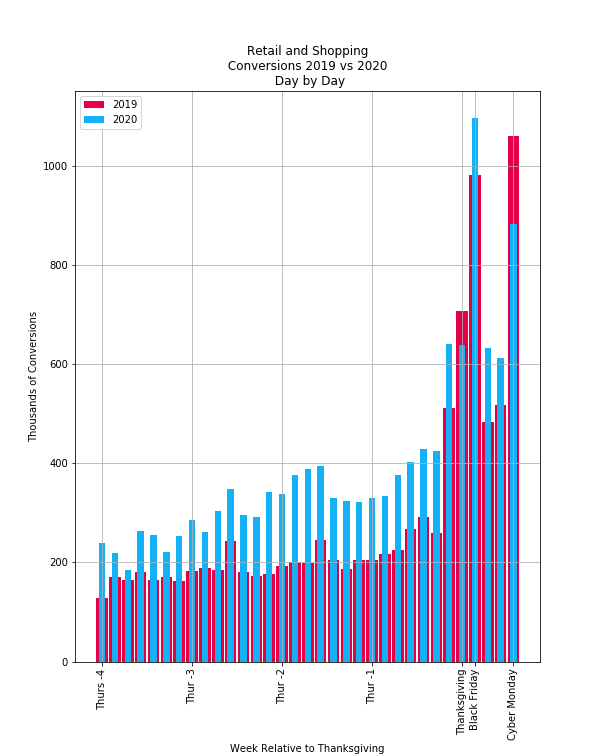

- Purchases were up 49% in the weeks leading up to Black Friday and Cyber Monday.

- Purchases were up 12% on Black Friday but down 17% on Cyber Monday.

- For the month of November, purchases were up 35%.

Key takeaway

Consumers bought earlier, taking advantage of the early promotions from retailers in the weeks leading up to Black Friday and Cyber Monday 2020, in addition to focusing on those two shopping days as they have in the past. A decrease in purchases on Cyber Monday could mean that shoppers had already found deals they wanted and were finished with their holiday shopping before Cyber Monday rolled around.

3. Shoppers were given more options to choose where they spent their money.

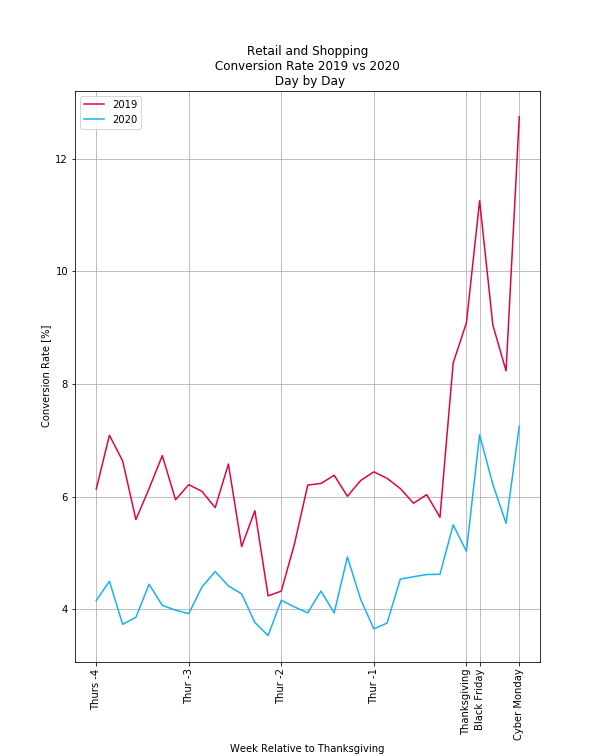

- Conversion rates were down an average of 33%, with some days as low as -60% in the weeks leading up to Cyber Week.

- On Black Friday and Cyber Monday, conversion rates saw a decrease of 37% and 43%, respectively, compared to 2019.

- For the month of November, conversion rates were down 31%.

Key takeaway

With more days to shop the same deals, shoppers may have been spreading out their orders and browsing between sites, given that they had more time to find the products they want.

4. Average order value (AOV) faltered slightly.

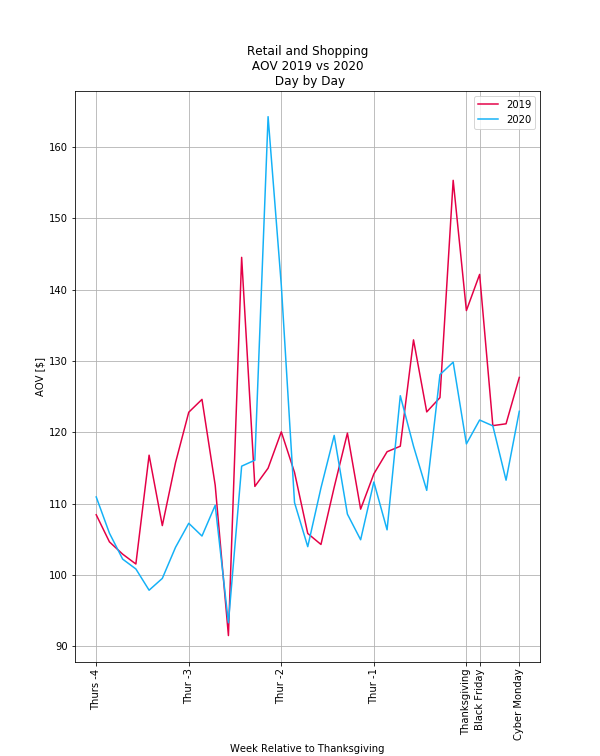

- In the weeks leading up to Cyber Week 2020, AOV was down an average of 3% compared to 2019.

- AOV was down 14% and 4% on Black Friday and Cyber Monday respectively, compared to 2019.

- For the month of November, AOV was down 31%.

Key takeaway

While average order value was down over the weeks leading up to Cyber Week and on Black Friday and Cyber Monday 2020, it was only by a few percentage points. This likely can be attributed to brands offering bigger deals on certain items in order to recover losses suffered throughout the year.

5. The weeks leading up to Cyber Week 2020 outperformed Black Friday and Cyber Monday. Fortunately, performance still holistically resulted in a revenue increase for the month of November.

- In the weeks leading up to Cyber Week, revenue increased 42% YoY compared to 2019.

- On Black Friday, revenue was down 4% YoY. Cyber Monday also saw a revenue drop of 20%.

- In the month of November, revenue increased 24% YoY compared to 2019.

Key takeaway

Black Friday and Cyber Monday underperformed in 2020 as shoppers were given access to deals and offers weeks ahead of Cyber Week. Despite a lackluster performance on the traditionally best-performing days, revenue was up for the entire month of November. This seems to validate that overall, the “extended deal window” strategy paid off for retailers.

6. Partners saw limited gains in payouts.

- Payouts started out slow but picked up in the last two weeks leading up to Cyber Week 2020, with an average increase of about 12% in the days leading up to Cyber Week.

- Payouts were down 17% on Black Friday compared to 2019, while Cyber Monday payouts were comparably down 32%.

- For the month of November, payouts only increased 2% YoY.

Key takeaway

While retailers were making more money YoY (a 27% increase in revenue in November 2020) partner earnings were relatively flat YoY. We cannot be entirely certain why, but a potential factor could include a rise in low-payout categories (like new electronics).

Cyber Week 2020 was different from years past but partnership revenue still grew

Cyber Week 2020 did not feature the usual setting of early morning shoppers, long lines, and crowded stores. Instead, most consumers shopped online over the course of weeks, rather than exclusively on Black Friday and Cyber Monday. As the pandemic mostly hindered in-store buying opportunities, many brands and retailers opted to release their holiday deals weeks in advance of Cyber Week. This caused a shift in the “holiday shopping window,” as more revenue was generated in the weeks leading up to Cyber Week than on Black Friday and Cyber Monday. The holiday shopping window in 2019 started one day before Thanksgiving in contrast to starting 15 days before Thanksgiving in 2020.

Despite reduced performance on Black Friday and Cyber Monday, the month of November saw a net increase across purchases, clicks, revenue, and payouts to partners. While the pandemic certainly affected Cyber Week, an improvised game plan from retailers and partners proved effective in convincing consumers to shop till they drop . . . or, in the case of this year, fall out of their chairs from online purchasing.