Amazon’s four-day Prime Day 2025 created a new playbook for major sales events—but what did it actually mean for the retail brands competing for attention during those 96 hours?

While Amazon celebrated “record-breaking” sales, the reality for brands was more nuanced. Our analysis of 1,146 North American retail brands reveals a market in transition, where extended sales windows create both opportunities and unexpected challenges.

The new reality: Volume vs. efficiency

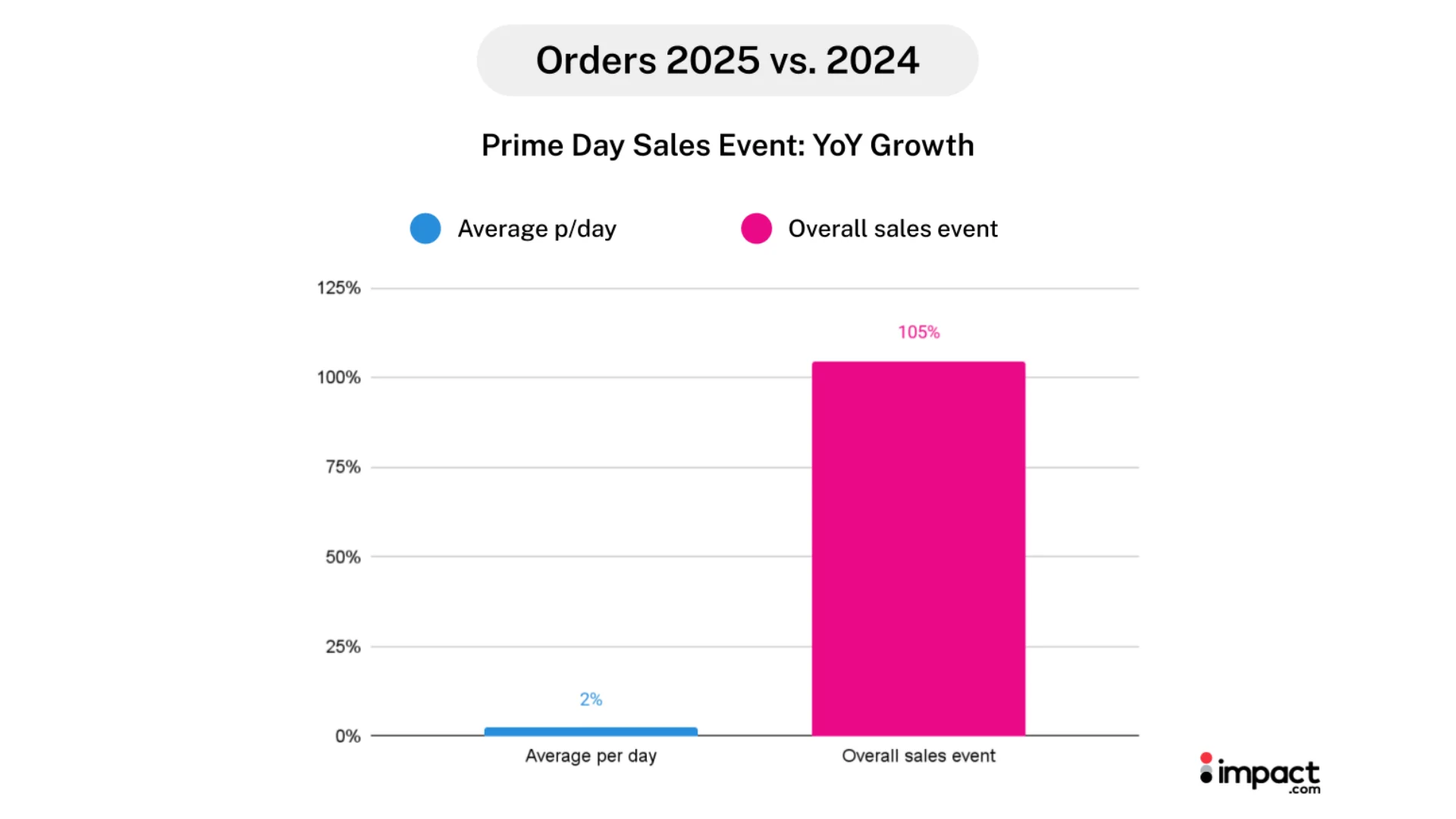

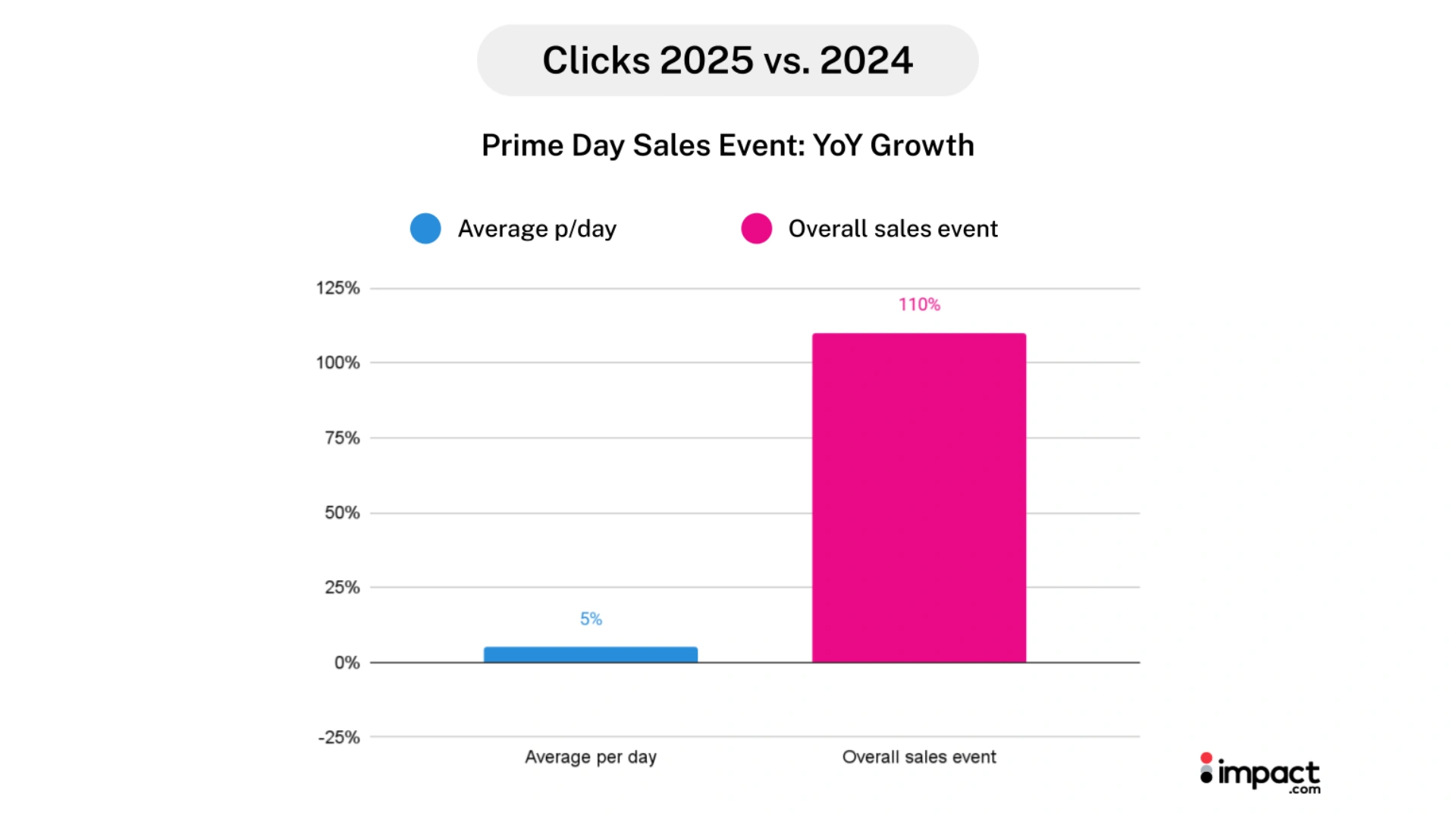

The numbers tell a complex story. Total click volume surged 110% and orders jumped 105%—impressive headlines that mask a more judicious truth. When we normalized for the event’s extended length, the average daily performance painted a different picture:

- Consumer behavior shifted dramatically: Purchase journeys stretched from 6.78 to 7.36 days as urgency dissolved

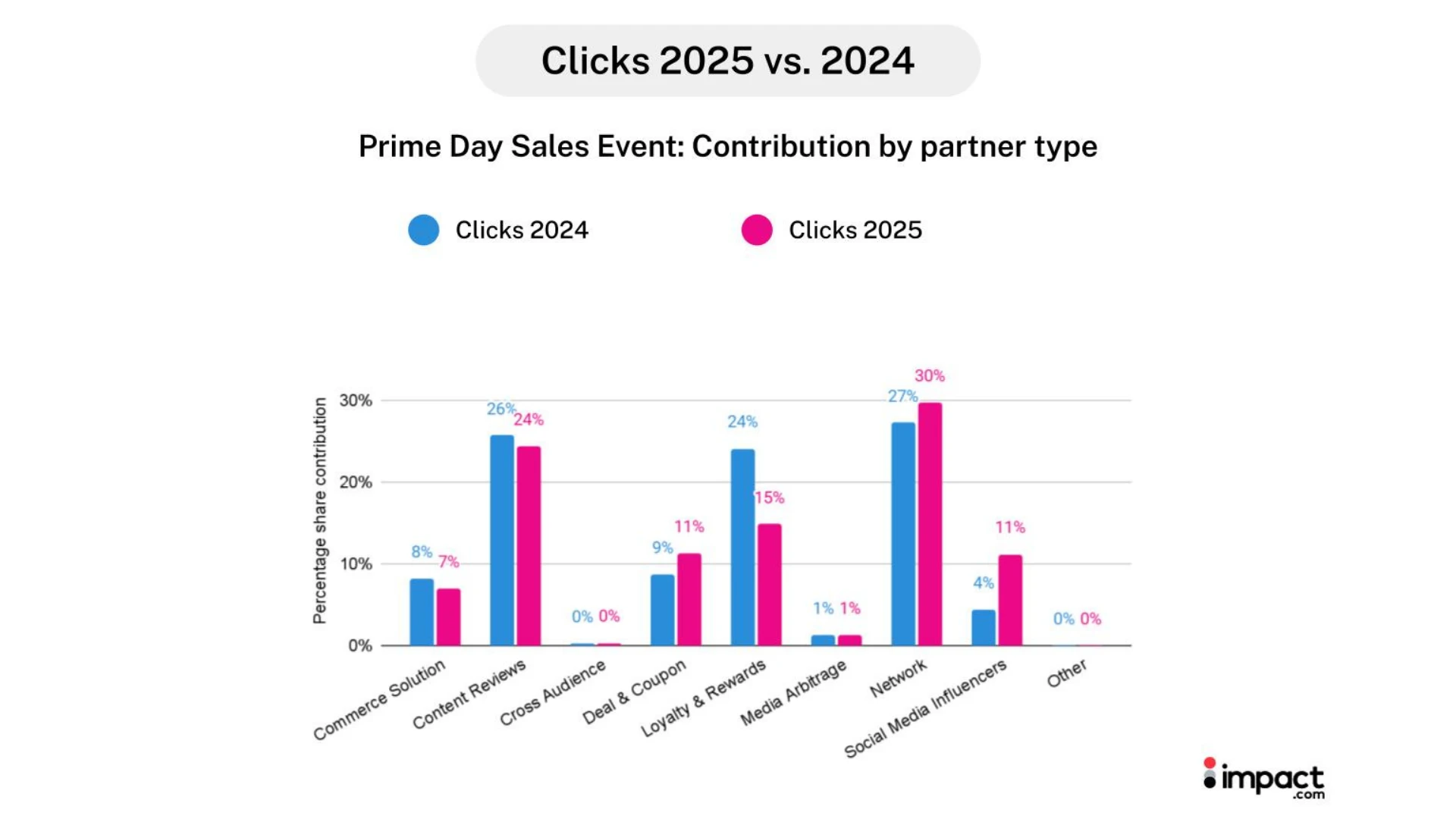

- Traffic sources diversified: Influencers quadrupled their contribution share of clicks to 12%, while traditional loyalty programs lost ground

- Spending patterns evolved: Shoppers bought 14% more items per order, but at 19% lower individual item values

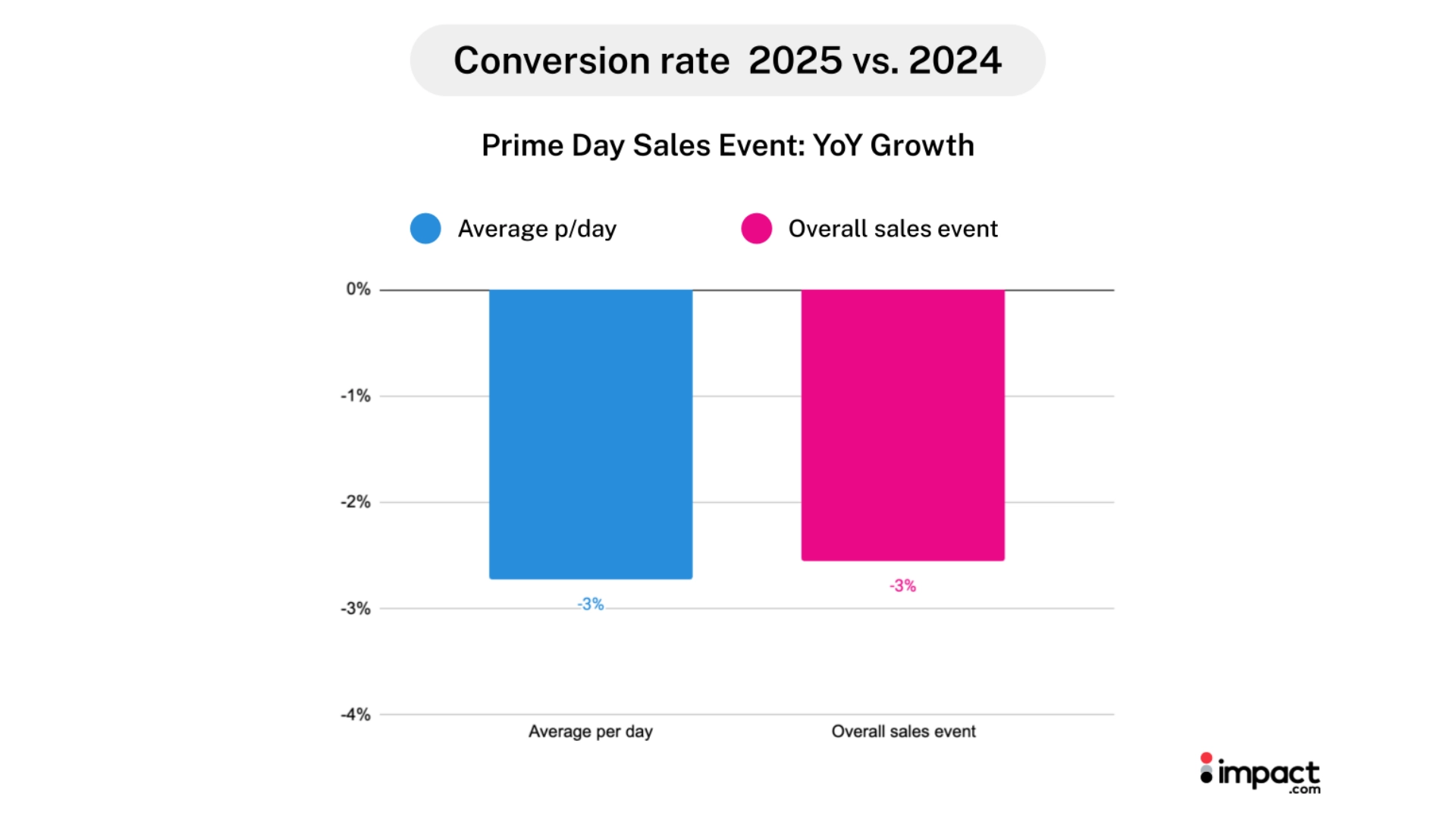

- Conversion efficiency declined: Despite higher engagement, daily average conversion rates declined 3% as research replaced impulse buying

Beyond Prime Day: Market signals for every marketer

These trends extend far beyond Amazon’s summer sale. As Target’s Circle Week stretches to seven days and Walmart extends events to six days, the entire retail calendar is moving toward sustained engagement over flash-sale urgency.

For performance marketing teams, this means looking beyond Prime Day to better understand how consumer behavior is adapting across all major shopping moments. The brands that succeeded during Amazon’s extended window were those that adapted their partnerships strategies, pacing tactics, and conversion optimization for a different shopping mindset.

What you’ll gain

This analysis reveals six critical insights that will reshape how you approach extended sales events:

- How traffic source diversification is reducing reliance on traditional channels

- Why pre-event momentum now matters more than opening-day performance

- Which categories thrived in the extended format, and which struggled

- How commission strategies changed as brands optimized for efficiency over volume

- What the rise of research-driven shopping means for your conversion funnel

- Why the four-day format may become the new standard for major retail moments

The data behind the insights

Amazon’s Prime Day headlines focus on total sales and record-breaking volume. But for performance marketing teams, the strategic questions run deeper: How did the extended format affect partner performance? What happened to conversion rates when urgency was diluted? How did traffic sources change over four days instead of two?

Our analysis of 1,146 same-store North American retail brands provides a different lens on Prime Day 2025—one focused on the partnership marketing metrics that directly impact your strategy.

What we tracked

We analyzed key performance metrics across the retail and shopping vertical during two critical periods:

- Prime Day 2025: July 8-11 (four days) vs. Prime Day 2024: July 16-17 (two days)

- Extended analysis period: The full month leading up to and including each Prime Day event

The metrics we focused on were chosen specifically for their central value to performance marketing teams: clicks, orders, conversion rates, average order value (AOV), consumer spending, and commission payouts across different partner types—from traditional affiliates to emerging influencer partnerships.

Why daily averages tell the real story

Simply comparing 2025’s four-day totals to 2024’s two-day event would be misleading—of course, longer events generate higher volumes. The key insight comes from understanding average daily performance patterns and efficiency metrics.

By normalizing the data and comparing the average daily performance to last year’s daily averages, we can answer the questions that matter: Did the extended format improve or dilute daily performance? How did consumer behavior actually change when urgency was stretched across 96 hours instead of 48?

We also conducted an extra day impact analysis comparing the first two days of Prime Day 2025 (July 8-9) to the final two days (July 10-11), revealing how momentum altered throughout the extended event.

Partner performance insights

One of the unique aspects of our analysis is the ability to track how different partner types—from loyalty and rewards programs to influencers to deal aggregators—performed throughout the extended sales period. This partnership marketing perspective reveals changes in traffic sources and commission efficiency that don’t appear in traditional retail analyses.

Why Amazon extended Prime Day 2025: Market forces reshaping major shopping events

Amazon’s decision to double Prime Day from two to four days wasn’t made in isolation. It reflects three powerful market forces that are reshaping the entire retail calendar—forces that every marketer needs to understand as they plan their own extended sales strategies.

1. Competitive pressure is driving extended promotional periods

The mid-July shopping window has become highly competitive, with Walmart running six-day “Deals” events (July 8-13), Target stretching Circle Week to seven days (July 6-12), and even emerging platforms like TikTok Shop launching extended summer sales.

Amazon’s four-day expansion was a calculated response—when competitors offer longer shopping windows during the same period, maintaining a two-day event risks looking limited. The strategy worked: Amazon captured 75% of Prime Day spending in 2025, up from less than 60% in 2024.

For performance marketers: This competitive dynamic isn’t unique to Amazon. As Black Friday spreads across November and holiday shopping starts in October, brands face the same pressure to extend their own promotional periods to remain competitive.

2. Consumer behavior is shifting toward research-driven shopping

Amazon’s internal data likely showed what our analysis confirms: consumers wanted more time to make decisions. According to Amazon, shoppers specifically requested more time to navigate the millions of available deals without the pressure of a compressed timeline.

The average purchase journey in our network stretched from 6.78 to 7.36 days, extending by over half a day during the Prime Day 2025 analysis period (30 days leading up to and including Prime Day), signaling a redirection from impulse buying to deliberate purchasing.

Extended events cater to this new consumer mindset. Rather than creating artificial urgency, Amazon chose to accommodate browsing patterns where shoppers research across multiple days, compare deals, and make more thoughtful purchases.

The strategic implication: The rise of research-driven shopping means performance marketers need to optimize for longer funnels, not just conversion moments. Success requires sustained engagement across multiple touchpoints, not just opening-day impact.

3. Operational benefits made the extension feasible

Behind the scenes, the extended format delivered tangible advantages:

- Logistics efficiency: Spreading demand across four days reduced peak strain on fulfillment networks

- Server stability: Distributed traffic loads minimized the website crashes that plagued earlier Prime Days

- Inventory management: Third-party sellers could better forecast demand and manage stock levels

- International coordination: Different regions could stagger their peak activities

These operational improvements enabled Amazon to deliver a smoother customer experience while handling record volumes.

The broader trend: From flash sales to sustained engagement marketing

Amazon’s extension represents a calculated pivot from “flash-sale urgency” to “sustained engagement marketing.” Instead of creating artificial scarcity, they’re building longer-term customer relationships through extended value periods.

This mirrors what we’re seeing across the retail calendar: Black Friday has become “Cyber Week,” Cyber Monday extends through Tuesday, and holiday shopping now starts in early October. The era of concentrated, high-pressure sales days is giving way to extended promotional periods that prioritize customer experience over urgency tactics.

What this means for your strategy: As major shopping events continue to extend, marketers need to balance the benefits of sustained engagement with the risks of diluted urgency. Understanding how Amazon navigated this tension provides a roadmap for optimizing your own extended sales events.

The extended format experiment: What worked and what didn’t

Amazon’s four-day Prime Day was a real-time experiment in balancing volume with efficiency. The extra sales day impact.com analysis reveals both the opportunities and risks that performance marketers need to understand as extended sales events become the norm.

The momentum pattern: Front-loaded performance with late-event fatigue

To understand the true impact of extending Prime Day, we analyzed performance across the four-day period, comparing the first two days (July 8-9) against the final two days (July 10-11). The results reveal a clear pattern that should inform every extended sales strategy.

But the most surprising finding came before the event officially began: orders placed the day before Prime Day exceeded Day 1 performance by 4%, suggesting that pre-event anticipation and early-access promotions were more powerful than the official launch.

First two days vs. final two days performance:

- Clicks declined 4% in the final two days

- Orders decreased 5% as momentum slowed

- Consumer spending dropped 4% despite continued promotional activity

- Brand commission payouts fell 7% as efficiency declined

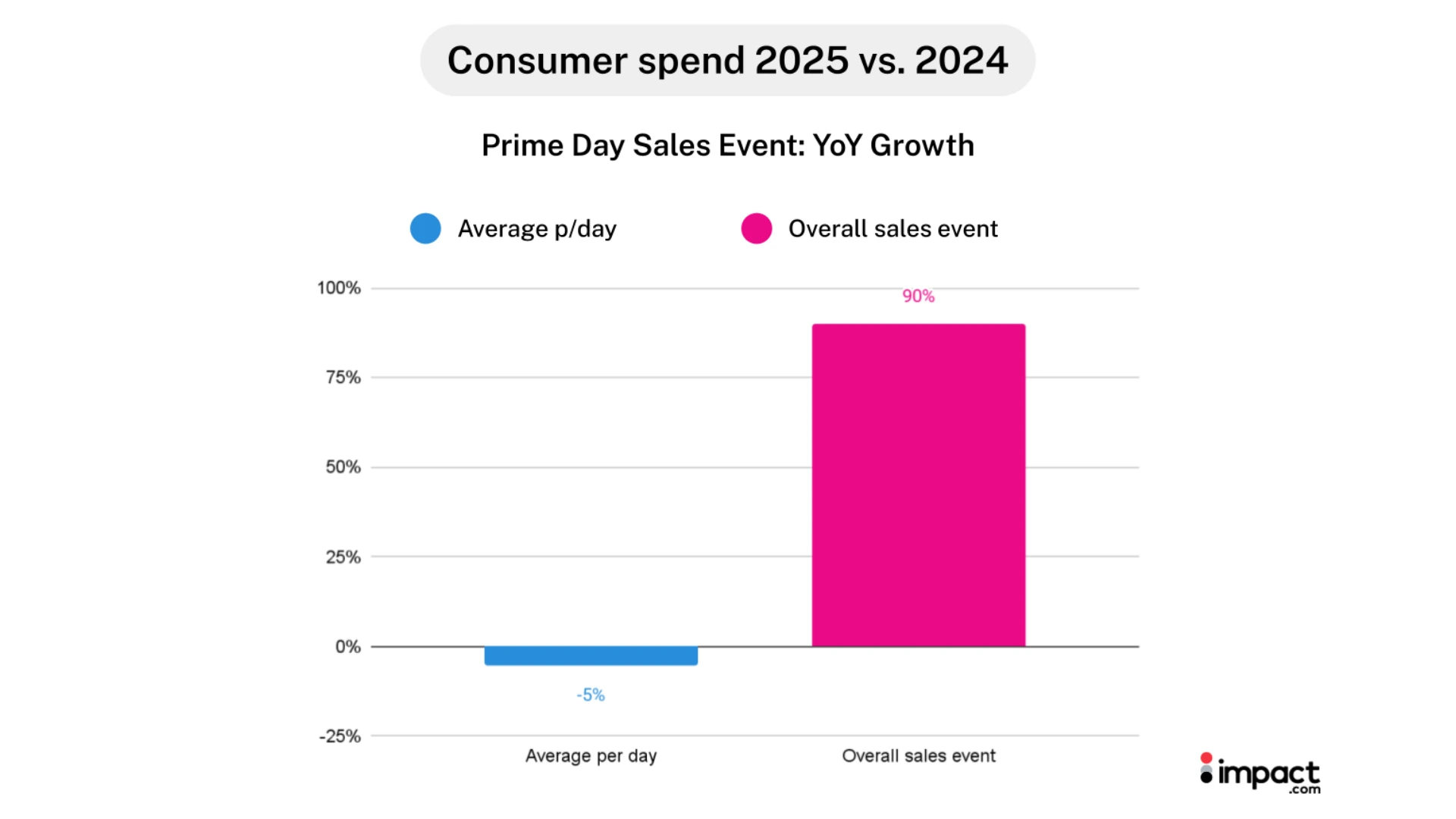

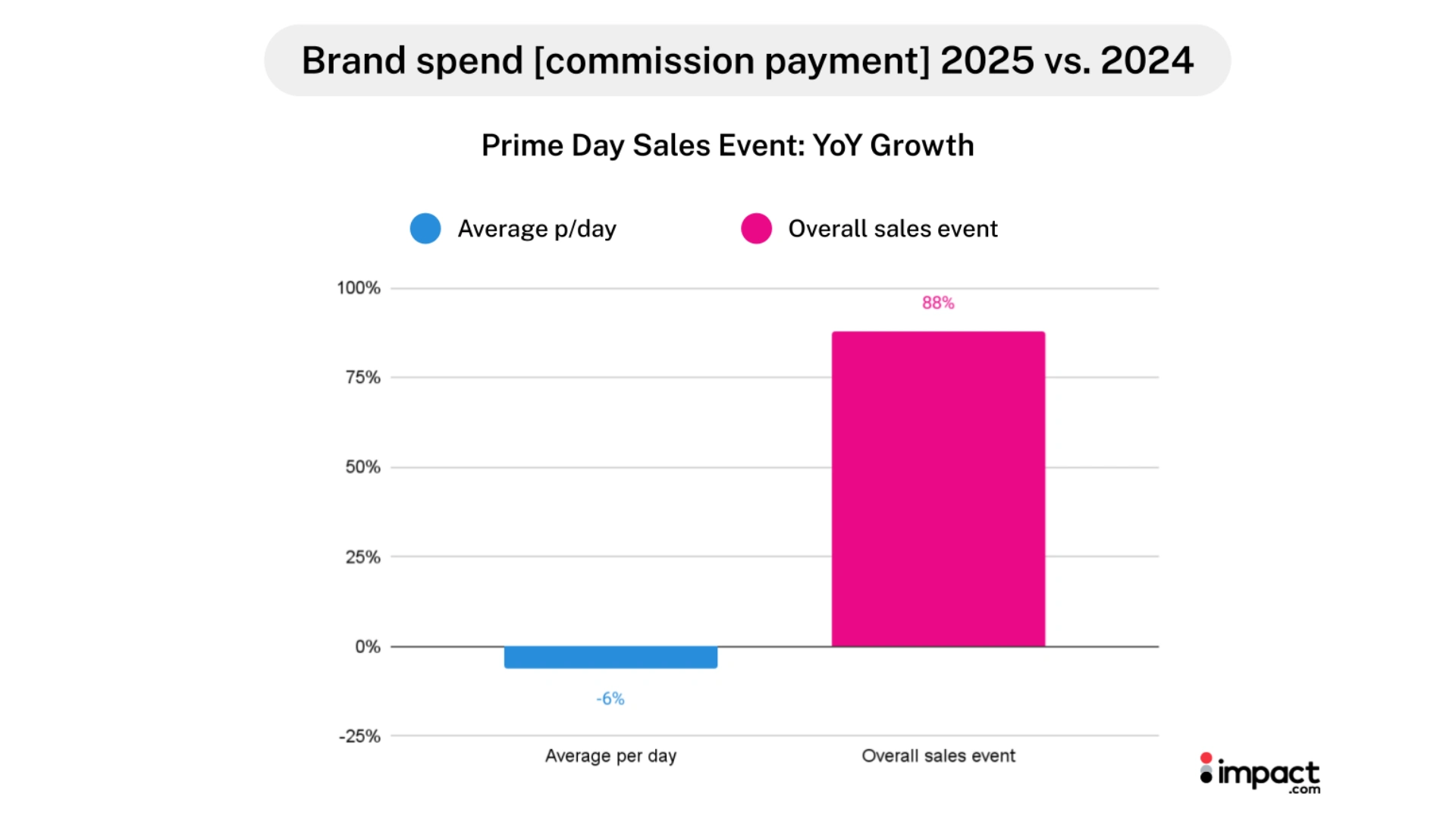

YoY daily average: Prime Day 2025 vs Prime Day 2024

- Clicks: Daily average increased only 5% YoY

- Orders: Daily average increased 2% YoY

- Consumer spending (daily average) dropped 5% despite more orders

- Brand commission payouts (daily average) fell 6%

This front-loaded pattern suggests that while extended events can capture more total volume, they risk diminishing returns as urgency fades and shopper fatigue sets in.

Strategic implications: Opportunities vs. challenges for performance marketers

| Opportunities | Challenges |

| Higher total engagement: Four-day events drove 110% more total clicks, creating more touchpoints for brand discovery and consideration | Diluted daily efficiency: When normalized for the event length, daily performance gains were modest, with daily average clicks increasing just 5% |

| Extended customer journey accommodation: Average purchase journeys stretched to 7.36 days, allowing brands to support research-driven shopping behavior | Reduced conversion urgency: Longer events weakened the “buy now” pressure, with average daily conversion rates dropping 3% as shoppers took more time to decide |

| Broader promotional flexibility: Brands could stagger deals across multiple days, test different offers, and optimize based on real-time performance | Momentum decay: Performance peaked early, then declined, requiring more sophisticated pacing strategies to maintain engagement throughout the extended window |

| Improved inventory management: Extended windows allowed better demand forecasting and stock planning, particularly beneficial for smaller brands | Increased complexity: Success required more strategic planning, budget pacing, and creative refresh to prevent deal fatigue |

What this means for your extended sales planning

The four-day format revealed a tension in extended sales events: volume vs. efficiency. Our analysis found that the extended sales period successfully drove higher total engagement and sales, but at a lower efficiency.

For performance marketers, this suggests three critical considerations:

- Plan for front-loaded performance: Allocate your strongest deals and highest budgets to the opening days when consumer attention peaks

- Build in momentum sustainers: Extended events require strategies to combat shopper fatigue—consider escalating deals, limited-time flash sales within the extended period, or category rotations to maintain urgency

- Optimize for different consumer mindsets: Early days capture urgency-driven shoppers, while later days attract more deliberate, research-focused buyers requiring different messaging and offers

The extended format isn’t inherently better or worse, but it requires adapted strategies that account for changing consumer behavior patterns throughout the promotional window.

6 extended sales event strategies marketers can learn from Prime Day 2025

While Amazon’s extended Prime Day generated more volume, it also revealed emerging changes in how consumers discover, research, and purchase. These six insights form a connected story about the evolution of partnership marketing and the rise of deliberate commerce.

1. Partner ecosystems evolved from loyalty-driven to discovery-focused

The most dramatic transformation occurred in how consumers found and validated purchases, and it signals a deviation in partnership marketing strategy. Loyalty and rewards programs’ share of orders plummeted from 58% to 41%, while influencers quadrupled their contribution to 12% and deal and coupon platforms doubled their share contribution to 24%.

Extended shopping windows gave consumers time to seek validation from multiple sources, rather than rely on familiar loyalty relationships. They wanted education from trusted voices (influencers), price validation from comparison platforms (deal sites), and discovery tools that supported their research process.

What brands can learn: Commission strategies adapted to this new reality, with spending distributed more evenly across partner types, and rates dropping 1% YoY, as negotiations favored performance over relationships. The winners were partners who could provide authentic product education and comparison value, not just transactional convenience.

Partnerships imperative: Extended sales events reward authentic influence over transactional relationships. Your partner mix needs to support research-driven behavior through creators who educate, platforms that compare, and tools that facilitate discovery.

As October Prime Day, Black Friday Week, and other major shopping events continue to extend, brands could consider allocating larger budgets to partner types, such as influencers who increased their contributions to traffic and orders over the last year.

2. Research-driven shopping is replacing impulse buying

The changes in partnerships directly relate to changing consumer behavior. Average daily clicks rose just 5%, but the average purchase journey stretched from 6.78 to 7.36 days, over half a day longer than last year.

Consumers weren’t clicking to blindly buy. They were clicking to learn—which explains why they increasingly turned to educational partners like influencers, rather than transactional ones like traditional loyalty and reward programs.

The behavioral evidence: The traffic source changes reflect this research-first mindset. Consumers sought trusted voices for product education (influencers), actively compared offers across multiple touchpoints (deal and coupon platforms), and prioritized discovery over familiarity (loyalty and reward program decline).

The new reality: The flash-sale era built on artificial urgency is ending. Success now requires supporting longer, more complex buyer journeys with partners who can educate rather than just promote. This new trend accelerates during major shopping periods when consumers have more options and time to research, making educational content and trusted voices more valuable than traditional promotional tactics.

3. Pre-event momentum matters more than opening-day impact

Here’s a finding that should reshape every sales event strategy: the day before Prime Day generated 4% more orders than the official Day 1. The extended format dilutes urgency and moves peak performance to the anticipation phase.

The front-loaded pattern continued throughout the 2025 event: Day 1 alone captured 27% of total orders across all four days, with daily sales performance declining steadily afterward.

This pre-event surge wasn’t accidental. As consumers embraced research-driven behavior, they used the pre-event period to finalize decisions made during their extended consideration process.The data supports this shift: daily average clicks in the build-up period exceeded average clicks during the Prime Day event by 61%. The official launch became execution day, not discovery day.

What this means for brands: Stop planning sales events as sprints starting on Day 1. The real conversion opportunity begins weeks earlier during the research and anticipation phase. Your pre-event content and early-access strategies may drive more revenue than your opening-day promotions. For any major shopping event—October Prime Day, Black Friday Week, or brand-specific campaigns—success depends more on October engagement than November execution.

4. Conversion efficiency declined as shoppers prioritized value discovery

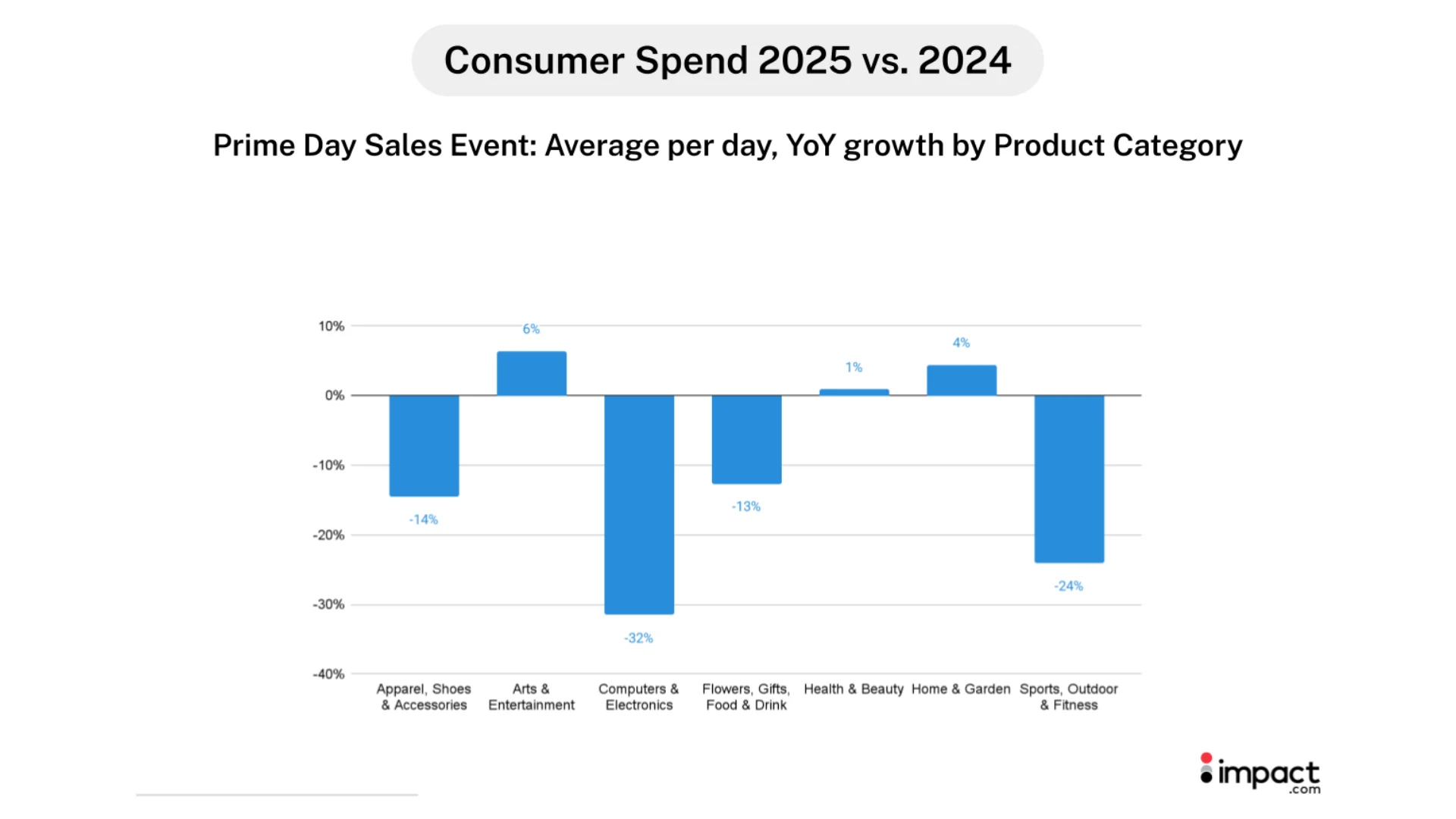

While engagement rose, daily average conversion rates dropped 3% as the extended format reformed shopping behavior. But this decline wasn’t uniform across categories—it revealed notable patterns that marketers need to understand.

Computers and Electronics saw conversion rates plummet 14%, likely due to higher price points requiring more research in an extended, less urgent environment. Meanwhile, Health and Beauty and Home and Garden categories posted conversion rate gains, suggesting these everyday essentials benefited from the relaxed shopping pace.

The broader lesson: conversion rate decline isn’t necessarily performance failure—it can signal successful adaptation to research-driven consumer behavior. The brands that succeeded didn’t necessarily achieve the highest conversion rates, but rather optimized for the new, longer consideration cycle.

Key adaptations: Different categories require different extended-event strategies. High-consideration purchases need educational content and comparison tools, while everyday essentials can leverage the extended window for discovery and trial. This becomes especially critical during holiday shopping periods when gift-giving adds another layer of research behavior to purchase decisions.

5. The economics of shopping shifted from premium to quantity

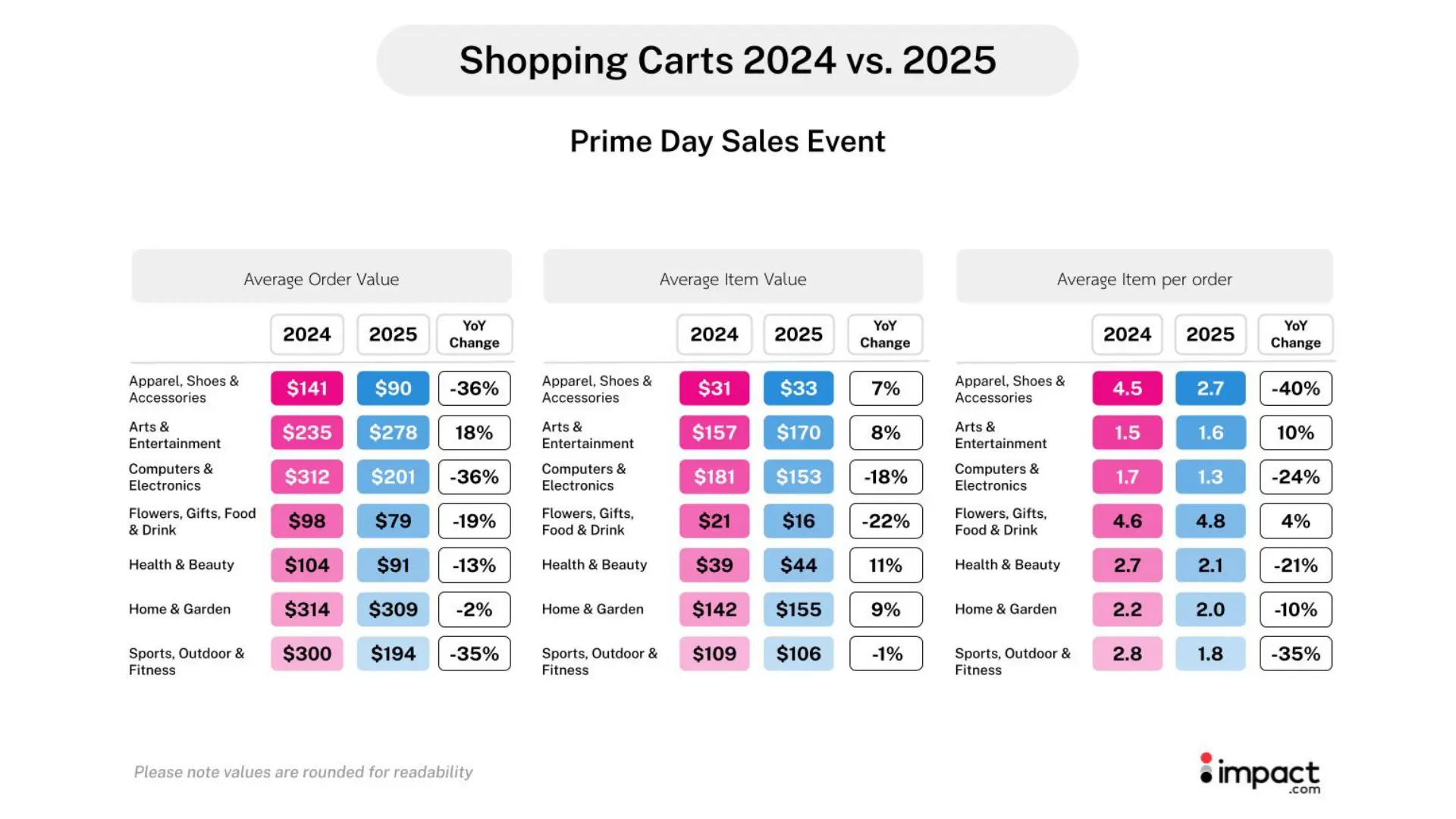

Despite daily average orders increasing, the overall average order value dropped 7% to $120 during the sales event, leading to lower average consumer spending. The story behind this decline reveals an emerging opportunity. Consumers purchased more items per order, but at a lower cost per item.

Cart behavior evolved significantly: Shoppers purchased 14% more items per order (from 2.5 to 2.8 items), but individual item values dropped 19% (from $52 to $43 per item). The extended window encouraged consumers to try more products rather than focus on single, high-value purchases.

Category-specific patterns emerged: In the Apparel, Shoes and Accessories, Health and Beauty, and Home and Garden categories, consumers actually spent more per item but bought fewer items overall, suggesting quality-focused purchasing in specific areas while experimenting broadly in others.

Revenue strategy implications: Instead of pushing for higher AOV through premium upsells, focus on intelligent cross-selling and product discovery. The extended format rewards breadth of offering and smart bundling over premium positioning. This approach becomes even more valuable during peak shopping seasons when consumers are actively comparing options across multiple events and timeframes.

6. Daily spending declined despite increased transaction volume

This finding challenges conventional wisdom about extended sales events. Despite a 2% increase in daily average orders, average daily consumer spending dropped 5% YoY, revealing that volume doesn’t automatically translate to revenue growth.

The underlying pattern: Consumers used the extended window to optimize their purchases, not maximize them. More time meant better deal comparison, more thoughtful buying, and less impulse spending. The categories that grew in terms of consumer spending—Arts and Entertainment, Health and Beauty, and Home and Garden—succeeded by adapting to this deliberate shopping mindset.

Brand spending reflected this shift: Commission payouts dropped 6% daily as brands adjusted their commission structures to reward partners that contributed to higher-value orders rather than just order volumes. This represented a move from quantity-based to quality-based partner incentives.

Revenue optimization insight: Extended events require a margin strategy, not just volume chasing. Success comes from understanding how deliberate shopping affects pricing, promotion depth, and channel allocation—and how the right partner mix can support these longer, more complex buyer journeys. As shopping calendars become increasingly crowded with extended events, this approach separates winners from volume chasers.

How adding sales days changes marketing performance

These six insights tell a unified story about how partnership marketing is adapting to longer sales periods. By adding more days to a sale, brands can alter how consumers discover, validate, and purchase products. The winners were brands that recognized that longer events require different partner relationships built for research-oriented, value-seeking, discovery-focused consumers.

As extended sales events become the norm across retail calendars—from October Prime Day to Black Friday Week to brand-specific campaigns—evolving your partner strategy is now a clear competitive advantage.

Your competitive playbook for the extended sales era

Prime Day 2025 was Amazon’s longest sale to date, and a preview of commerce’s future. The four-day experiment revealed how extended sales events reshape consumer behavior, partner relationships, and competitive strategy. These insights become your competitive advantage as you prepare for the busiest shopping season ahead.

What this means for your upcoming major shopping events

As you finalize strategies for October Prime Day, Black Friday Week, and the extended holiday shopping season, these behavioral patterns provide a logical framework:

Partnership strategy renewed: Analyze partner budgets to allocate larger portions to partners that drive traffic and orders, like emerging influencer partners. The research-driven shopping behavior that emerged during Prime Day’s extended format will intensify during holiday gift-giving periods, when consumers research not just for themselves, but for others.

Pre-event momentum prioritization: Your biggest revenue opportunities may occur before your events officially begin, as seen by the finding that pre-event orders exceeded Day 1 performance by 4%. Plan your influencer collaborations, content partnerships, and early-access strategies accordingly.

Category-specific adaptation: High-consideration categories, such as computers and electronics, will require different extended-event strategies than everyday essentials. During holiday shopping, when gift-giving adds another research layer, educational content and comparison tools become even more critical for conversion.

Margin-focused optimization: Extended events reward strategic thinking over volume chasing. With consumers buying 2.8 items worth $43 each instead of 2.5 items worth $52 each, success comes from intelligent cross-selling and discovery facilitation, rather than premium positioning.

Ready to optimize your partnerships strategy?

The insights from Prime Day 2025 provide a clear roadmap for succeeding in the extended sales era. But translating these findings into performance requires the right partnership platform and strategic approach.

Schedule a demo with impact.com to see how we can help you implement these partnership marketing strategies for your upcoming major shopping events. From influencer relationship management to real-time performance optimization, we’ll help you turn these market insights into a competitive advantage.

To expand your partnership marketing program, check out these great guides: