In this year’s mid-year analysis, the impact.com data science team uncovered that people made more purchases in the retail and shopping vertical during the first half of 2024 compared to the same period in 2023. This increased spend persisted despite lingering concerns about inflation and when interest rates will drop.

As partnership marketers, it’s crucial to understand why consumers are spending strategically and what inspires them to hit “buy.”

The 2024 Mid-Year Consumer Trend research study analyzes consumer behavior during the first two quarters of this year and compares it to the same period in 2023. These insights can help you make data-driven decisions and adjust your marketing strategy to more effectively connect with your audience for the remainder of 2024. See how you can best align with changing consumer preferences this year.

Methodology

impact.com’s Data Science team conducted the study in July 2024 that tracked and analyzed key metrics across thousands of North American brands in the retail and shopping vertical to compare the first half of 2024 to the first half of 2023 in a year-over-year (YoY) analysis.

Our analysis benchmarked multiple performance metrics, including:

- Clicks

- Transactions

- Consumer spending

- Conversion rates

- Average order value (AOV)

- Brand spending

Researchers tracked these key performance indicators by comparing same-store, YoY data from brands that actively used the impact.com platform in 2023 and 2024.

The goal of this report is to offer retailers deeper insight into:

- How consumers engaged in online shopping during the first half of 2024

- How the economy continues to impact consumer spending choices in 2024

- How brands can appeal to consumers in the second half of 2024

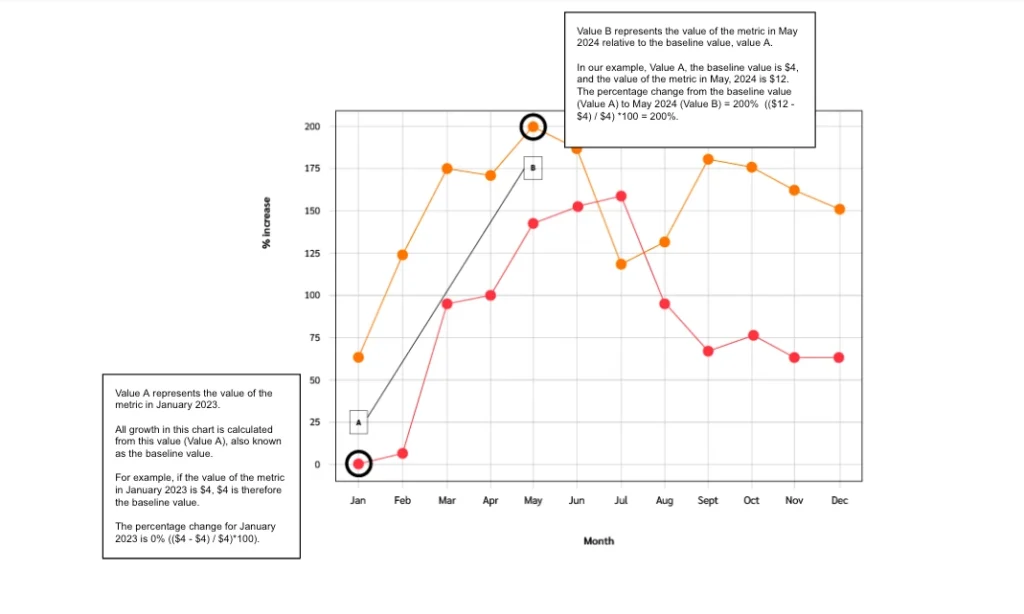

The values shown in the trend graphs represent the percentage change in a value relative to that value at a specific time, also referred to as the baseline value.

Our analysis measured all values as a percentage change relative to the baseline value from January 2023.

For example:

1. Consumer research fuels clicks and conversions

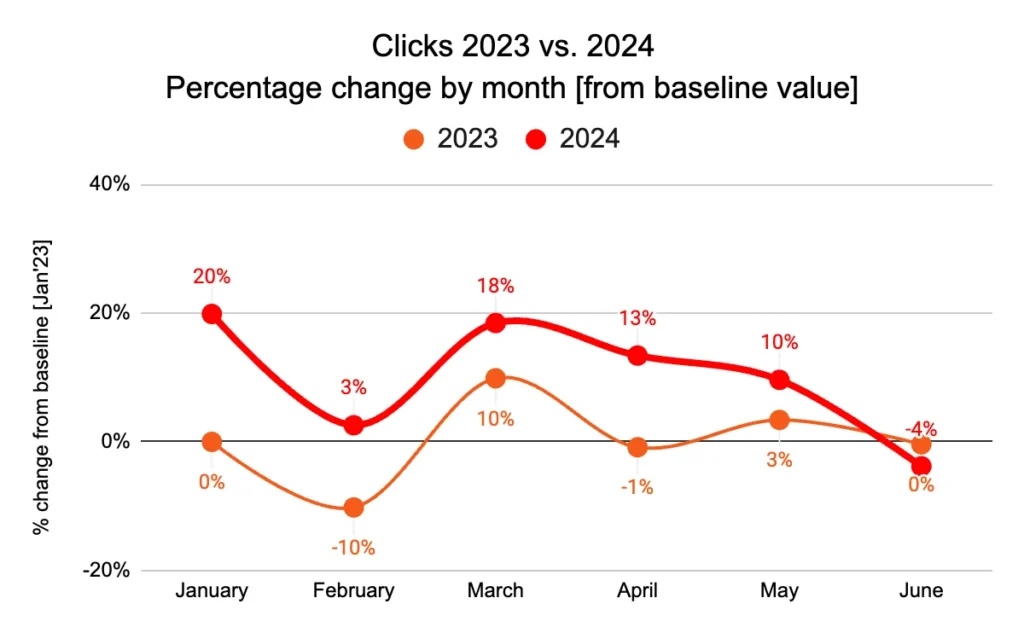

Consumers continued to spend cautiously, conducting more research online before purchasing. This shift is reflected in the 10% increase in clicks during the first six months of the year as consumers made more purchases online.

Content reviews help consumers make informed purchasing decisions by allowing them to do their own research. Partnerships are an essential way to educate consumers about product value, increase brand awareness, and build trust.

As a result, partners are becoming an increasingly important part of the brand marketing mix.

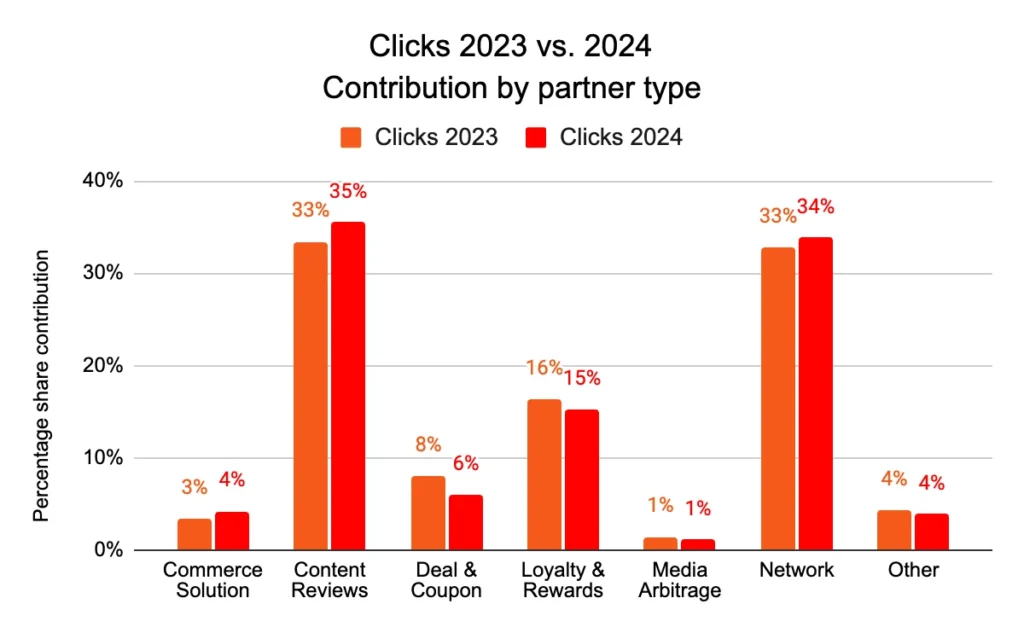

Our analysis shows that 35% of this year’s clicks were attributed to content review and network partners. These partners were the main contributors to total clicks last year, highlighting the increasingly vital role research plays in the buyer’s journey.

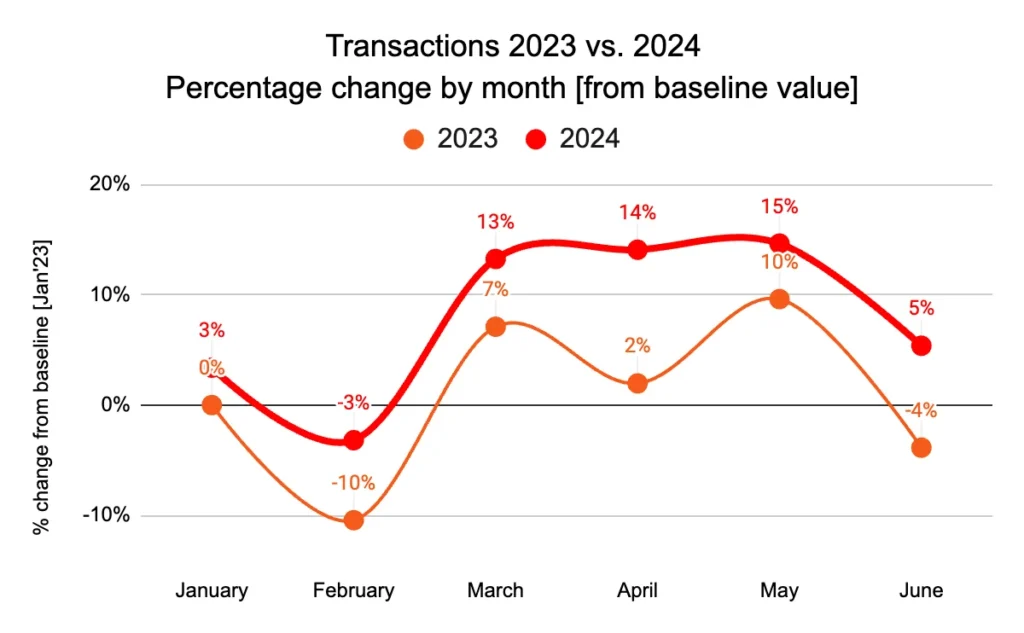

2. Transactions increase as inflation slows

US retail data shows consumers getting back on their feet. Conversion rates dropped slightly (-2%) during the year’s first half, but despite this decrease compared to last year, conversion rates have slowly risen each month in 2024.

The conversion rate reached a new high point for the year in June, exceeding the rate seen in June 2023.

Despite conversion rates being lower than last year, increased click volume resulted in 7% more transactions than in 2023. Most of this year’s transactions took place in May, consistent with last year.

3. Budget-conscious consumers keep an eye on costs

While some lingering concerns remain about inflation, shoppers continue to make purchases while being careful not to overspend.

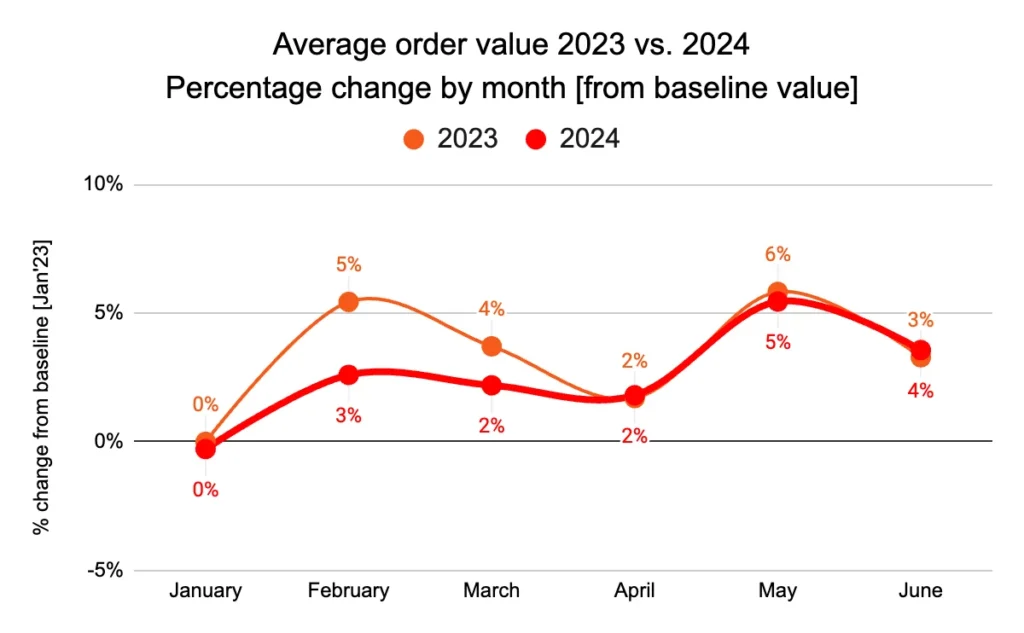

Consumers purchased more items (8%) per order this year, increasing from 2.8 to 3 items in 2024. However, the items’ value was 8% lower than last year. This led to the overall spend per purchase decreasing slightly (-1%) compared to 2023.

Consumer sentiment seems to be improving. Despite being slightly lower in 2024, AOV saw an upward trend during the first 6 months of the year. AOV was 4% higher in June compared to January 2024.

AOV declined in April, suggesting shoppers were waiting for popular shopping days—and deals—for Mother’s Day and Memorial Day in May.

4. Consumer spending rises

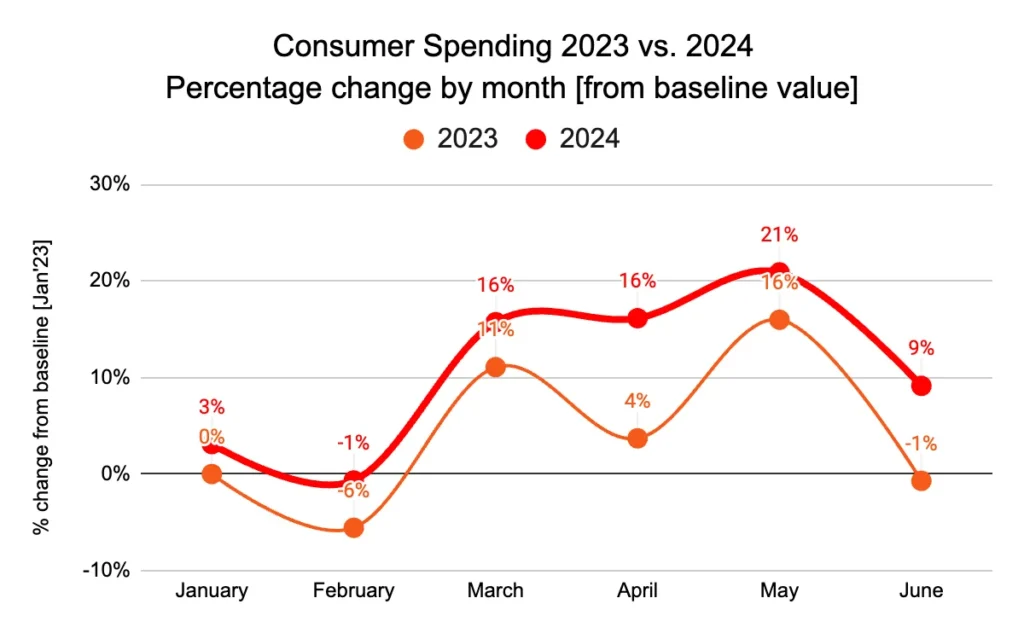

Even as consumers spent less per order, they made more purchases than last year—resulting in a 6% increase in consumer spending this year.

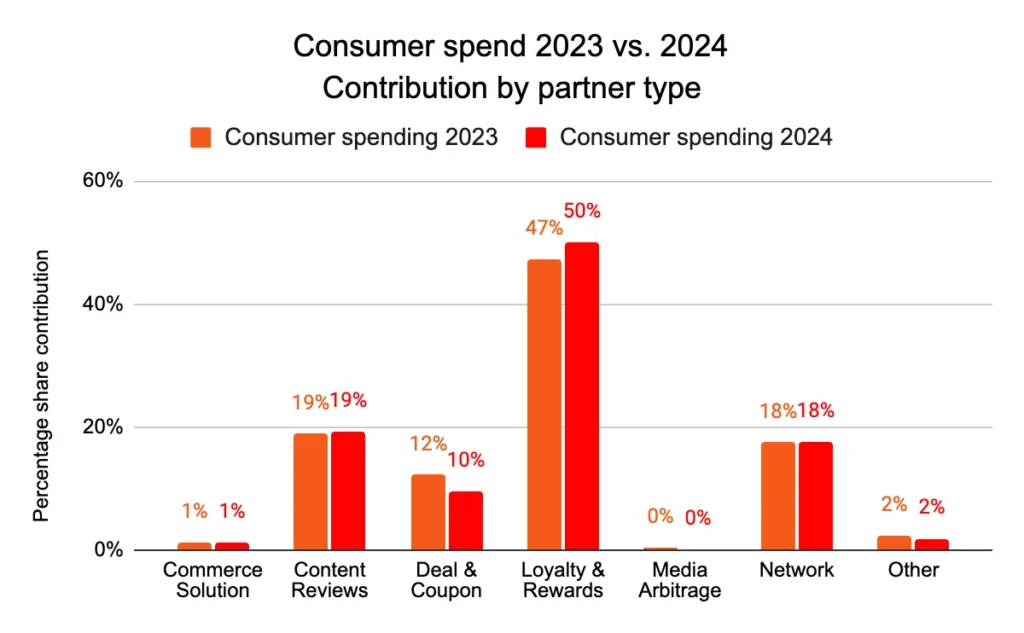

Our research shows that half of consumer spending in 2024 was attributed to loyalty and rewards partners, ticking up from 47% last year.

As careful consumers continue to be intentional about where and when to spend, they look to loyalty and rewards programs to help manage costs without sacrificing quality or necessities. According to a Snappy survey of 1,500 Americans, 7 in 10 indicated loyalty programs were critical to deciding which businesses and brands to purchase from.

To capitalize on this desire to save, brands can also leverage exclusive discounts offered by partners to drive positive sentiment and sales.

5. Brand spending grows to reward partner performance

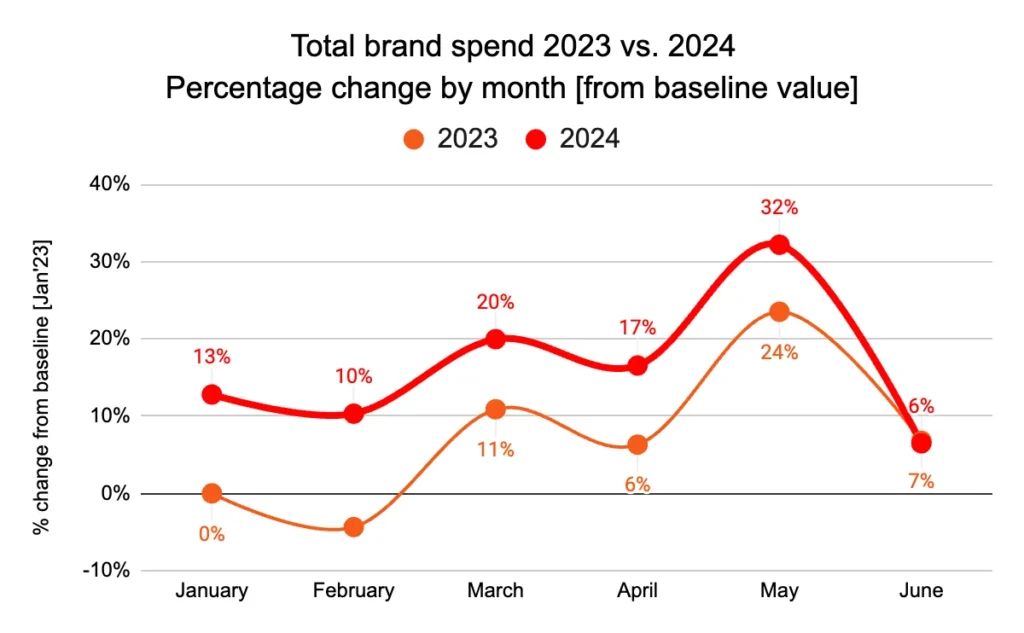

Brands steadily adjusted to consumers conducting more research and making more purchases online. As partners consistently demonstrate their worth to brands, many companies are compensating their partners accordingly.

Brand spending rose by 9% so far in 2024. This was due to the higher transaction volume (7%), coupled with brands increasing commission rates by nearly 4% compared to the previous year.

Brands are specifically investing in action-based payments, which increased 11% YoY. Meanwhile, non-action-based payouts dropped 4%.

Partnerships remain a cost-effective marketing method for brands, as action-based payouts enable them to pay only for positive outcomes. As consumers continue to manage price inflation, brands can turn to performance-based partnerships to remain resilient in a challenging market.

Get pumped for rising consumer confidence in 2024

Inflation appears to be cooling, accompanied by a hot stock market and low unemployment rates.

With solid economic growth in the year’s first half and potential interest rate reductions, consumer confidence is likely to increase and fuel greater consumer spending.

Even as consumers become more confident, they’ll likely continue to conduct research and take advantage of loyalty and reward programs. Partnerships provide an important avenue for consumers to find and benefit from the money-saving opportunities they seek.

Explore more ways partnerships can boost your performance in 2024: