Tight budgets didn’t dampen the holiday spirit during this year’s Cyber Week. Record-breaking deals drove consumers to spend nearly $40b across the iconic five-day shopping spree—a 6.1% increase year over year.

As shoppers prepared to spend 2.2% more on gifts this year, many took advantage of deep Black Friday and Cyber Monday discounts to check off their shopping lists. This data uncovers insights into today’s consumer, showing brands what they can expect from shoppers this holiday season and beyond.

The impact.com Cyber Week research study provides insightful information to help brands assess and compare their partnership performance to other retailers. Use the data to uncover the trends shaping customer behavior and develop strategies to optimize partnerships for growth.

Index:

Methodology

The impact.com Cyber Week Research conducted on November 29, 2023, tracked key metrics for more than 1000 North American brands containing same-store data (that were active and productive in the month leading up to Cyber Week). The year-over-year (YoY) analysis looked into brands in the Retail and Shopping industry, comparing their performance during Cyber Week 2023 to Cyber Week 2022.

The analysis tracks performance metrics—average order value, clicks, transactions, conversion rates, commission, and revenue—to analyze Cyber Week performance.

Cyber Week refers to the period from Thanksgiving to Cyber Monday. The analysis period includes the four weeks leading up to Thanksgiving and including Cyber Monday:

- 2022: 10/30 – 11/28

- 2023: 10/29 – 11/27

While the complete analysis of the Retail and Shopping vertical includes various sub-categories, we chose to feature brands in the following popular product categories for this report:

- Apparel, Shoes, and Accessories

- Computers and Electronics

- Health and Beauty

- Home and Garden

- Sport, Outdoor, and Fitness

This report aims to offer unique and valuable insights into consumer behavior and significant trends leading up to (and including) Black Friday and Cyber Monday.

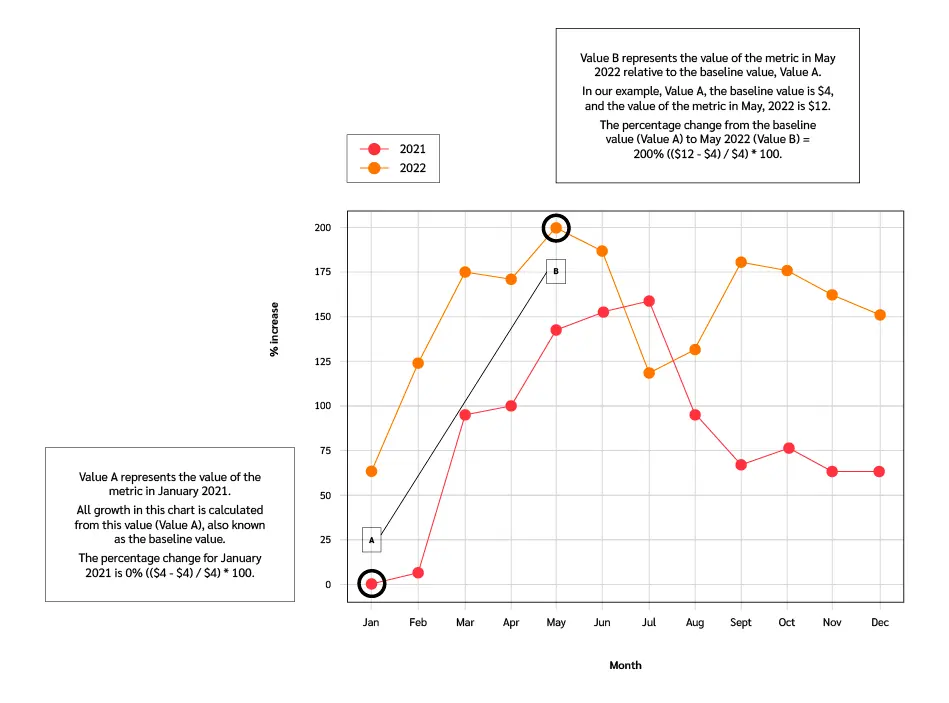

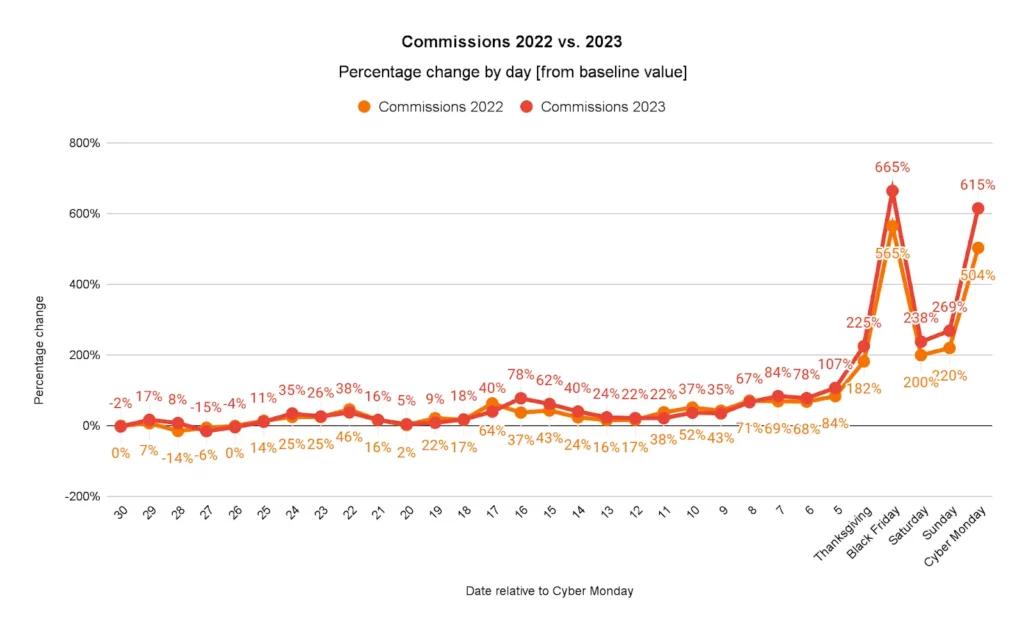

Interpreting the graphs

Unless otherwise noted, the values shown in each graph represent the percentage change in a metric’s value relative to that value at a specific time, also referred to as the baseline value. Our analysis measures all values relative to the baseline one month before Cyber Week 2023.

For example:

5 key findings in the Retail and Shopping vertical

Retail and Shopping include brands from multiple sub-verticals. The research shows how consumers discover, research, and purchase new products. This research also spotlights new habits and trends that built momentum over the last year.

Discover five key metrics to help pinpoint current trends:

- Clicks increased 23% as shoppers researched their wishlists

- Transactions grow 9% alongside Cyber Monday popularity

- AOV sees a modest 4% bump driven by Black Friday shoppers

- Revenue increased 13% for brands with partnerships

- Partners earned 16% more from commission payouts

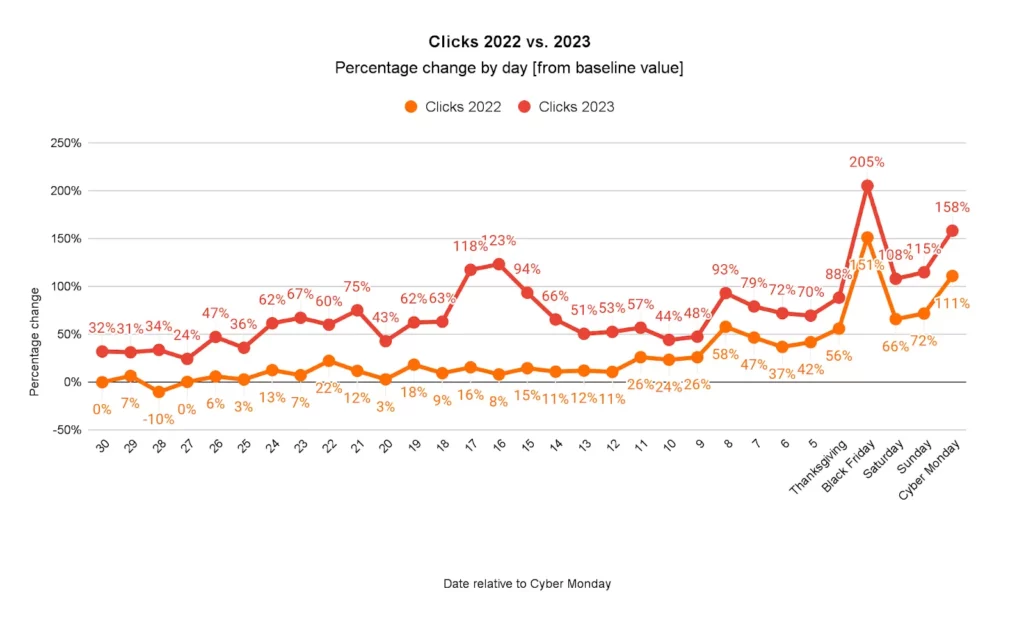

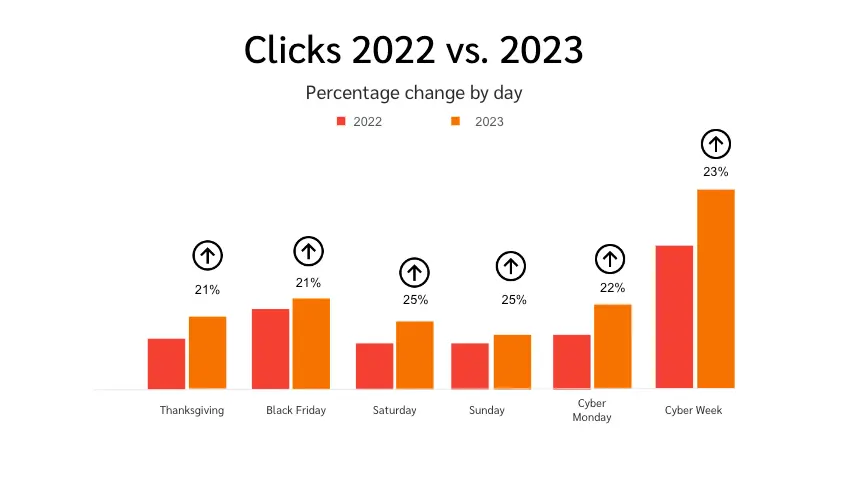

1. Clicks increased 23% as shoppers researched their wishlists

Cyber Week window shopping is a thing of the past. Now, over half of all shoppers compile items on their wishlist ahead of time, ready to strike when they find the best deal. This year, the increase in clicks leading up to Cyber Week revealed how consumers compared discounts and studied their options in preparation for the deal days.

Once Cyber Week arrived, shoppers continued to scour for the best deal, increasing clicks by 23% YoY. Apparel, Shoes, and Accessories brands reported a 20% YoY increase in clicks, noting a 13% increase on Black Friday. Meanwhile, Arts and Entertainment brands reported a 63% YoY single-day click increase on Cyber Monday and a 22% increase throughout the event.

Computers and Electronics—a popular investment during Cyber Week sales—saw a surprising 2% decrease in overall clicks and a 14% drop on Black Friday. Slashing prices by over 30% on Cyber Monday may have seemed too good to miss for budget-conscious shoppers, driving more impulsive purchases. Yet despite record-low prices, Cyber Monday delivered 12% fewer transactions than last year.

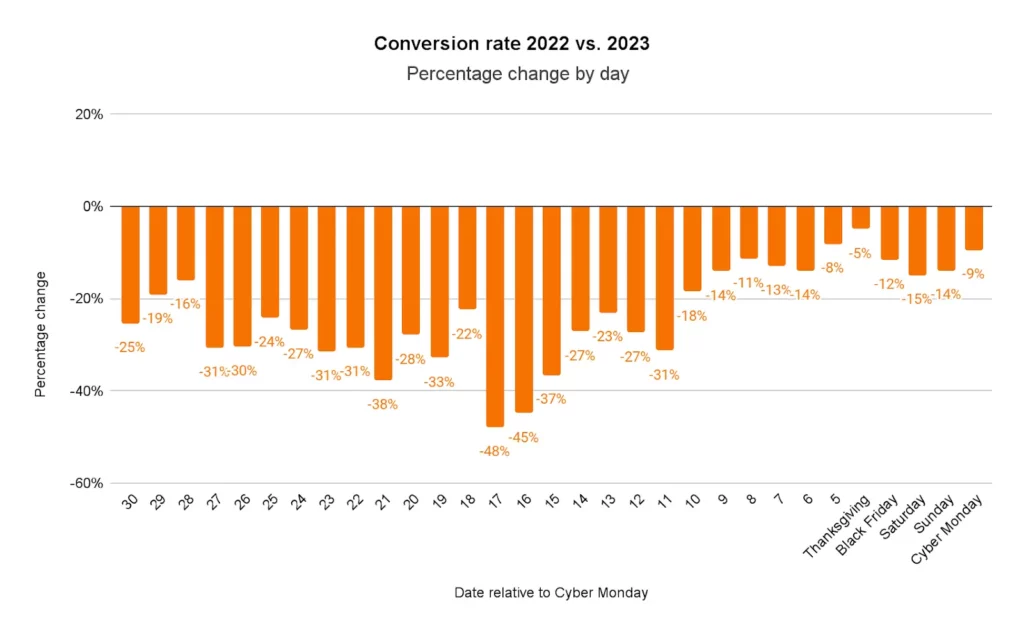

This year’s increase in clicks accompanied a sharp decline in conversion rates. Black Friday conversions dipped 12% YoY across the Retail and Shopping industry, while Cyber Monday conversions dropped 9%. These drops suggest that most shoppers stuck to their wishlists this year, continuously checking for the right moment to buy.

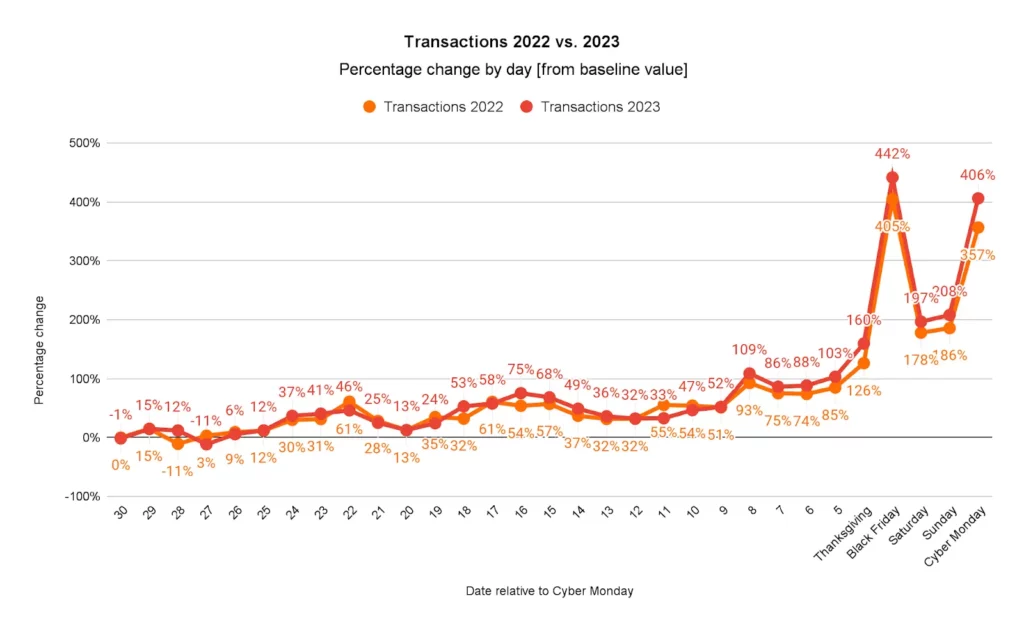

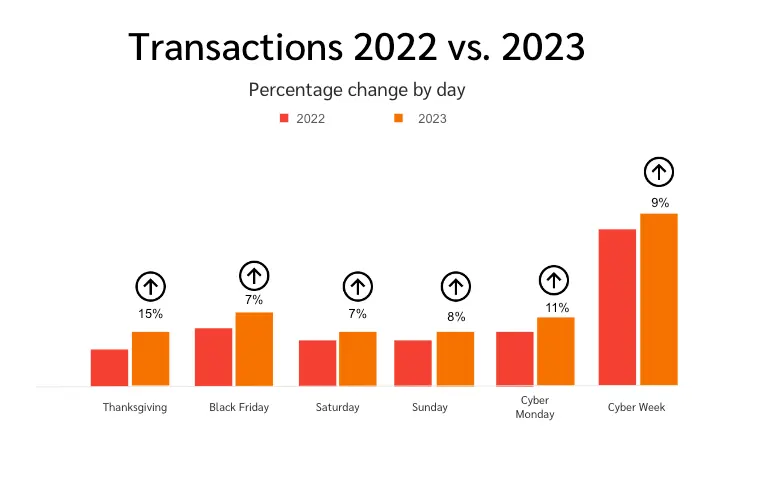

2. Transactions grew 9% alongside Cyber Monday popularity

Shoppers eagerly awaited the best deals during this year’s Cyber Week, resulting in over $13.1b in sales on Cyber Monday.

Even though Black Friday shoppers completed the most transactions this year, Cyber Monday transactions saw an 11% surge in popularity, contributing to the 9% increase in total transactions across brands during Cyber Week.

Cyber Monday’s growing popularity suggests that e-commerce will continue to thrive, with forecasts of consumers spending $1 online for every $5 they spend during the holiday season this year.

Unlike other Retail and Shopping sub-categories, a 9% increase in clicks led Home and Garden brands to secure 12% more transactions this year. Shoppers jumped on Black Friday deals for Home and Garden buys to drive a 14% increase in transactions YoY, even though furniture items were heavily discounted on Cyber Monday.

Consumers also bought more Apparel, Shoes, and Accessories on Black Friday when discounts were at their highest, driving a 6% boost in transactions during Cyber Week compared to 2022. Cyber Monday was popular for Sports, Outdoors, and Fitness brands, which saw an impressive 12% increase in transactions YoY.

Brands in Art and Entertainment and Health and Beauty struggled in comparison. Plummeting conversion rates 21% lower than last year led to a 4% decrease in Arts and Entertainment sales. Meanwhile, Health and Beauty brands saw a 9% dip in transactions compared to the previous year. The lower investment in these brands may connect to consumers’ decision to spend 26% less on non-gift holiday spending this year.

A possible explanation for this year’s 9% transaction increase may be mobile shopping. As impact.com’s consumer research predicted, smartphones are now the primary method for online Cyber Week shopping; 52% of this year’s transactions happened on a mobile device.

However, this shift isn’t necessarily better for brands. Conversion rates on desktop computers approached 7%, nearly double those on smartphones. Shoppers consistently bought more items on desktops than tablet or smartphone devices. These metrics are a critical reminder that consumers often use multiple devices to shop and research; brands must provide a consistent shopping experience across all devices to maximize conversions.

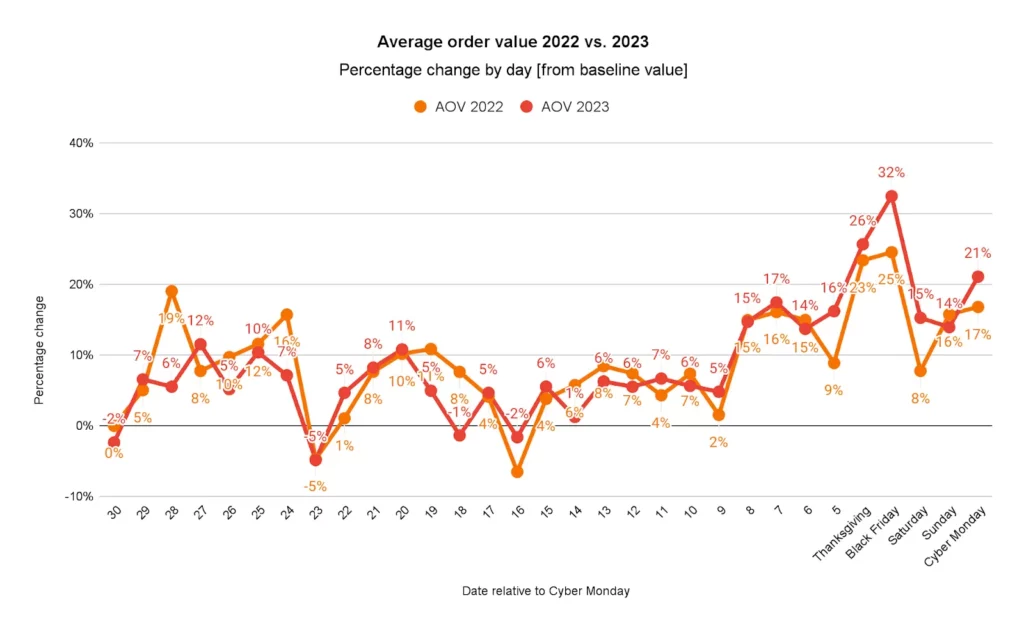

3. AOV sees a modest 4% bump driven by Black Friday shoppers

Even though shoppers bought 11% more items per order on Cyber Monday, the average basket size only increased by 4% YoY. Black Friday’s 6% AOV increase contributed notably to the year’s marginal 4% bump.

While AOV normally indicates shoppers buying more items, this year’s increase may be attributable to rising inflation. Higher prices could drive consumers to buy less expensive items or pay more for fewer items, contributing to increased AOV.

For instance, more expensive Arts and Entertainment purchases may account for the category’s 15% boost in AOV this year. For Computer and Electronic brands, deep Cyber Monday discounts can explain why AOV was higher on Black Friday than Cyber Monday.

Apparel, Shoes, and Accessories, and Health and Beauty brands are more likely to contribute higher AOVs to larger cart sizes. The former saw an 11% AOV boost this year, while the latter experienced a 7% increase.

Buy Now Pay Later options are likely also contributing to higher order values. Shoppers spent $8.3b with Buy Now Pay Later (BNPL) services during November (November 1 – November 27) this year, reflecting a 42% increase in popularity YoY. On Cyber Monday, BNPL usage inceased 42.5% YoY. This flexibility lets consumers take advantage of the year’s best deals without straining their monthly budgets.

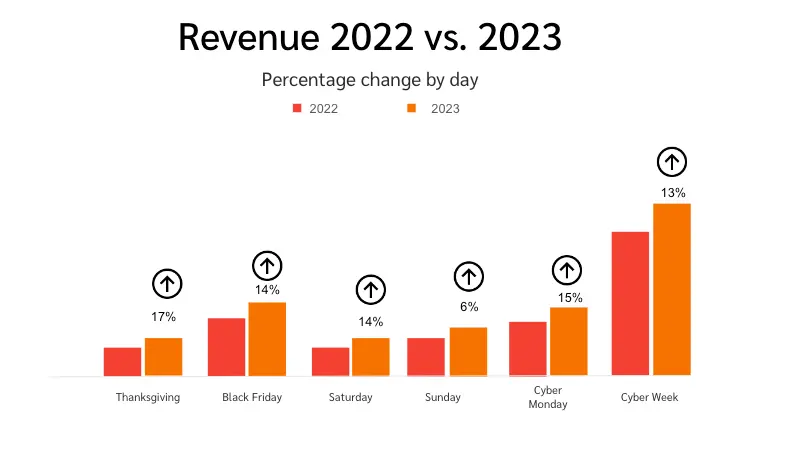

4. Revenue increased 13% for brands with partnerships

While Adobe Analytics found that consumer spending increased 7.8% during Cyber Week, brands working with impact.com reported a 13% boost in revenue YoY. This discrepancy reveals the power partnership has on revenue, which drove 12% of all sales this year.

By leveraging partnerships, brands have successfully amplified their revenue by driving more converting clicks to their products. This, in turn, has increased transactions and higher revenue earnings

Most brands generated most of their revenue on Black Friday, aligning with our findings on average order values and the number of transactions above. For instance, Apparel, Shoes, and Accessories brands report 18% higher revenue YoY, mainly attributable to Black Friday deals. Home and Garden brands’ Black Friday sales significantly contributed to their 13% revenue growth. Across all brands, Black Friday revenue was up 14% compared to 2022.

However, the other shopping days are catching up and contributing more revenue this year than ever before. Cyber Monday saw a 15% YoY boost in revenue, while Small Business Saturday saw a 14% increase. Higher Cyber Monday revenue may be responsible for the 9% revenue boost for Sports, Outdoor, and Fitness brands, as well as Arts and Entertainment brands’ 10% growth.

Only one brand category saw decreased brand revenue: Health and Beauty. A 9% drop in transaction volume likely contributed to the category’s lackluster performance, decreasing brand revenue by 4% YoY. However, a 2% increase in commission payouts and a 7% boost in AOV shows that partnerships played a big role in helping Health and Beauty brands capture revenue this year.

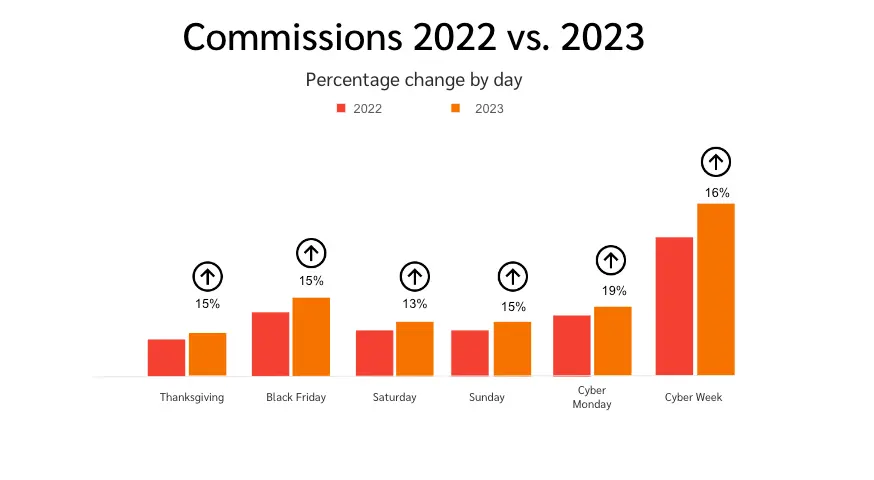

5. Partners earned 16% more from commission payouts

Partners reaped the rewards of their hard work this year, receiving 16% higher commission earnings throughout Cyber Week.

While driving more sales contributed to higher commission payouts, brands invested more in their partnerships, paying partners higher commission rates for premium placement during Cyber Week. That led Apparel, Shoes, and Accessories to pay 17% more in commission earnings this year, while Home and Garden brands saw an 18% increase in commissions.

Even Health and Beauty brands paid 2% more in commissions in 2023 despite a 9% drop in sales and a 4% drop in revenue.

Brands may have been more intentional about their partnership marketing strategies this year. Cyber Monday commission payouts increased by 19% this year, showing that partnership content continued to reach shoppers over the weekend. Extending partnership campaigns into the weekend may provide huge benefits if Cyber Monday continues to grow in popularity.

Partnerships are the key to winning Cyber Week—and beyond

As shoppers battled inflation by tightening their belts, they patiently waited for brands to offer the deep discounts they’ve come to expect during Cyber Week. This year, they spent weeks researching products, tracking their wishlists, and analyzing deals. Ultimately, it led to the most successful Cyber Week, reaching nearly $40b in revenue.

Advertising Cyber Week sales isn’t enough to attract today’s discerning consumers. Now, brands need to become a resource, making the research process easier for busy shoppers. Working with partners is a powerful way to reach thoughtful shoppers, increase product awareness, and drive conversions: everything you need to win Cyber Week 2024.

Don’t wait until next year to improve your Cyber Week performance. Start creating partnerships today, and reap the rewards during next year’s holiday season.

Ready to create successful partnership relationships for your next big shopping event? Schedule a demo to see how impact.com can get you started.